January 2007

Trading Tip:

FOREX 101: Make Money with Currency Trading![]()

by Rich McIver

For those unfamiliar with the term, FOREX (FOReign EXchange

market), refers to an international exchange market where currencies

are bought and sold. The Foreign Exchange Market that we see today

began in the 1970's, when free exchange rates and floating

currencies were introduced. In such an environment only participants

in the market determine the price of one currency against another,

based upon supply and demand for that currency.

FOREX is a somewhat unique market for a number of reasons.

Firstly, it is one of the few markets in which it can be said with

very few qualifications that it is free of external controls and

that it cannot be manipulated. It is also the largest liquid

financial market, with trade reaching between 1 and 1.5 trillion US

dollars a day. With this much money moving this fast, it is clear

why a single investor would find it near impossible to significantly

affect the price of a major currency. Furthermore, the liquidity of

the market means that unlike some rarely traded stock, traders are

able to open and close positions within a few seconds as there are

always willing buyers and sellers.

Another somewhat unique characteristic of the FOREX money market

is the variance of its participants. Investors find a number of

reasons for entering the market, some as longer term hedge

investors, while others utilize massive credit lines to seek large

short term gains. Interestingly, unlike blue-chip stocks, which are

usually most attractive only to the long term investor, the

combination of rather constant but small daily fluctuations in

currency prices, create an environment which attracts investors with

a broad range of strategies.

How FOREX Works

Transactions in foreign currencies are not centralized on an

exchange, unlike say the NYSE, and thus take place all over the

world via telecommunications. Trade is open 24 hours a day from

Sunday afternoon until Friday afternoon (00:00 GMT on Monday to

10:00 pm GMT on Friday). In almost every time zone around the world,

there are dealers who will quote all major currencies. After

deciding what currency the investor would like to purchase, he or

she does so via one of these dealers (some of which can be found

online). It is quite common practice for investors to speculate on

currency prices by getting a credit line (which are available to

those with capital as small as $500), and vastly increase their

potential gains and losses. This is called marginal trading.

Marginal Trading

Marginal trading is simply the term used for trading with

borrowed capital. It is appealing because of the fact that in FOREX

investments can be made without a real money supply. This allows

investors to invest much more money with fewer money transfer costs,

and open bigger positions with a much smaller amount of actual

capital. Thus, one can conduct relatively large transactions, very

quickly and cheaply, with a small amount of initial capital.

Marginal trading in an exchange market is quantified in lots. The

term "lot" refers to approximately $100,000, an amount which can be

obtained by putting up as little as 0.5% or $500.

EXAMPLE: You believe that signals in the market are indicating

that the British Pound will go up against the US Dollar. You open 1

lot for buying the Pound with a 1% margin at the price of 1.49889

and wait for the exchange rate to climb. At some point in the

future, your predictions come true and you decide to sell. You close

the position at 1.5050 and earn 61 pips or about $405. Thus, on an

initial capital investment of $1,000, you have made over 40% in

profits. (Just as an example of how exchange rates change in the

course of a day, an average daily change of the Euro (in Dollars) is

about 70 to 100 pips.)

When you decide to close a position, the deposit sum that you

originally made is returned to you and a calculation of your profits

or losses is done. This profit or loss is then credited to

your account.

Investment Strategies: Technical Analysis and Fundamental

Analysis

The two fundamental strategies in investing in FOREX are

Technical Analysis or Fundamental Analysis. Most small and medium

sized investors in financial markets use Technical Analysis. This

technique stems from the assumption that all information about the

market and a particular currency's future fluctuations is found in

the price chain. That is to say, that all factors which have an

effect on the price have already been considered by the market and

are thus reflected in the price. Essentially then, what this type of

investor does is base his/her investments upon three fundamental

suppositions. These are: that the movement of the market considers

all factors, that the movement of prices is purposeful and directly

tied to these events, and that history repeats itself. Someone

utilizing technical analysis looks at the highest and lowest prices

of a currency, the prices of opening and closing, and the volume of

transactions. This investor does not try to outsmart the market, or

even predict major long term trends, but simply looks at what has

happened to that currency in the recent past, and predicts that the

small fluctuations will generally continue just as they have

before.

A Fundamental Analysis is one which analyzes the current

situations in the country of the currency, including such things as

its economy, its political situation, and other related rumors. By

the numbers, a country's economy depends on a number of quantifiable

measurements such as its Central Bank's interest rate, the national

unemployment level, tax policy and the rate of inflation. An

investor can also anticipate that less quantifiable occurrences,

such as political unrest or transition will also have an effect on

the market. Before basing all predictions on the factors alone,

however, it is important to remember that investors must also keep

in mind the expectations and anticipations of market participants.

For just as in any stock market, the value of a currency is also

based in large part on perceptions of and anticipations about that

currency, not solely on its reality.

Make Money with Currency Trading on FOREX

FOREX investing is one of the most potentially rewarding types of

investments available. While certainly the risk is great, the

ability to conduct marginal trading on FOREX means that potential

profits are enormous relative to initial capital investments.

Another benefit of FOREX is that its size prevents almost all

attempts by others to influence the market for their own gain. So

that when investing in foreign currency markets one can feel quite

confident that the investment he or she is making has the same

opportunity for profit as other investors throughout the world.

While investing in FOREX short term requires a certain degree of

diligence, investors who utilize a technical analysis can feel

relatively confident that their own ability to read the daily

fluctuations of the currency market are sufficiently adequate to

give them the knowledge necessary to make informed investments.

Rich McIver is a contributing writer for The Forex Blog: Currency

Trading News (http://www.forexblog.org/ ).

Article Source: http://EzineArticles.com/?expert=Rich_McIver

Announcement:

FXCM Forex Feed

by

Howard Arrington

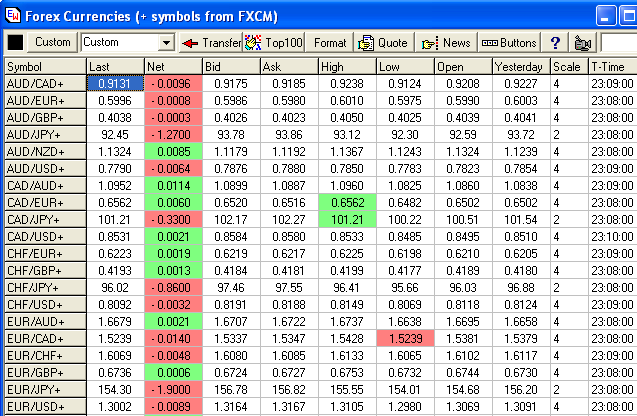

Ensign Windows includes a free Forex

feed from FXCM (Forex Capital

Markets), who is a major player in the forex markets. This

free feed has real-time quotes on the following 56 currency

pairs.

|

AUD |

CAD |

CHF |

DKK |

EUR |

GBP |

HKD |

JPY |

NZD |

SGD |

USD |

| AUD |

|

X |

X |

|

X |

X |

|

X |

X |

|

X |

| CAD |

X |

|

|

|

X |

X |

|

X |

|

|

X |

| CHF |

X |

|

|

|

X |

X |

|

X |

|

|

X |

| DKK |

|

|

|

|

|

|

|

|

|

|

X |

| EUR |

X |

X |

X |

|

|

X |

|

X |

X |

|

X |

| GBP |

X |

X |

X |

|

X |

|

|

X |

X |

|

X |

| HKD |

|

|

|

|

|

|

|

|

|

|

X |

| JPY |

X |

X |

X |

|

X |

X |

|

|

X |

|

X |

| NZD |

X |

|

|

|

X |

X |

|

X |

|

|

X |

| SGD |

|

|

|

|

|

|

|

|

|

|

X |

| USD |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

|

The real-time feed from FXCM updates with every change in a Bid

or Ask. It is not a snap shot type of feed which updates every

few seconds. This sets Ensign's implementation apart from the

majority of others who claim to have a forex feed into their

software. Ensign's implementation also has a refresh

capability for tick based charts, intra-day, daily, weekly and

monthly charts. Tick refresh is available for the last 100,000

ticks on each symbol pair. Intra-day refresh is available for

the last 4 months. Daily, weekly and monthly refresh is

available for the last 14 years (from May 1993 for most

symbols).

The coverage of symbols are 28 symbol pairs from FXCM, and the

inverse relationship for these same 28 pairs. So while FXCM

broadcasts data for 28 symbols, the feed from Ensign will give

quotes on 56 symbols. These 56 symbols will show on the Forex

market group quote page. Click the big Q button for a quote

page. Click the Forex market group button on the bottom of the

quote page to show the Forex Currencies.

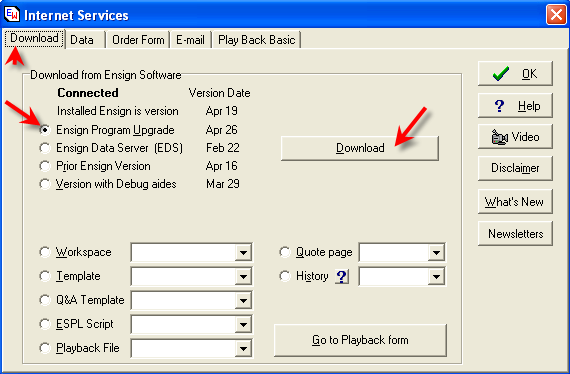

Steps to take:

To get the FXCM feed, download the latest version of Ensign

Windows. Click menu File | Open | Internet Services and

select the Download tab.

On this form, wait for the column of Version Dates to

fill in. Select the bullet for Ensign Program Upgrade,

and then click the Download button. The Ensign Windows

program will download an upgrade, exit, and begin the

installation. Accept the default prompts which will

install the Ensign upgrade. When the installation is

finished, rerun Ensign Windows.

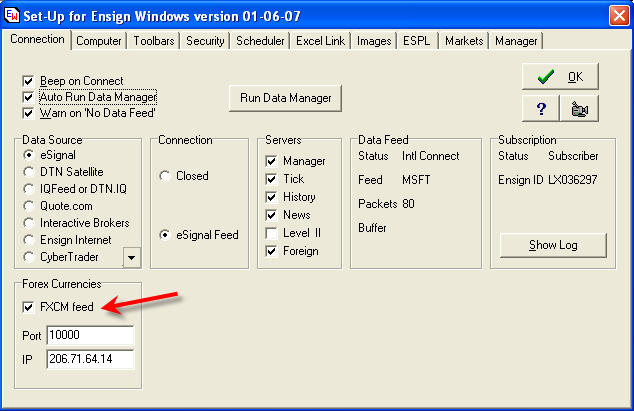

Now click menu Setup | Connection. Enter

10000 as the Port value, and 206.71.64.14 as the IP

address. Check the box for the FXCM feed and Ensign will

connect to the Ensign servers and process the FXCM feed.

Uncheck the FXCM feed box to stop the data feed. If you

experience difficulty in getting the FXCM feed to flow, you might

try unchecking and rechecking the FXCM feed check box .

Ensign's implementation processes the FXCM feed in parallel with

the data feed you subscribe to. You can have a feed from

eSignal, IQFeed, CyberTrader, or Interactive Brokers and optionally

elect to also have the 56 forex symbols from FXCM by checking the

FXCM feed checkbox. The FXCM symbols will be automatic,

meaning there is no need to enter any symbols on the Setup | Manager

watch list. Those who will use just the FXCM feed should

select Ensign Internet as the Data Source.

Users are welcome to track the forex symbols from FXCM, even

though they do not have an account with FXCM. The feed is from

FXCM to Ensign's servers in Salt Lake City. When you connect

to the feed, you are connecting to Ensign's servers, and not to any

FXCM server. The historical refresh data is also maintained in

a database on the Ensign servers.

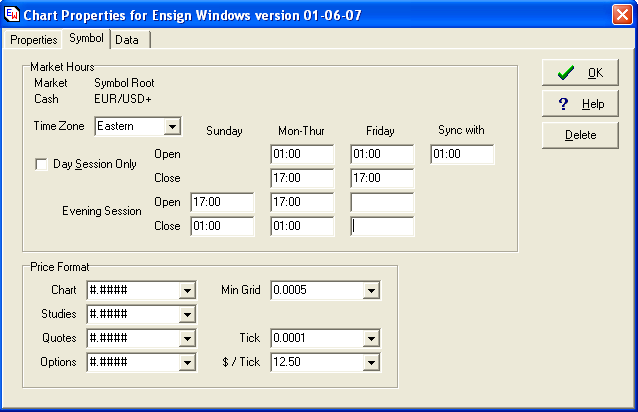

Symbol properties:

The symbol format will be two currency roots separated

by a slash and have a + character as a suffix. This will make

the symbols from FXCM unique and not conflict with forex symbols

from any of the supported data vendor feeds.

One word of explanation is that Ensign has imposed a 2 decimal

shift on the Yen quotes. This makes it standard with the way

Ensign quotes Yen currencies from our other data feeds. The

JPY/USD+ quote shows 0.83794 when the actual price is

0.0083794. The extras 2 leading zeros in the price just

make the price harder to read. So Ensign quotes it as 0.83794

by multiplying the actual quote by 100. This format is easier

on the eyes and mind and takes less space to show on a chart

scale.

Forex is 24 hours, so here is example market hours page for the

EUR/USD+ symbol.

The forex symbols can be shown on quote pages, snap

quotes, time and sales, and charted in any time frame.

Ensign is charting the changes in the Bid price.

There is no volume with each tick, so a default volume of 1 is

used. The volume that shows is a tick count total and it

is treated as at the Bid on a down tick and at the Ask on an up

tick.

Why do quotes differ?:

Equity and Futures traders are used to prices being the same at

any given time regardless of which firm they are trading through or

charting provider they are using and often assume the same holds

true for spot FX. Because the spot FX market is decentralized,

meaning it lacks a single exchange where all transactions are

conducted, each FX dealer (market maker) may quote slightly

different prices on their markets. Therefore, any prices

displayed by a third party charting provider, which does not employ

the market maker's data feed, will reflect indicative prices and not

necessarily dealing prices.

Market watchers, such as S&P

or ESignal, compile indicative quotes as a proxy for the actual

market movement. These prices are derived from a host of

contributors such as banks and clearing firms, which may or may not

reflect where FXCM's market is. Ensign Windows uses the FXCM

data feed and will reflect prices that mirror the prices in FXCM's

Trading Station dealing rates window.

Free Trial:

You are invited to download Ensign Windows from the Ensign web

site and give the program a thorough evaluation. Click this

link for Download

Instructions. Installing the program gives you a 1 week

trial use period. After that we hope you will subscribe.

The program use fee is $1.35 per day for the balance of this month,

and then $39.95 per month thereafter until you notify Ensign

billing you want to cancel. Use the built in Order form

to initiate a subscription.

Trading Tip:

Make 2007 Your Breakout Year!

by Judy Mackeigan, aka Buffy

Are you reading that title and thinking,

"I've been trying to do that for so long!" or "Said that last

year." "Trading is the hardest thing I have every tried to

do." Well, you are what you think! So let's discuss

some constructive actions you can do to get on the

super highway to success and off the old dirt back road.

This article is more for the traders that think it

is impossible to have a winning week. For those of you who

have winning weeks and then give it all back, the problem is

often one of the following: a different market, not

knowing when not to trade which is a trading decision, and/or

patience to let your setup come to you.

The first step is to stop trading real money.

This will allow you to focus entirely on learning to trade and also

stop the psychological damage that usually goes with the frustration

of losing.

Do you expect too much?

There are two areas many traders expect too much

from. The first area is from your system. Your

system's job it to give high probability signals for you to

take. Will they all be winners? NO! But they

should all have the odds with them. Traders run around trying

new things all the time trying to find the system that doesn't miss

a trade or signal a loser. Perfectionism is NOT possible in

the market. Your job is to take your setups, win some money,

lose some money and make more than you lose. Constantly

changing your system often shows an unwillingness to deal with

an emotional issue that might be holding you back. The most

common one is taking a loss for what it is and not a direct attack

on your ego.

The second area is from yourself

and where you are on the learning curve. Too many traders

think trading looks easy and wonder why they can't "get it" even

though they have heard "Trading is one of the hardest but yet

most rewarding endeavors you will ever learn to do."

Accept where you are on the learning curve now. Don't put a

time deadline on yourself as to when you will be ready to trade

live. Once you accept that it will happen when it

happens, the learning becomes so much easier without the pressure.

Settle on a system and have setup rules

When watching the charts posted daily, you will see

traders progress through the learning process of setting up what

works for them. Setups and exits are working. Then the

market changes, so they change their charts as they go off in search

of the perfect system. There is NO such thing!! If you

do change things when at this stage of learning, it is recommended

you run it side by side your normal charts. By doing this you

transfer your knowledge to the newly defined indicators and may also

better judge how well they work. The traders who are

constantly change their charts or system, do not believe THEY are

the Holy Grail they so desperately seek. Nobody or anything

else. You control whether money goes into or out of your

pocket.

Your system should be in your comfort

zone. Do you like scalping, intraday trend or counter trend,

long or short time frames, etc? Trying to learn a

system that isn't in your comfort zone usually doesn't work as you

are now fighting the emotions of being out of your comfort zone and

the emotions of trading. Finding the answers takes time.

Start with a trading system that makes

sense and talks to you when you look at a

chart. Many systems work. Pick one and learn

it. Stick with it until you know it well. Not just

the basics, but learn all the little nuances too. You will

develop a feel for what the market might be going to

do next. Over time you will add and

remove tools from your trading system to come up

with your own trading cocktail. The daily posts show

the confluence of all the various methods. They show

the same area for entries/exits, whether the

method is price action, pivots, trend lines, Fibonacci

levels, CCI, bands or 2XBline, etc. A good system

will usually work on all time frames and with most markets with

little or no adjusting.

Now you have a system and it is time to pick a

setup. It is recommended when you start out to pick a

setup that it is with the trend. By doing this, entries and

exits are more forgiving. Often the setup time frame is picked

by the reward you wish to receive by being right.

All you need to own is one setup to be profitable. You do

not need every point the market is

offering. Going after all the points the market

offers, will cause you to try to trade too many different

types of setups at once. Pick ONE setup that you

like and take it to profitability in your real account. Once

that is accomplished, then you can add another setup. Find the

easiest setup for you to see and practice it with

simulation trading before trading the setup in your real

account. Watch any other trade setup as a

future one to learn. Do not sit there and feel emotions

over missed money. Missed money is better than lost

money. Patience -- you can't learn to run before you can even

walk.

Are you marking charts?

By annotating your charts, you are training your

brain to see your setup on your charts with your

colors. These should be confirmed as being correct.

You wouldn't want to have to undo all that learning from a

misunderstanding. After two weeks you will find it much easier

to notice things without having them marked on the chart.

By posting charts marked with your entry/exit

for others to evaluate, constructive comments may be

made that might have kept you out of the losing trade or

in a winning trade longer, thereby increasing your knowledge.

It also shows an acceptance on your part to making mistakes.

Do you have rules for losers?

A loss is not a personal attack on your ego.

It is part of the business of trading. Keep your losses

small. When you do have a loss, learn to immediately forget it

and ask yourself, "Do I want to reenter? Is my setup

still valid?"

An example of rules might be:

1) One trade not following rules -- take

a break - no questions asked.

2) Three losers for the day

-- Quit! Accept that, for whatever reason, you are

not dancing with the market. You are just

getting your toes stepped on. To continue

trading often does some emotional damage that will have to

be dealt with later. Take the rest of day off,

or just observe and learn. Later analysis might show 1)

not your type of market 2) you didn't have the patience

to wait for your setup to come to you or 3) lack of

focus, i.e. phone call needing to be made, errand

that has to be run. Basically, the feeling that

you should be doing something else is usually not a good time

to trade.

There is a story about a trader who had done

very well. He rewarded himself by purchasing a fancy new

car which he picked the from the dealer on a Friday

morning. He made the decision to trade that day

and enjoy the car after markets closed. He experienced

his worst losing day in months because his focus was

on playing with the new car in the parking lot and not on what

his charts were telling him.

The other big focus distraction can

be results thinking. Is this trade going to be a winner

or loser? If your results for today will make your first

profitable week, or month, then you are focused on that and not

what the market is telling you. Chances are your trading

will not be profitable. Even when you are in a trade, if you

find yourself thinking of anything else other than the listening to

the market, then it is time to exit the trade! Try

asking yourself questions to maintain your focus.

Have you practiced by paper trading

first?

Today with the ability to practice, practice,

practice before using real money, there is no reason to pay the

expensive tuition often required years ago. Many

traders feel it isn't the same emotionally, and they are

right unless you have the correct mental approach to paper

trading. You want to have the same attitude towards paper

trading that athletes have for all the training they do

for their one race that counts for the Olympic gold.

It is practice that not only trains the brain

to see your setups without thinking, but also by

using discipline numbers, will give you direct feedback on how

you did with your system with what the market was offering that

day. By tracking these discipline numbers daily and

consistently doing well, you will find you have more

confidence in yourself and your chosen setup when you go live

in your real account. Do not go live until you can trade

the various types of markets successfully at actual speed. If

you don't use actual speed for your final "test", you might

find yourself doubting if you learned patience

to wait for your setup.

Have you kept track of your progress?

Don't compare yourself to others...there is always

someone better. Compare your progress to yourself and where

you were a month ago. You can't know where you are now if you

don't know where you were, if you don't

keep a record. By tracking your progress, you will

know when you are ready to go live and have the confidence to do so.

There was a trader who was so proud of his 5

points for the day when he first started trading futures. Then

someone said they had made 20. What an attitude shift

on his part! He went from being elated over a job well

done to 'oh my, what was wrong to have missed that much.'

Luckily a lesson was learned that day. He is still

learning. The trader with the 20 points was the

goal he was working for. How silly for him to expect to

already be there!

Do you have trouble pulling the trigger?

This can be a problem both in simulation and

live. It usually says you don't have total confidence in

yourself and/or your system. If you have been keeping track of

your progress as suggested above, just tell yourself, you can't win

the game if you aren't even playing! Wait for your setup as

defined by your rules - you know, the one you can see from

across the room - and then acknowledge your fear but tell

yourself you have done your homework, you have paper traded

profitably, you have learned how to manage a trade, and then

hit the order button!

Switching from paper trading to a real

account

When you feel you are ready, start out with one

trade a day. It is amazing how much this will reduce the

pressure of trading a full day and will also help you pick your best

setups and not overtrade. When you have a couple of

consecutive weeks (months) of profitability or feel comfortable

then go to two trades a day. At each step you may unveil

more emotional issues to deal with. Accepting losses seems to

be the biggest problem. Not being able to accept losses as

part of the business of trading and taking them as a personal blow

to your ego is why many run around tweaking their system,

trying new systems etc. Stop, and instead of running around,

just deal with the problem of accepting losses. No one is

saying you have to like losing. What is being said is that you

need to accept losses as part of the game and not a personal attack

on your ego. Be happy you took the loss because you did

your main job - preserved your capital to be around for

tomorrow.

Do you put in quality screen time?

You feel you are staring at charts for hours on end

and you should know how to trade by now. Not true.

Quality time is more important than quantity time. Have a plan

on what you are going to work on when you sit down. Make sure

to include reviewing losers. I know you rather go over

your winners but you will learn more from your losers.

Entries, exits, staying in a trend trade are a few of the

things you might decide to work on. If you are having

trouble in an area, post charts and ask questions of fellow

traders. If you don't know what you are missing, how can

you progress? Silliest thing is to do the same old thing and

expect different results.

You are what you think!

Discourage negative thinking! You are

what you think. Don't use "I can't..., or I will

never....". If you think you can't, then you won't and

the whole process of learning becomes harder. If you catch

yourself making negative statements, add "until now" to the

sentence as Nqoos recommends. This at least tells the brain

there is hope you can. Look in the mirror in the morning and

tell yourself, "I am a successful trader." Be who you

want to be. Stop negative thoughts by thinking positive

ones.

- Treat each trade like the first one of the day.

- Focus on the trade and what the market is telling you.

- Keep your losses small. Let the winners run.

- Do your homework by marking charts and posting for

discussion.

- Ask questions -- there is no such thing as a silly one.

- You will see the result in your account balance.

You, and only you, can make 2007 your breakout

year!

Buffy can be reached in the BLine chat room #2 in the

Ensign Windows program or by using the free EChat

program. |