December 2004Trading Tip:

The Geometry of Draw Tools

by Howard Arrington

Draw tools are used by technicians to analyze chart

patterns. They are a convenient way to measure price and

time relationships and embody such characteristics as slope,

parallelism, channeling, and retracement percentages. Many

tools are related to each other with just a slight variation in a

construction principle. Seminars, trading systems, and books

are frequently based upon draw tools wherein the author expounds his

special insight as to their use in trading the markets. I have

used the name of the tool that I am familiar with, and apologize if

you recognize the draw tool by some other name. The draw

tools are simply geometrical constructions, and this article will

show how they are constructed.

Trend Lines Trend Lines |

|

| Trend Lines are the fundamental

construction tool. They are drawn most often

between two significant turning points. This type of

trend line is often called a swing line.

Variation: A Linear Regression trend

line is determined mathematically so that it is a 'best fit'

line. The least squares method plots the line through

the prices so as to minimize the distances between the prices

and the trend line. Variation: A Linear Regression trend

line is determined mathematically so that it is a 'best fit'

line. The least squares method plots the line through

the prices so as to minimize the distances between the prices

and the trend line.

Variation: Extend the lines forward and/or backward

in time. |

|

Channel Lines Channel Lines |

|

| Channel Lines are constructed

parallel to a Trend Line with a spacing that contains the

highest high and lowest low of the chart bars.

Variation: The spacing is based on the Standard

Deviation of the prices.

Variation: The spacing is based on a percentage of

the price.

Variation: Raff Regression Channel lines

are equidistant channel lines drawn parallel to a Linear

Regression trend line. Variation: Raff Regression Channel lines

are equidistant channel lines drawn parallel to a Linear

Regression trend line.

|

|

Pesavento Patterns Pesavento Patterns |

|

| This draw tool is named after Larry

Pesavento, who popularized this analysis method in his book

'Profitable Patterns for Stock Trading'. The

technique labels the X-B line with the price percentage

relationship of A-B compared to X-A.

In the example: (Price A - Price B) / (Price A

- Price X) = 0.618 |

|

Support and Resistance Lines Support and Resistance Lines |

|

| Support trend lines are drawn

underneath chart bars by connecting swing lows.

Resistance trend lines are drawn above chart bars by

connecting swing highs. The most popular use of such

lines is to watch for the trend to break through the trend

line, at which time a position is taken in the direction of

the new trend.

Variation: Add a channel line parallel to a Support

or Resistance trend line. For example, a channel line

could be drawn through point A that is parallel to the X-B

line. |

|

Fibonacci Extension Fibonacci Extension |

|

| The X-A-B pattern is often used to

forecast future price action. The Fibonacci Extension

technique constructs the next trend line B-C parallel to the

X-A trend line. The length of B-C will be a

Fibonacci percentage of the length of the X-A

line. The three most common lengths considered are

0.618, 1.000 and 1.618. The example shows these

three target price levels.

Variation: Point C (the 1.000 Fibonacci

Extension) can be obtained by moving the X-B line to point

A. The line A-C is equal in length to X-B and parallel

to X-B. The A-C line is a measured move to the Price

Time Target. The expression Price Time Target (PTT) comes from

the book 'Precision Trading with Stevenson Price and Time

Targets'. Variation: Point C (the 1.000 Fibonacci

Extension) can be obtained by moving the X-B line to point

A. The line A-C is equal in length to X-B and parallel

to X-B. The A-C line is a measured move to the Price

Time Target. The expression Price Time Target (PTT) comes from

the book 'Precision Trading with Stevenson Price and Time

Targets'.

|

|

Parallel Lines Parallel Lines |

|

| A line is drawn parallel to the X-A

line to create a channel through point B. The

channel is sub-divided with more lines that are equally

spaced.

Variation: Use different percentages to sub-divide

the A-B line, such as the Fibonacci percentages of 0.214,

0.382, 0.50, 0.618, and 0.7856

Variation: Use larger percentages to draw additional

parallel lines outside of the A-B channel.

Variation: Draw the X-B leg first, and then move to

point A. This will draw the lines parallel to the X-B

line instead of parallel to the X-A line. |

|

Andrews Pitchfork Andrews Pitchfork |

|

| The Andrews Pitchfork is

constructed using parallel lines using three points labeled

X-A-B. X, A, and B are typically swing

peaks. The pitchfork handle is constructed from

point X through the midpoint of the A-B trend line. Two

lines (tines) are drawn parallel to the handle from points A

and B.

Variation: Addition lines (tines) are drawn at the

quarter and eighth points along the A-B trend line, i.e.. at

0.125, 0.25, 0.375, 0.625, 0.75, and 0.875.

Variation: Fibonacci percentages are used instead of

the eighth points, i.e.. 0.214, 0.382, 0.618, and 0.786.

Variation: Draw tines outside of A-B by using higher

percentage levels.

|

|

Schiff Lines Schiff Lines |

|

| Schiff Lines are constructed like

the Andrews Pitchfork. The difference is the end of the

pitchfork handle begins at the midpoint of the X-A line

instead of from point X. Thus, the tines are parallel to

the X-B line. |

|

Speed Lines (general form) Speed Lines (general form) |

|

| Speed Lines are another variation

of the Andrews Pitchfork. All lines (rays) are

drawn from point X. The rays pass through

sub-division points on the A-B line. A-B may be

sub-divided into eighths or Fibonacci percentages. |

|

Fibonacci Levels Fibonacci Levels |

|

| Fibonacci Levels is one of the most

popular tools. It is basically the Schiff Lines

variation of the Andrews Pitchfork with point B relocated to

form a right triangle with the X-A line. This is a two

point construction because point B is automatically aligned

horizontally with point A and vertically with point X.

The A-B line is sub-divided using Fibonacci percentage

levels of 0.382, 0.50, 0.618, and 0.786.

Variation: Add Fibonacci extension levels at

1.272, 1.618, 2.00, etc.

Variation: Sub-divide A-B into eighths: 0.25,

0.375, 0.50, 0.625, 0.75, etc. |

|

Speed Lines (Fibonacci form) Speed Lines (Fibonacci form) |

|

| Speed Lines are a variation of the

Fibonacci Levels tool. Instead of horizontal lines being

drawn at the sub-division points on the A-B line, rays are

drawn from point X through the sub-division points on the A-B

line. This is the special case where point B forms

a right triangle with the X-A line.

Variation: Sub-divide A-B into eighths: 0.25,

0.375, 0.50, 0.625, 0.75, etc. |

|

Gann Fan Gann Fan |

|

| The Gann Fan was a primary

construction technique used by the famous trader W. D.

Gann. The A-B line is divided into eighths (or thirds),

and rays are drawn from point X to or through the A-B

sub-division points. Likewise, the horizontal

distance is sub-divided into eighths (or thirds), and rays are

drawn from point X to the horizontal division points.

The unique characteristic is that the A-B length should

equal the X-B length. This means there is a specific

relationship between price (A-B line) and time (X-B

line). Therefore, some unit of price equals some

unit of time.

The 1x4 label means the line moves 1 unit of price in 4

units of time. This is 25 percent of the A-B

height. The 1x2 line passes through the A-B

midpoint.

|

|

Gann Square Gann Square |

|

| The Gann Square is created by

drawing a Gann Fan from each of the four corners of a

square. The example shows the 3 primary fan lines of

2x1, 1x1, and 1x2 drawn from each corner.

Variation: Draw additional fan lines for the

quarter point sub-divisions.

Variation: Arrange additional Gann Squares to be

adjacent to each other to form a grid for the chart bars to

overlay. |

|

Pyrapoint Pyrapoint |

|

| Pyrapoint is an automation of the

Gann Square principle. A unit of time is

automatically derived from a price to create a

square. The 1x1 fan lines are drawn from corner to

corner to create the ascending and descending channels.

Variation: The tool is based on degrees of rotation

around Gann's Square of Nine. Larger or smaller

squares can be selected by changing the parameter for the

degrees of rotation.

Pyrapoint is copyrighted by Don E. Hall and discussed in

detail in his book titled 'Pyrapoint'. |

|

Fibonacci Retracement Fibonacci Retracement |

|

| Fibonacci Retracement combines a

Gann Fan being drawn from point A and Fibonacci Levels drawn

between the fan lines. The tool draws the 2x1,

1x1, and 1x2 fan lines. The 1x1 line in the

retracement fan is a mirror image of the X-A line reflected

about point A.

Variation: Draw an inverted fan from point B,

which is the point that forms a right triangle with the X-A

line.

Variation: Draw the retracement fan from the

midpoint of the A-B line.

Variation: Use eighth division levels:

0.25, 0.375, 0.50, 0.625, 0.75, etc. |

|

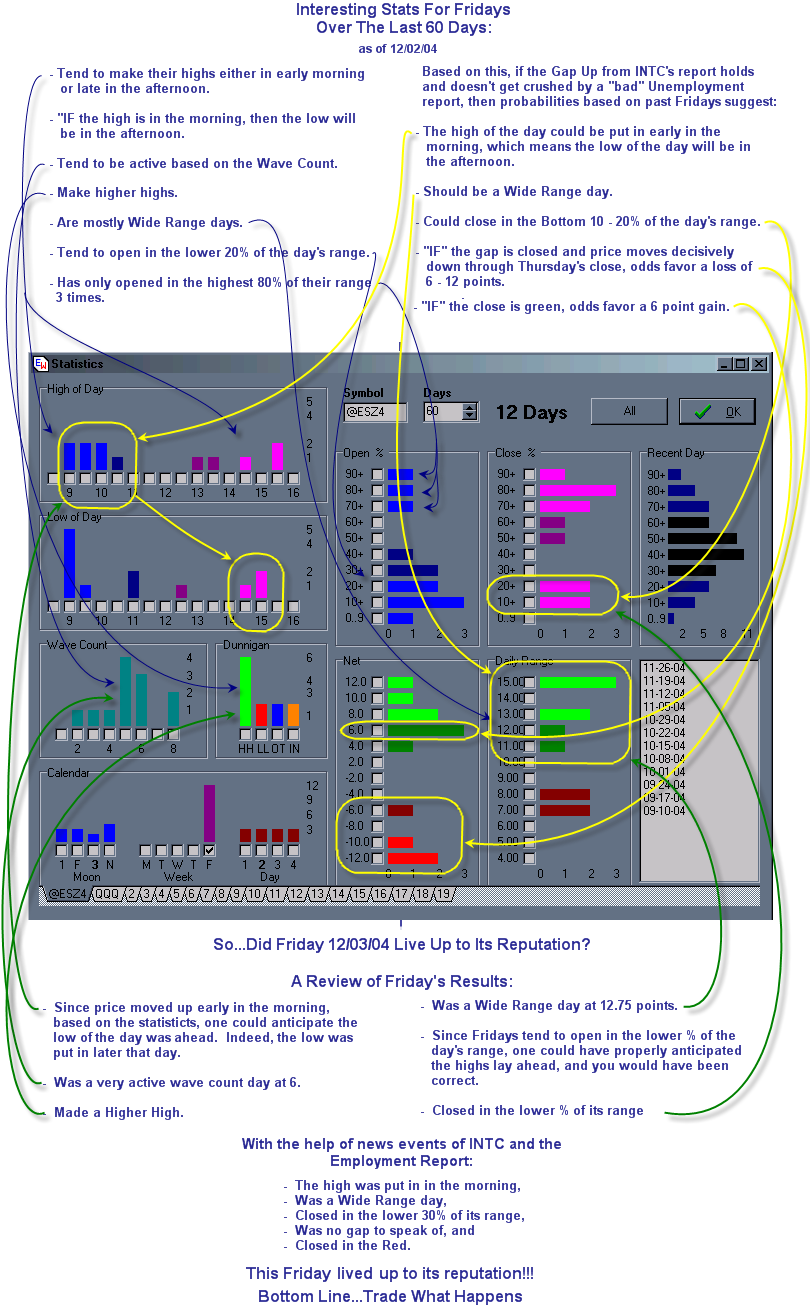

Trading Tip:

Friday Statistics

by Donald Dix

Trading Tip:

Volume Alert

by

Howard Arrington

The following chart shows when the volume is above the average

volume.

The visual shows volume with the Blue histogram bars,

and a 10 period simple average of volume plotted as the Red line

curve. When the volume moves above the average volume, a fat

Green histogram bar is plotted through the height of the average

volume curve. The following study alert was used to create

this visual effect.

Panel A returns a 10 period simple average of the

volume. The period for the average function is the Number

field, which can be changed to plot a different average

volume. The alert test is True when the average volume is

below the panel B value which returns the bar's volume. When

the condition is True, the Green histogram is plotted. When

the condition is False, the Red curve is plotted. The

value plotted is the average volume calculated by panel A

|