December 2006

Trading Tip:

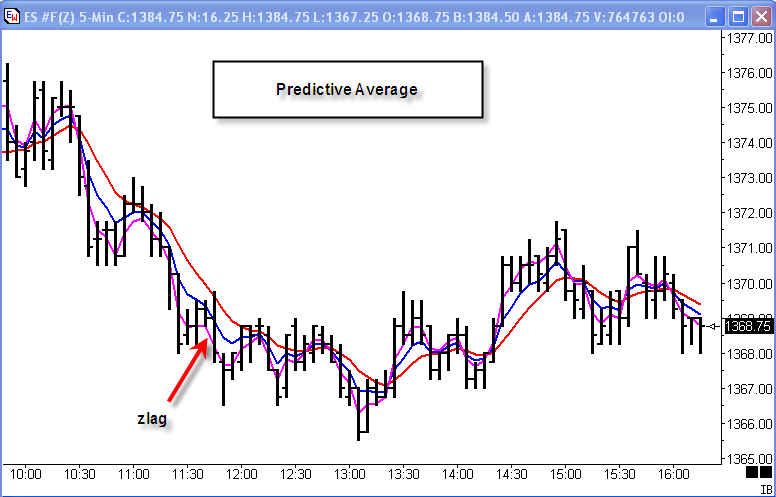

Predictive Average![]()

by Howard Arrington

This Predictive Average is a clever method for removing some of

the lag inherent with moving averages. The principle involved

is to use the spread between two moving averages as an offset from

the original moving average. In this example, the

original moving average is the Blue line. The spread

distance between the Blue line and a 2nd moving average (Red

line) is added to the Blue line to create the Predictive

Average which is drawn in Pink.

Formula:

ave1=xaverage(price,period);

ave2=xaverage(ave1,period);

spread=(ave1-ave2);

zlag=(ave1+spread);

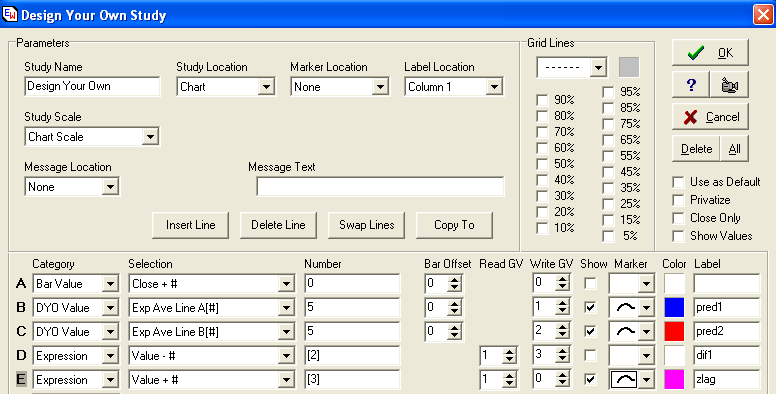

DYO Implementation:

Line A will be your price selection. Example uses the bar

closes, but could be changed to be a bar's High or Low. Line B

is the Exponential average of the data on Line A. Line C

is the average of the data on Line B. This is the calculation

for ave1 and ave2. The 1st average is stored in

GV[1]. The 2nd average is stored in GV[2]. GV

is our notation for a global variable of which there are 255

variables. Line D calculates the spread between the two

averages by subtracting GV[2] from GV[1].

Line D reads GV[1] for Value and subtracts the Number field which

is the contents of GV[2]. This result is written in GV[3] and

is the spread value. Line E reads the average from GV[1], adds

the contents of GV[3] which was written by Line D, and plots the sum

as a Pink line. This is the zlag expression.

This example can be downloaded from the Ensign web site using the

Internet Services form. The template for the example is

named: 1391-PredictiveAve

Template: 1391-PredictiveAve

Trading Tip:

Anticipating Moving Average Crossovers

by Howard Arrington

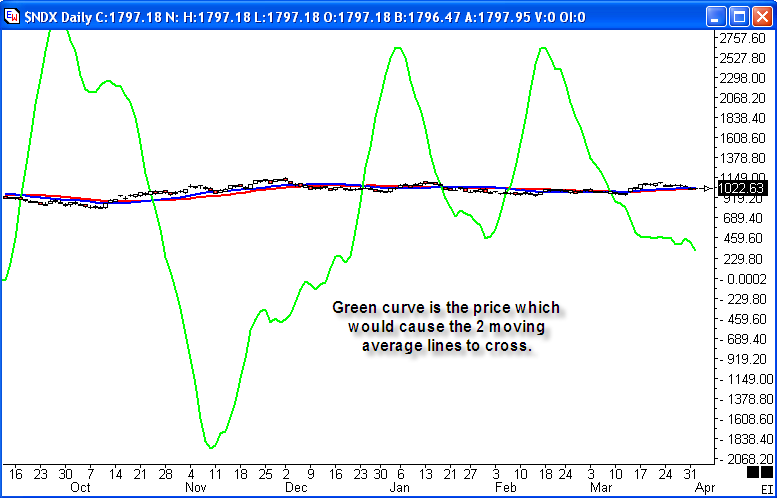

A significant feature in Ensign Windows is the PriceFinder(TM)

technology that can be used with any study. PriceFinder is a

selection in the Design Your Own(TM) study feature. It

can be used to solve for tomorrow's close and plot the price

that would cause two moving averages to cross.

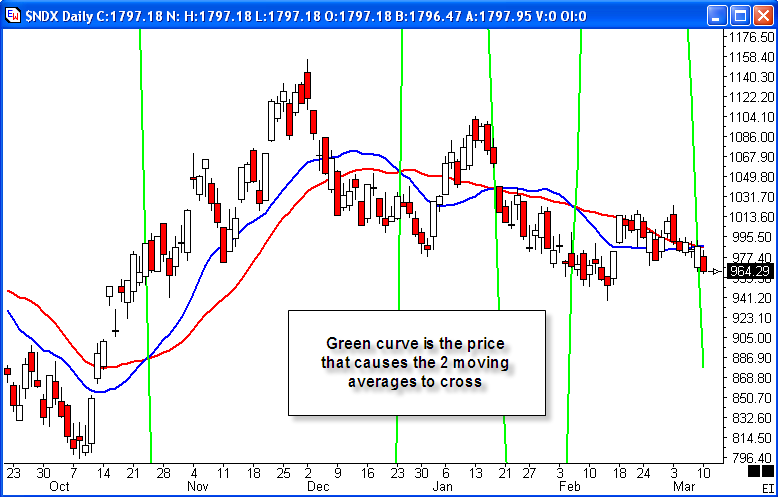

Figure A - Ensign Windows PriceFinder. The

blue line is a 20-day moving average, and the red line is a 30-day

moving average.

The green line was calculated using Ensign's PriceFinder.

This curve shows the price which would cause two moving averages to

cross. As the two averages get near each other, the green line

approaches the averages. The advantage and power of

PriceFinder, is that it can be used with any study. Go

to the file:///C:/EnsignSoftware/index.htm

web site for additional examples of PriceFinder being used with

Bollinger Bands, Commodity Channel Index, and Relative Strength

Index.

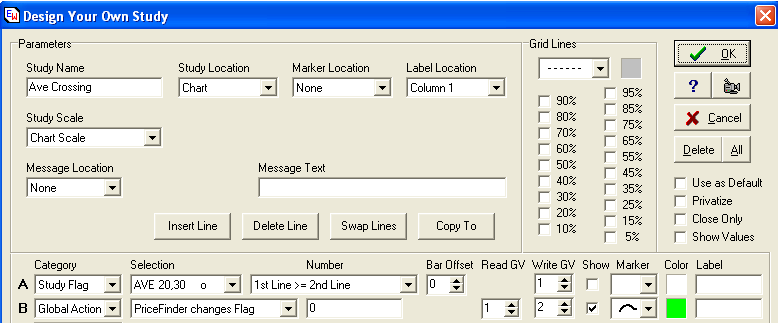

The creation of the crossover price curve required 2 lines in

Ensign's Design Your Own study, as shown below.

Figure B - Design Your Own parameters that

implement tomorrow's close (TC) curve.

The Line A selection is a Boolean flag for the Moving Average

lines, and will have a True value when the 1st line (20-bar average)

is above the 2nd line (30-bar average). Line B uses the

PriceFinder technology to calculate the next bar's close that would

cause the Boolean Flag from Line A to change states. This

price is plotted using a green curve line.

The following chart is the same chart shown in Figure A.

The scale has been changed to show more clearly the relationship of

the bars, the 2 moving average lines, and the price curve

that causes the 2 moving average lines to cross.

Figure C - Next bar's closing price that causes the 2

moving averages to cross.

When the blue line (20-bar average) is below the red line (30-bar

average), a higher price is needed to raise the blue line to cross

the red line. The green line is showing the price for

tomorrow that is needed to cause the 2 moving averages to

cross. Once the blue line is above the red line, the

next bar's price (green line) price would naturally be below

the two averages. A lower price is needed to cause the

blue line to descend to cross the red line.

Formulas for calculating the price that would cause 2 moving

averages to cross are published in the February 2007 issue of Stocks

and Commodities in the article 'Anticipating Moving Average

Crossovers' by Dimitris Tsokakis.

Trading Tip:

$TICK and $TICKI Divergence

by Howard Arrington

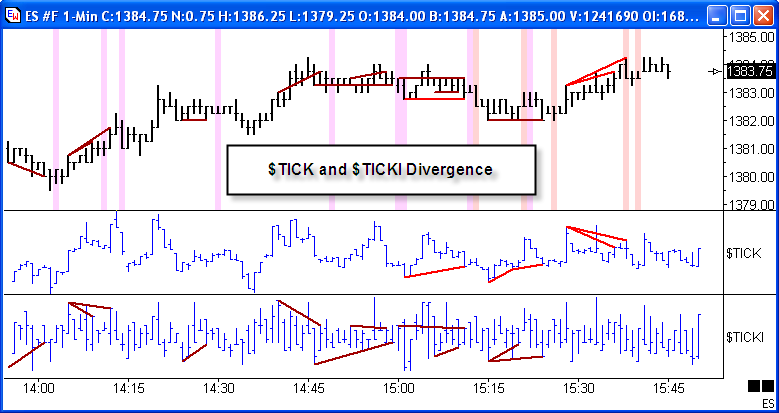

Ensign has a tool for showing Divergence between a

study or overlay and the host chart. In this example $TICK and

$TICKI are added to the ES #F e-mini chart as overlays.

The Divergence study is marking divergence formations between the

overlays and the ES #F chart.

Rarely will $TICK and $TICKI have divergence on the same

bar. You can study the example and decide what action you

might want to take when divergence is present. One

drawback to factor in is that the Flag for the Divergence on either

overlay will be 2 bars after the Divergence occurred.

This example can be downloaded as a template from the Ensign web

site using the Internet Services form. The template is

named: 1398-TickDiverge. In the

template's content note the use of a DYO to select the High or the

Low of the overlay for use in the Divergence calculation, so the

divergence lines are drawn from the Highs and/or Lows on the

overlays.

Template: 1398-TickDiverge

Trading Tip:

CCI Zero Line Pullback

by Howard

Arrington

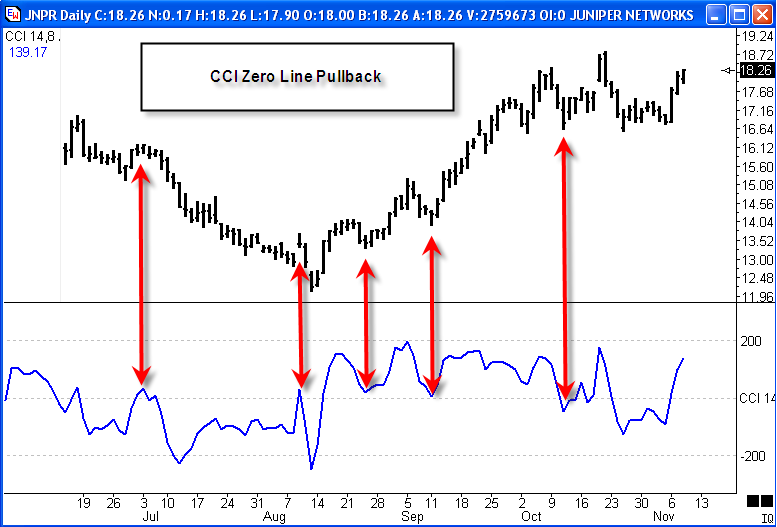

What is a pullback? And how could it be found using the

Commodity Channel Index (CCI)?

Pullback usually is referring to a retracement wave in a

trend. With a CCI study, the price pullback causes the

CCI line to head towards the zero line, and typically reverse at the

zero line about the time the retracement

is complete. Patrons of CCI call this a 'zero line

bounce'.

The first 2 arrows show pullbacks in a down trend, where the CCI

returned to the zero line and then the down trend continued.

The last 3 arrows show pullbacks in an up trend, where the CCI

returned to the zero line and then the up trend continued.

|