September 2006

Trading Tip:

Equi-Volume Bars![]()

by Ana

Maria Gallo

Copyright (c) 2006 AM Gallo

Ensign Software's

latest release introduces new features that are absolutely

delightful, particularly for the trader who appreciates and wants to

exploit the role volume plays in the market. This article focuses on

Howard Arrington's implementation of Equi-Volume,

but will touch on another key new feature, Bid/Ask

Volume.

Background

The

Equivolume concept was developed by Richard W. Arms, Jr., who in

1967 also developed another important contribution, the Arms Index

or TRIN, also a volume-based tool. Mr. Arms originally

calculated both TRIN and Equivolume, along with the companion Volume

Adjusted Moving Average (VAMA) and Ease of

Movement, using slide rules and later, calculators. What a

treat it is for the modern trader to simply right click and within a

few strokes, apply these concepts to any chart, any time frame.

Please see the Resources at the end of the article for further

reading on how Mr. Arms applies his ideas.

Equivolume Overview

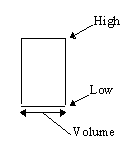

Put in

its most simple terms, a box is drawn with the high and low as top

and bottom. The width of the box is determined by the volume traded

during that bar's time frame. From Mr. Arm's book Volume Cycles in the Stock

Market:

According to Mr. Arms,

"The shape of each Equivolume box provides a

picture of the supply and demand for the security during a

specific trading period. Short and wide boxes (heavy volume

accompanied with small changes in price) tend to occur at turning

points, while tall and narrow boxes (light volume accompanied with

large changes in price) are more likely to occur in established

trends."

For reference, here is an image showing Mr. Arm's graphical view

of Equivolume.

[image sources: armsinsider.com]

Ensign Software Equivolume Implementation

Ensign's implementation of Equivolume

is quite sophisticated and allows for a number of display and study

options. Each feature deserves elaboration so as to better

appreciate the possibilities. Here is a summary, followed by

examples showing how each feature can be used.

- The "X-Axis" is uniform, allowing trendline and cycle studies

not readily implemented with the classic display;

- Equivolume can be applied to all price displays: time, tick,

range, and volume, for which tick volume is substituted for trade

volume;

- Bars can be displayed as Equivolume Candles, allowing wick

information not visible with the classic box display;

and

- Bid/Ask Volume can be incorporated into the Equivolume display

and, using Ensign Flutes, reflect the classic "box" display.

X-Axis Uniformity

In the

Arms implementation, the "time axis" is time modulated by

volume. As such it is irregularly narrowed or widened by the

volume of the boxes. A clever feature in Mr. Arrington's

implementation is to center the candles, thus keeping a uniform

X-axis, and use visual overlap to display the variable widths. This

allows use of classic indicators and draw tools to be accurately

implemented. The amount of overlap

is user selectable, as is the net space between bars.

"Crowding" can be alleviated by increasing the space between

bars. The later is particularly useful to swing traders who

have time on their side when evaluating price action.

Time Frame Flexibility

The

advent of price display using range, tick, and volume has opened up

trading strategies geared to reveal areas of reversal or congestion

that traders can exploit. Because Volume represents commitment

at price, incorporating Equivolume display on range (or volume) bars

adds yet another dimension time-based volume flow may mask.

Nevertheless, the "read" is the same: fat bars show heavy

participation, thin bars indicate light participation.

Range Bars

Range bars are formed as price moves through

the specified price increment, in the following example, 8 points.

When range bars overlap, price is congesting; fluid moves with

little overlap indicate buyers (or sellers) are enthusiastically

supporting movement.

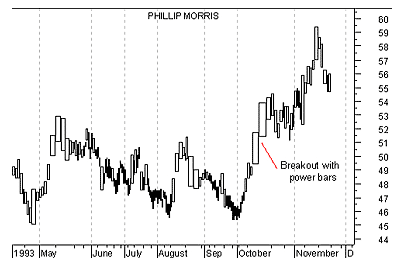

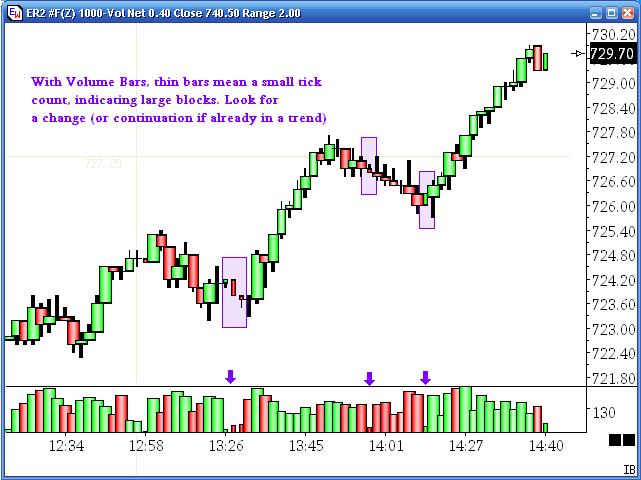

Volume Bars

Volume bars are exceptional in that when

displayed in the Equivolume style, they are somewhat

counterintuitive as tick count is the measure.

To clarify: A volume bar consists of a fixed number of

contracts traded, in this example, 1000 contracts. A tick may

consist of any number of contracts. So a 100-tick volume bar

of 1000 contracts represents an average of 10 contracts per tick

("small" traders). A 5-tick 1000-contract bar would be 200 contracts

average per tick (likely block trades).

Thus, a fat volume bar is composed of many ticks, ie, "smaller"

players; whereas a thin volume bar represents a few or even a single

tick of large volume, very likely block trades. This is one

visual "inversion" traders using Equivolume style on volume bar

charts must keep in mind.

Display Options:

Candle Bars

Shown below are "Ensign Rockets".

Equivolume is limited to the "body" of the candle, so that the tails

are still visible, providing additional sentiment information.

The bars have the "3D" option, which complement Equi-Volume very

nicely. Additionally, the lower volume panel displays

up/down volume with corresponding width properties. This is

particularly useful for reading doji (equal open/close) bars.

Although I refer to candles, Ensign's implementation also draws

Equi-Volume traditional bars and will even draw Line-on-Close

displays thicker and thinner.

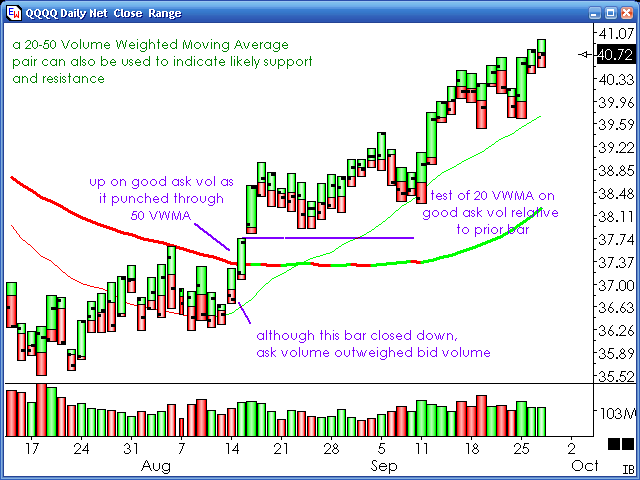

Flute Display

The Ensign "Flute" display best

approximates the original box style, but adds open and close hash

marks. For this example, I've used the Ask/Bid Volume coloring

option, where the "split" on each bar shows volume at the ask

(green) and bid (red). So not only do you see volume

participation, but also the bias in the volume is clearly

indicated.

Note: The Ensign Volume Weighted Moving Average is not the

same as Richard Arms VAMA, but does a fine job nonetheless.

Summary

An important idea to keep in mind

is that Equivolume width is a primarily a visualization, not an

absolute, although, one could indeed make it an absolute and use it

in a formula, as Arms mentions in his book. However, our eyes are

capable of amazing discrimination without having to resort to a

number or calculation. That is why consistent use makes for

good experience in deciding if they are a tool for you.

Going a step further, I speculate that neither Arms or

Howard use any "secret" factor to weight each bar, but as I mention,

I wouldn't know. My own work with volume has repeatedly taught

me that any significant impact volume has on the

current price bar is highly relative to the immediately surrounding

volume, usually within a few bars, far more so than say, volume

bars even twenty bars back. So, if there is any "weighting" ,

it would be to "normalize" the maximum width relative to some number

of surrounding bars. As Equivolume is primarily a

visualization, this type of normalization would have small, if

any, impact on the quality of the representation.

The question then becomes, how do I know that this particular

"fat boy" or "Olive Oyl" bar is meaningful? Like with pitchfork, my

first answer is "by repeated study and personal experience through

often use." The second answer is that one can access volume

impacts by also using a higher time frame. Including more

bars in the speculated normalization would, in my opinion, dilute

the usability of the width, similar to the way a moving

average flattens the longer you make it.

So, to summarize, while my curious nature prefers to know the

innards of indicators, I'm less fussy about the why and far more

interested that what features are there are tailorable enough

for my trading needs. I'd say that as long as Equivolume

yields tradable signals, then I'll use them until they no longer do

so.

Resources

Trading with

Equivolume is a free PDF book provided by Richard Arms on his

ArmsInsider.com website. This little book is well worth your time if

you are not yet familiar with this charting technique.

Strategies he explores, generously accompanied by charts, are

turning points, breakouts, continuation, support and resistance, and

gaps. While his focus is on short term swing trading, my own

experience, as illustrated herein, show there is great potential for

intraday traders to incorporate Equivolume ideas into their trading.

Trading Without Fear (1996) Expands on Equivolume, which

Arms considers an indicator of fear and greed in the market, as well

as the companion indicators Ease of Movement and Volume Adjusted

Moving Average (VAMA), that can take into account float and total

shares for stock trading.

Profits In Volume: Equivolume Charting (1999)

Richard Arms' original work on Equivolume.

Related Volume Topics on Ensign's web site: (click on a

link to read the article)

|