March 2005PriceFinder Study:

CCI 133 Bands

by Howard

Arrington

Perhaps the most significant

enhancement to the Ensign Windows program in 2005 will be the

PriceFinder™ technology that can be used with any study.

PriceFinder is a selection in the Design Your Own™ (DYO) study

feature. It is being used on the following chart to indicate

the price that would cause the Commodity Channel Index (CCI) study

to cross above 133 or below -133.

The upper green line is the price that would cause CCI to cross

above 133. Shortly after 14:00 on the chart the CCI crossed

above the upper green line, and the CCI in the sub-window has moved

above the 133 grid line.

And, every time the price trades below the lower red line, CCI is

below the -133 grid line. The green and red lines create

a visual channel that is useful in knowing what price it would take

to cause CCI to cross either of these significant grid levels.

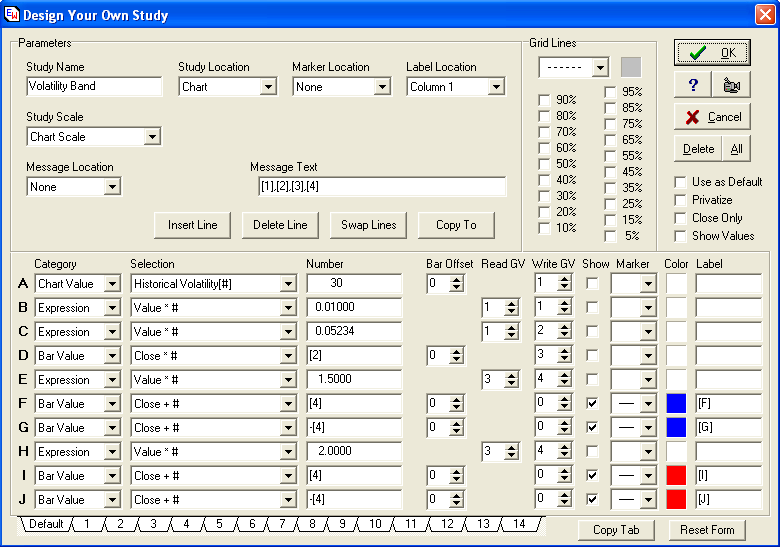

The CCI 133 Band lines are created with these Design

Your Own study parameters.

The PriceFinder™ needs a Boolean flag to know what

condition is to be tested. Line A is selecting the CCI

study condition of being above the 133 grid level. This

Boolean flag is either True or False and is saved in Global Variable

[1]. Line B is the powerful PriceFinder which will plot

in green the price that will cause the [1] flag to change

states. If the CCI study is below 133, what higher price will

cause CCI to cross above 133. If the CCI study is above 133,

PriceFinder will find the price that will cause the CCI study to

cross below 133.

Lines C and D are the implementation for plotting the

red line which is the price that will cause the CCI study to cross

the -133 grid level. Line C is the test that Line D will

find the price which causes the test condition to change states.

The [B] and [D] labels on Line B and Line D cause the

PriceFinder prices to show on the chart at the end of the

lines. The CCI study is currently above the -133 grid line, so

the red line value of 1205.25 is the price that ES #F would have to

go to on the 3 minute bar to cause CCI to cross -133. As long

as ES #F trades above 1205.25, the CCI value will remain above

-133. This is very useful information to be armed with when

CCI is used is making trading decisions.

Although the example used 133 and -133 as the levels

to test for, any CCI levels could have been the test conditions and

PriceFinder would have plotted the appropriate channel bands.

The tool is totally flexible. Even complex multi-study

consensus conditions can be the Boolean flag that PriceFinder is

asked to find the answer for.

A template named CCI-133-Bands can be downloaded from

the Ensign web site using the Internet Services form.

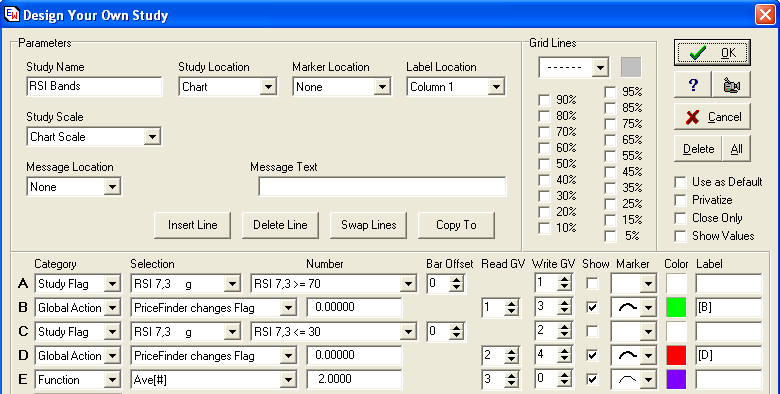

PriceFinder Study:

RSI Bands

by Howard

Arrington

This example is similar to the CCI 133

Bands example, but will illustrate plotting Relative Strength Index

(RSI) Bands to indicate when RSI is above 70 or below

30. Though the chart has an RSI study present on

it for the DYO Boolean tests, it is not being shown in this

example. I want the reader to get a new perspective about RSI

by looking at just the RSI Bands.

Line A is the test for RSI being above 70. Line

B plots in green the price that would cause RSI to be at the 70

level.

Line C is the test for RSI being below 30. Line

D plots in red the price that would cause RSI to be at the 30

level.

Line E is a quick way to plot a line at the mid-point

of the red and green lines. Therefore, this line shows whether

RSI is above or below zero. The candles shown in the example

are Ensign's new Rockets™

format introduced in last month's newsletter.

A template named RSI-Bands can be downloaded from the

Ensign web site using the Internet Services form.

PriceFinder Study:

Bollinger PriceFinder™

Bands

by Howard

Arrington

This example does something a little

bit different. A Bollinger Bands study on the chart

plots the green lines. The PriceFinder feature plots the blue

lines to show the price where the bar high will cross the upper

Bollinger Band and where the bar low will cross the lower Bollinger

Band.

An initial reaction is to think the green and the blue

lines should be the same. But not so, says the wise

man. As the price moves towards a Bollinger Band line, the

Bollinger Band line will move outward because of increased

volatility. For example, the price is currently at

1206.75. If the price were to go lower to touch the

lower green Bollinger line, the green line will move lower in the

process. The price will catch the lower Bollinger line at a

price of 1205.25. This illustrates the power of PriceFinder to

perform the complex math involved in finding the answer.

Line A is the test for Line B to find the price

for. Note that the Line B selection is to find the price that

makes the Flag True. This is a bit different than the prior

examples where the PriceFinder selection was finding a price which

made the flag state change.

The reason for using the selection of 'PriceFinder

makes Flag True' is because once the High is above the Upper Band,

there is no price that will undo the High. Lower prices

will not change the High! Therefore, it is only logical

to employ PriceFinder when the High is below the Upper Band to find

the higher price that will make the High catch the Upper Band.

Notice that when the High is already above the Upper Band that the

PriceFinder does not plot a line. This is why there are breaks

in the PriceFinder study line. The blue lines break when the

Flags being tested are already True.

A template named Bollinger-Bands can be downloaded

from the Ensign web site using the Internet Services form.

DYO Study:

Volatility Bands

by Howard Arrington

The Volatility Bands

calculate support and resistance levels for tomorrow's price

action. They are excellent for daily areas for support and

resistance and frequently are the location for reversals.

The formula for the Volatility Band uses a one day Historical

Volatility by multiplying the Historical Volatility by the square

root of 1 divided by 365, which is 0.05234.

VB Delta = Historical Volatility * Sqrt( 1 / 365) *

Daily Closing Price * Size Factor

Upper Band (Resistance) = Close Price + VB Delta

Lower Band (Support) = Close Price - VB

Delta

The Volatility Bands used for market observation are those with a

Size Factor of: 1.0, 1.28, 1.5, and 2.0.

This study can be implemented in Ensign Windows using the Design

Your Own™ study feature.

Line A calculates the 30 bar Historical Volatility and stores

this value in Global Variable [1]. Typical value is 17.50.

Line B adjusts the HV decimal placement by dividing by 100 and

resaves HV in [1]. [1] = HV * 0.01

Line C multiplies HV by the 0.05234 factor, which is the square

root of 1 / 365. Result is saved in [2].

Line D calculates the VB Delta = Close * HV * 0.05234. This

VB Delta is stored in [3].

Line E multiplies the VB Delta by one of the Size Factors, which

in this example is using 1.50. Result is saved in

[4].

Line F and G plot one pair of Volatility Bands for the VB Delta

in [4] by adding it and subtracting it from the Close.

Line H, I and J plot another pair of Volatility Bands for a Size

Factor of 2.

The Volatility Band values calculated today are used as Support

and Resistance levels the following day.

A template named VolatilityBands can be downloaded

from the Ensign web site using the Internet Services form.

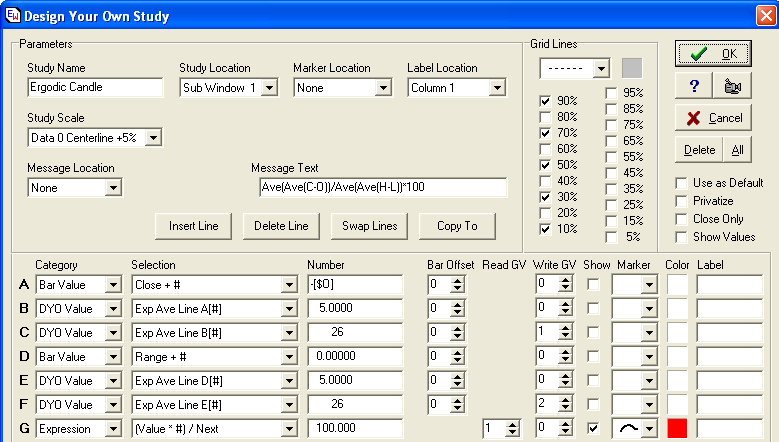

DYO Study:

Ergodic Candle Oscillator

by Howard Arrington

The Ergodic Candle

Oscillator is "a double smoothed ratio of the difference between the

Close (C) and Open (O) of each bar, and the difference between the

High (H) and Low (L) prices for each bar" originally created by

William Blau. This oscillator shows the trend well and is not

affected by opening gaps.

The formula for this study is: ECO =

(MOV(MOV(C-O,5,E))26,E) / MOV(MOV(H-L,5,E))26,E))*100

This study can be implemented in Ensign Windows using the Design

Your Own™ study feature.

Line A calculates the spread between the Close and the

Open. The -[$O] Number field entry subtracts the

Open.

Line B calculates a 5 period exponential average of

the Line A Close-Open spread.

Line C calculates a 26 period exponential average of

the Line B average. This numerator result is saved in GV

[1].

Line D returns the Bar range, which is the High - Low

spread.

Lines E and F accomplish the double average of the

Range, similar to the Line B and C steps. Result is saved in

[2].

Line G does the division of the numerator in [1] by

the denominator in [2] and multiplies by 100. This is the

ECO.

A template named ErgodicCandle can be downloaded from

the Ensign web site using the Internet Services form.

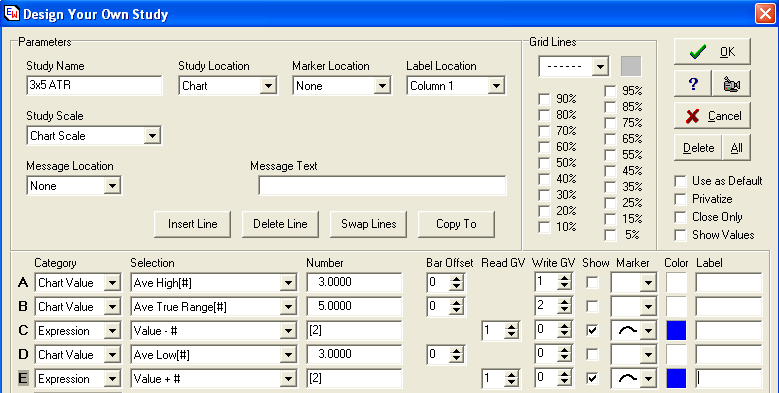

DYO Study:

Average True Range Channel

by Howard Arrington

A technique published

in Futures Magazine is used by Joe Duffy for identifying Support and

Resistance levels. Joe calls the indicator the

3x5ATR.

Click here for more information: www.futuresmag.com/library/daytrade97/day7.html .

The method of calculation for this indicator is:

- Add up the true ranges for the last five days and divide by

five. This is the 5ATR.

- Calculate a three-day simple moving average of the highs and a

three-day simple moving average of the lows.

- To calculate the 3x5ATR for potential resistance, add the 5ATR

to the three-day moving average of the lows. To calculate the

3x5ATR for support, subtract the 5ATR from the three-day average

of the highs.

This study can be implemented in Ensign Windows using the Design

Your Own™ study feature.

Line A calculates the 3 bar simple average of the High

and saves the result in Global Variable (GV) [1].

Line B calculates the 5 bar simple average of the

Average True Range and saves the result in GV [2].

Line C calculates the Support level by subtracting

5ATR from 3High. The result is plotted in Blue as the lower

band.

Line D calculates the 3 bar simple average of the Low

and saves the result in GV [1].

Line E calculates the Resistance level by adding 5ATR

to the 3Low. The result is plotted in Blue as the upper band.

A template named 3x5ATR can be downloaded from the

Ensign web site using the Internet Services form.

|