February 2005Trading Tip:

New Candle Types

by

Howard Arrington

Ensign Windows has introduced

four new candle types. The reason why will be explained and

illustrated in this article.

Bar Chart

The standard bar chart draws a vertical line between the

High and the Low. The Open price is shown with a hash

mark on the left side of the line. The Close price is

shown with a hash mark on the right side of the line. |

|

| Candlesticks

A candlestick shows the same Open, High, Low and Close

information as the standard bar. A rectangle (candle

body) is drawn between the Open and the Close.

Since the left side / right side relationship has

been lost, the type of rectangle used indicates the Open and

the Close.

A solid candle body is drawn for a Down Candle when the

Close is below the Open. Therefore, the Open is at the

top and the Close is at the bottom.

A hollow candle body is drawn for an Up Candle when the

Close is above the Open. Therefore, the Open is at the

bottom and the Close is at the top.

|

|

Framed Candles

This variation of a standard candlestick outlines the

candle with a frame. The Down Candle bodies

(solid) are colored. The Up Candle bodies are

hollow. |

|

| Solid Up Candles

This variation of a Framed Candles draws the Up Candles

with a solid body instead of a hollow body. One

color is used for every Down Candle, and a different color is

used for every Up Candle.

The Close price is at the bottom of a Red candle body, and

at the top of a Green candle body. The Open price is on

the opposite end of the candle body from the Close

price. |

|

| Color Bars

Standard bars can be drawn using color to indicate bar

relationships, study relationships, trends and alert

conditions.

This example uses 4 colors to show these Dunnigan Bar

relationships:

- Up bars are shown

in green.

- Down bars are shown in

red.

- Inside range bars are shown

in blue.

- Outside range bars are

shown in black. |

|

Color Candlesticks

Candlesticks can also be drawn using color. This is

the same Dunnigan Bars example as the previous Color Bars

example.

Both the frame and the body must be colored.

This is because the Open and Close relationship is indicated

by the candle body being solid or hollow. |

|

| Ensign Corners™

Ensign has introduced 4 new candle types so that the candle

bodies can be solid and colored with any color. This

eliminates the Open/Close relationship information because

there are no hollow candle bodies to indicate when the Close

is above the Open. Therefore, variations on the candle

frame are used to indicate the Open and the Close.

Ensign Corners™ is a blend of a standard bar and a

candlestick. The Open is shown with a hash mark on the

left side of the candle body. The Close is shown with a

hash mark on the right side of the candle body.

|

|

| Ensign Zebras™

This variation draws a diagonal line across the candle body

from the Open on the left side to the Close on the right

side. The diagonal line is a quick visual indication of

whether the candle is a Down Candle or an Up Candle.

Since the candle bodies look like forward or backward Z's,

the name for this Z-bars presentation format is Ensign

Zebras™.

|

|

| Ensign Rockets™

This variation uses a different line thickness for the

candle wicks and one edge of the candle body frame. This

presentation format is called Ensign Rockets™.

The wick and body edge on the Open side of the candle body

are drawn with a thicker line. This is the thrust side

of the Ensign Rocket.

The Close side of the candle body is the Rocket nose, and

shows the direction the Rocket is headed.

|

|

Ensign Flutes™

The final variation draws a rectangle from the High to the

Low instead of from the Open to the Close. Like a

standard bar, the Open price is shown with a hash mark on the

left side. The Close price is shown with a hash mark on

the right side.

This presentation format is called Ensign Flutes™. |

|

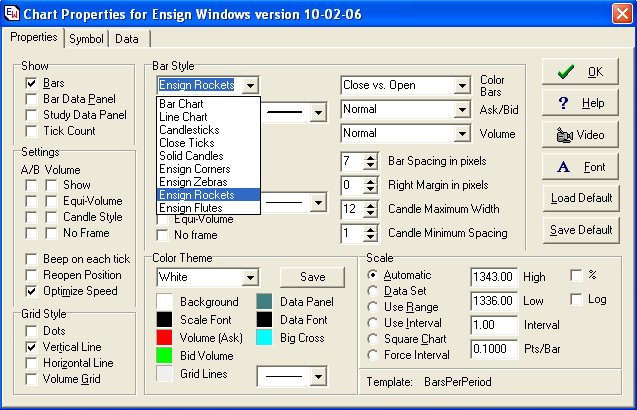

Ensign Software is excited to announce this new innovation in

Ensign Windows. These new candle types permit Color Bar

studies to color the candle bodies with any color, yet retain the

Open/Close information in the candle frames. Ensign Windows

users need to upgrade to the Beta release. Open a

chart. Use menu Charts | Types to select one of the new candle

types, or press CTRL-P to show the chart property form and select

the candle type on the Chart Type drop down list. Enjoy!

Feedback:

'Just a quick note as the trading day progresses. I have to

say I was a little worried when you brought out the new candlestick

types. As usual you were right. Brilliant is the word

that comes to mind. I am using the Ensign Rockets this

morning. I am up 18 points in the Russell using these bars

alone. See attached chart. I am ignoring the other

indicators generally. I look for the thrusters to be on the

bottom for a long and then look at the 2997 Volume chart for a

confirmation of entry. If there is no arrow on the 2997 I

refuse the R1290 entry. So far today six trades, four winners

for the aforementioned 18 points on two contracts. I can go

play golf now! I added an arrow and the word “Chop” to

the chart. When there are no fat wicks and tails to the bars

it seems to indicate chop. That’s a wonderful chop indicator

if it works out. Thank you for your continued outstanding work

in our behalf.' -J. West 02-17-2004

(charts shown with J.'s permission)

Trading Tip:

Candle Recognition

by

Howard Arrington

The following example color

codes different specific Candle formations. This is a clever

use of the new Ensign Rockets™ and Ensign's powerful Design Your Own

Study feature.

Line A detects the Doji formation, where the Close

price equals the Open price, and labels this candle with the letter

D.

Line B detects the Hammer formation, where Close and

Open are in the upper part of the range. Body is colored

magenta.

Line C detects the Gravestone formation, where Close

and Open are in the lower part of the range. Body is colored

yellow.

Line D detects a strong up move. Close and Open

are in the outer extremes of the candle range. Body is colored

green.

Line E detects a strong down move. Close and

Open are in the outer extremes of the candle range. Body is

colored red.

Line F detects a Spinner formation, where both Close

and Open are in the middle of the range. Body is colored

cyan.

The Number field values control the # percentages for

the tests, and can be adjusted to suit your personal

preferences.

This example is available as the CandleRecognition

template which can be downloaded from Ensign's web site using the

Internet Services form.

Trading Tip:

Thoughts about Full Time

Trading

by Jay West

If you are serious about trying to become a successful full time

trader, I offer these comments. If not, stop reading. It

will be a waste of your time.

It takes a special mental intelligence and ability, as well as a

burning desire, and personal

discipline to become a successful trader. You can

have the best trading template, software, and platform in the world

and still may not be successful. Why is that? It

is almost always the temperament

and control of your emotions that

determines your destiny. Everyone needs to work on and

improve/change this personal situation to eventually become what

they want to be in trading. Trading

discipline is born from emotional control. Usually

traders are their own worst enemy. That, coupled with their

trading environment that is. Trading environment is critical

to success, but not as critical as the control of one’s

emotions. You must gain

control to be successful. There is no substitute

for this control. Nothing you can do to offset this deficiency

will help. How do you know if you are “out of control”?

Trading the “money” is probably the most universal tip off that you

are out of emotional control. The lack of ability to stop

trading when you are losing is also a good indicator.

How do you control emotions? Simply by trying to develop

patience and making your focus the system and not

the end results of your trading actions. Stay immersed in the present. In other words,

stay immersed in the process of trading. Reading the charts,

the indicators, the momentum or lack of it in the market.

That’s the way you communicate with the market and overcome

emotional urges. Do not try to outguess the

market. Stay away from “outcomes” or as I call it “what

if” thinking because that destroys your objectivity and focus on

what’s important and creates negative thought processes. If a

golfer focuses on whether or not he will make a three foot putt and

the consequences of missing it instead of the process involved in

making the stroke required to have a successful outcome he will

surely miss that putt. He places a huge monkey on his back by

worrying about the consequences of making or missing that

putt. Especially if there is pressure to make the putt such as

a double or nothing bet, carrying his share of the load in a two man

team event etc. The same thing happens in trading except that

there is usually much more pressure associated with that

activity. It can be almost a life and death situation if you

allow it to become that. This “outcomes” or

“what if” thinking causes you to lose your focus on the really

important things that will help you be successful.

What’s important is the step by step process of

trading. It really is as simple as that. At least

it was for me. Once I gained that perspective on approaching

the market, I had the control I needed and things started to get

better. Just remember the only thing you can control in

trading the market is how you react to the things you are

seeing. Control of your emotions is

critical in reacting in the correct manner to what you are

seeing.

Let’s get personal here. I had a non supportive family (my

wife hated me trading), a small account, and a lot of un-success to

overcome when I started trading. Sound familiar? The

only way I got out of it was to develop a

resolve that I would be successful and disprove all the nay

Sayers, no matter what. More importantly, I decided that I

would gain a patient attitude and “slow

things down” in my trading world. I adopted this concept of “slowing

things down” from statements I saw from highly successful

professional athletes and some teaching principles I used in

teaching Leadership in Army service schools. When Pro golfers,

Pro basketball players, and interestingly enough NASCAR drivers are

being highly successful, it is like everything slows down and it

becomes easy to see what to do and how to do it. Under the

tremendous stress of combat, the same thing occurs when a leader is

operating properly. It is like everything is in slow

motion. With this concept in mind, I picked the AB to trade

because it seemed to move slower than the NQ or ES. I tried to

select methods and time frames (R100 and R75) that were slower paced

in terms of signals. That would slow things down for me and

allow me to gain control of my emotions and decision making

processes. I got lucky. I found a great chat room where

a man named Woodie showed me the way to remain calm in the face of

adversity and that “a better trade was surely coming”. I also

found a great software company called Ensign Software and was able

to develop some fairly good templates that supported those

goals. The main thing I did however was

to make a conscious decision to grab my emotions by the throat and

control them. I wanted to be in control of

me. Simple as that. I would refuse to let anything

or anyone deter me from that basic goal. It has worked, but

every day is a new struggle to accomplish it. But once it has

been done, the confidence is there that helps you do it over and

over again. It never goes away,

this quiet panic that most traders live

with. You just learn how to control

it. Do this one thing and it will be easier to gain

the success you crave.

Trading Tip:

How Did They Do That

by

Frank Del Casino

Every day traders are posting

fantastic charts on the http://www.dacharts.com/ web

site. Some of these informative charts were created with

the tools, studies, markers and alerts available in Ensign

Windows. Take a look at this chart template created by

Frank Del Casino (nickname Discovery) with help from others in the

B-Line chat room.

So what does this chart show and how did Frank do

that?

Weekly & Monthly: On the left

side of the chart are support and resistance levels based on the

prior week's High, Low and Close and the prior month's High, Low and

Close. Support and resistance levels are standard

formulas based on three prices.

Section Panels: Below the chart are 5

panels showing various key values. The first section in gray

is showing the High/Low range of the opening 60 minute time

period. These two levels are marked on the chart with the H

and L letters.

The 2nd section in blue is showing Today's Open price

and Yesterday's Close price. Today's Open price is shown with

a thick black horizontal line.

The 3rd section in lighter blue is showing the Weekly

Pivot, Weekly High, and Weekly Low prices for the prior week.

The pivot price is the average of the High, Low and

Close. Example:

(1178.00+1164.25+1174.75) / 3 = 1172.33

The 4th section in purple is showing the Monthly

Pivot, Monthly High, and Monthly Low prices for the prior month.

The 5th section in yellow is showing Yesterday's Upper

Value Area price, Point of Control, and Lower Value Area

price. These values are obtained from a price histogram study.

Support & Resistance: S&R lines

for today based on the opening 60 minute range are being plotted as

the white, blue, green and red stair-stepped lines.

Click this link for information on setting up these Dynamic

Support and Resistance lines.

Daily Prices: A Daily Price Lines tool is

showing horizontal lines at key levels such as YH = Yesterday's

High, P = Yesterday's Pivot, YL = Yesterday's Low, H = Today's High,

and L = Today's Low.

A workspace and a template for this set-up can be downloaded from

the Ensign web site using the Internet Services form.

The workspace file is named Discovery and the template file is

named Discovery.

The workspace will open Weekly, Monthly, 30-minute, and 3-minute

charts. The charts need to be refreshed.

The price

histogram study on the 30-minute chart stores its values in global

variables so they are available for use with other charts. If

you want to read 30 minute histogram values on volume charts, copy

the Design Your Own (DYO) study from the histogram template to

another tab in DYO. Then open a volume chart and add a

DYO from those tabs to that chart. Refresh the histogram

chart, then refresh the volume chart. The histogram UVA,

POC, and LVA values should be there. Alter section or line

styles to your taste.

Once set up, you can save a Weekly

template, Monthly template, and a Histogram template from those 3

charts. Also save a template from the master chart which is

the chart where you read all values and have all the

lines. Then open those chart timeframes in any workspace

you want and apply the weekly, monthly and histogram templates you

saved. Finally, apply the master template you saved from

your volume chart or 3 minute chart to a time frame chart of your

choice. Refresh all charts, and it should then be in your

trading workspace. Save your

workspace. Make duplicate workspace somewhere.

All this would not be possible without the splendid powerful

tools Ensign Windows makes available to their subscribers.

To learn more about this type of a chart, and how the

various items shown are of value in trading, please go to the B-Line

chat room and join in the discussion. Hundreds of

traders patronize this chat room to talk shop, share ideas, discuss

methods, and help each other create charts like the one shown

above. If you need more information about the chat room,

click this link.

|