November 2001Study Tip:

Relative Strength Index Fundamental

Behavior

by Howard Arrington

The August

2001 issue of the Trading Tips newsletter introduced the

use of a theoretical Elliott wave formation as an aid in

understanding the fundamental behavior of a study. The

theoretical formation will be used this month for understanding the

Relative Strength Index introduced by J. Welles Wilder Jr. in his

book, "New Concepts in Technical Trading Systems".

Various characteristics can be found in the 7 bar Relative

Strength Index (RSI) study applied to this theoretical chart.

5 Wave Minor Trend Analysis: (blue 1-2-3-4-5 small

numbers)

1) The RSI crosses above 50 in minor wave 1, but

stays below 70.

2) Minor wave 2 may cause RSI to momentarily dip

back below 50.

3) Minor wave 3 takes RSI higher, often to around

80. In the real world %K will often reach 80 but rarely

90. Study tip: It is important to realize that it

is minor wave 3 that takes RSI to its highest high!

4) Minor wave 4 causes RSI to cross below 70 from

its lofty high, but remain above 50. This crossing is the

FALSE signal that traders fall for all too often. Going short

because of a turn at 3 is premature, and your stop just above

the top at 3 is taken out by the final thrust to the top at

minor wave 5. The psychological tendency is to ignore

the signal at 5 because of the loosing short attempted at

wave 3.

5) Minor wave 5 causes RSI to rise again, often

crossing back above 70, but the market lacks the duration in trend

to elevate RSI to a higher high. When RSI turns down and

crosses 70 the second time, this is the signal. Study

tip: Look for divergence, where the price action put in new

highs, but the study does not. Divergence between RSI

and price is a very strong indicator of a turning point.

Divergence is marked on the theoretical chart with short blue

lines.

3 Wave Minor Correction Analysis: (blue a-b-c

letters)

a) Minor wave a returns to the previous

support level of minor wave 4. But the drop of RSI is

huge, falling from a lofty high below 40. This rapid fall is

similar to the rapid rise that occurred in minor wave 1.

b) Minor wave b is a Fibonacci

retracement from a back towards 5.

The example has its price stopping at the top of wave

3. The effect on RSI is to rally back above 50,

possibly around 60.

c) Minor wave c takes RSI to new lows

around 30. The example shows a drop slightly below

30. Study tip: Divergence will not occur this

time. Therefore, the signal to go long is the first time

RSI crosses above 30. This is shown in the example at major

waves 2 and 4 (large red numbers) where the market

meets the long term support trend line shown in red.

Signal Summary:

The process starts over again as Relative Strength Index behaves

in a similar fashion for major waves 3 and 5 as it did for major

wave 1. The a-b-c correction of major wave 4 will be

similar to major wave 2. The ideal place to short is after

major wave 5 is in place, at what will be minor wave 2 of the first

trend leg of the new major correction.

Study tip: Relative Strength had three turns with

divergence at the end of major waves 1, 3 and 5 marked in

red. RSI turns at the end of the two reaction waves 2

and 4 did not have divergence. Look for this pattern to

help you identify the 5th major Elliott wave. The divergence

signal at the end of wave 5 is the ideal place to go short after a

major up-trend, or long after a major down-trend.

Bar Parameter:

Now that the fundamental behavior of Relative Strength Index is

understood as the Elliott waves develop in a market, the theoretical

chart will be used to observe the effect of different bar parameters

on the RSI. The bar parameter is used in the RSI formula to

average the Up and Down net totals. Changes in the bar

parameter affect the volatility of the study as illustrated

below. Study tip: Use a bar parameter that produces RSI

highs around 80 and lows around 20.

Research Tip:

Simulation Broker

by Howard Arrington

Last month's issue discussed the ability of the Ensign Windows

program to simulate a real-time data feed for a dummy symbol named

DEMO. This article discusses an Ensign Windows feature to

trade paper trades with a simulated order entry form. With a

DEMO chart displayed, click the right mouse button on the chart to

display a pop-up menu for the chart. Click on the menu

entry for Sim-Broker to show the simulated order entry form.

This simulation broker can also be used real-time to track trades

for any symbol. Sim-Broker tracks trades for the chart that

opened the Sim-Broker form.

The form is divided into thirds. The left third is

where you enter your actions. The middle section shows a

summary of trades that have been placed. The right hand side

shows a transaction log. Click on the Printer button on the

main button bar to print the Summary information and the Transaction

Log.

The form is divided into thirds. The left third is

where you enter your actions. The middle section shows a

summary of trades that have been placed. The right hand side

shows a transaction log. Click on the Printer button on the

main button bar to print the Summary information and the Transaction

Log.

In the Order frame, select Buy or Sell, then select an order

Type. The Type can be a market order, limit price, stop or

stop and reverse. The trade quantity can be

entered. Simulated stock trades might use a quantity of

100-200 etc. For the DEMO symbol, use 1 or 2, or the quantity

you would usually trade for ES or NQ.

The next box is where Price is entered, followed by the Submit

button. For practice, select the Buy bullet, Market bullet,

with a quantity of 1. Then click Submit button. In so

doing a time stamped transaction is posted in the log. It will

read: Buy 1 @ Market. Shortly thereafter a fill is

received back with a time stamp and fill price.

This will initiate a position shown in the Summary frame.

The illustration shows Short with Qty of 4 and the fill price.

Further to the right the current price is shown. The next line

in the summary shows the profit/loss for this open position.

Under trades is shown the accumulation of all trades made using

Sim-Broker and the total profit loss for all trades.

Underneath the summary window is an edit box where the commission

for a round trip trade is entered. A typical commission is ten

dollars. Next to that is a box labeled Arrows. When

checked the fill prices for buys and sells will be marked on the

chart with arrows. Red arrows mark sells, and green arrows

mark the buys. The chart also shows the stops and limit

buys/sells with short horizontal lines.

A position is closed out by buying or selling the opposite side

of the position. After completing a round trip the Position

Summary will show Flat, and a horizontal break line will be posted

to the transaction log.

Pending limit orders and stops are shown in the pending frame

with a price by the checked box. To enter a limit buy, select

Buy and Limit. The Price window will show a static number that

was the current price when the order Type was changed to

Limit. You can use the spinner arrow that is part of the Price

box to increment or decrement the price. Click the Submit

button to post a message to the transaction log: Buy 1 @

......... The Pending frame will show a check mark by

the word Buy and then a price.

If the market goes lower and

touches the Limit Buy price, the check in the Buy checkbox will be

removed. A message will post in the transaction log:

Bought 1 @ and the fill price. Use the buy/sell Limit

order to place orders where you want to buy or sell.. Limit buys

will be below the current price. Limit sells will be above the

current price.

Likewise, stops can be used to go long or short. Select Buy

or Sell, and market type would be Stop. The stop also needs a

price. Buy stops are placed higher than current price and will

be shown on the chart with a short horizontal green line by the

price scale. The Buy Stop BS checkbox in the pending section

will become checked and show the stop price. Stops are easily

adjusted by submitting the stop order again using a new price.

The location of the alert line will be adjusted to the new stop

price. A later stop cancels the earlier stop.

The items

that show in the pending frame can be canceled by unchecking the

box. A buy stop is canceled by clicking the BS checkbox.

This removes the stop and the entry made to the transaction log will

show xx BS 1 @ ...... The xx in

the log entry means 'canceled'.

SAR is a stop and reverse. If long, enter a SAR at a

lower price to go short. If the SAR price is touched, then the

long position will be liquidated and reversed short the number in

the Quantity box. If position is long 5, and a SAR with

Quantity 1, it will then sell six, five to go flat and 1 to go

short. SAR can be put on either side of the current

price.

The Reset button will clear the summary and

transaction log. Another characteristic is that Sim-Broker is

doing a lot of math and tracking trades, and the form needs to be

open. The form can be minimized but not closed.

Sim-Broker will not work if closed. Multiple Sim-Broker

forms can be open simultaneously to track different symbols.

Hardware Tip:

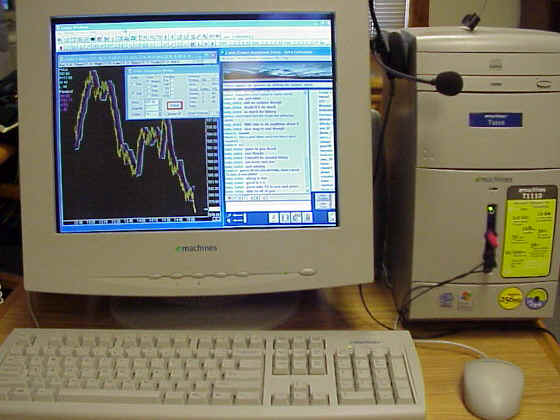

Windows XP and the eMachines

T1110

by Howard Arrington

I bought a new computer with monitor on November 9th, 2001, from

Sam's Club for $599. Since I have been totally impressed with

both the computer and with Windows XP, I thought many of you would

be interested in my experience.

The eMachines T1110 computer has the following

specifications:

- 1 Gig Hz Intel Celeron processor

- 256 Meg of memory

- 30 Gig hard disk

- 12x CD-RW drive

- 3.25 diskette drive

- 56 K data/fax modem ITU V.92 ready

- 10/100 Mb Ethernet card

- Keyboard, mouse and small speakers

- 17 inch flat screen CRT monitor

- Windows XP Home edition pre-installed

- 3 PCI slots, 1 available

- 2 USB ports, 1 serial, 1 parallel, 1 game port, head phone,

speakers, and line-in jacks.

It took less than 15 minutes to unpack the computer, and plug in

the colored cables to the matching jacks on the back of the

computer. I also connected a cable from the router for the

office network to the Ethernet port. I then powered up

the computer and filled in the registration forms.

Windows XP detected my office network and Internet access through

the router, and self registered with Microsoft and with

eMachines. In a matter of minutes I was up and running, and

beginning my discovery of the new XP operating system from

Microsoft.

I used the preinstalled Internet Explorer 6 to go to the eSignal

web site at www.esignal.com, and download the eSignal 6.1 software

to obtain the Data Manager. I installed Ensign Windows,

entered my account and password in the Data Manager, and was up and

running on my eSignal account within a few minutes. I

have not encountered any problem in running the Data Manager and

Ensign Windows with the XP operating system.

The more I have used the computer and XP, the more I love

it. It is the fastest computer I have used and feels elegant

compared to the 300 MHz computer I have been using. I

really like the operating system and have yet to discover a problem

with it, or with the applications I use. Occasionally I

stumble on to a neat new feature of XP such as the Date/Time dialog

form includes the ability to synchronize the computer system clock

from the Internet. Another slick tool is the Task Manager

which is displayed by a right mouse click on the Start task

bar. The Task Manager includes a Processes tab which

shows the CPU utilization broken down by application. Ensign

Windows with Data Manager running is pretty steady at using 2% of

the CPU. The Page File usage is quite constant around

114 MB.

This inexpensive computer from eMachines is really a great

computer. I consider it a 'hot deal' at $599 because it

includes the 17 inch monitor, 256 Meg of memory, Ethernet port, a

CD-RW for burning CDs, a fast 1 Gig Hz processor, and Windows XP

preinstalled. I have not been disappointed in the

slightest. In fact, I went back to Sam's Club 12 days later to

buy another one and was disappointed that they were sold

out. |