May 2007

Trading Tip:

Pyramiding a Position![]()

by

Howard Arrington

The April

2007 issue of the Trading Tips newsletter showed how a trading

system could be designed using the Design Your Own (DYOs) features

and Study Alerts in Ensign Windows to implement the logic and

execute the trades. A training class was given on the design

of the trading system and the class

transcript can be read to better understand the trading system

design.

This month's article will build upon last month's Ensign

Stochastic System to show how it can be improved by:

-

Controlling the entry price for the trades.

-

Managing the position size by adding rules for

pyramiding.

The purpose for writing this article is to teach you how to do

more complex things. I am not trying to pass out 'fish'..... I

am trying to pass out 'fishing poles' and show you how the fish can

be caught.

Controlling the Entry Price

In the Ensign Stochastic trading system, there are various rules

for entering a trade Long or Short, and then various rules for

exiting the trade with a profit, exiting based on the Stochastic

pattern, or exiting based on time. All entries and exits used

the Last price of the bar that created the signal.

Possibly the system could be improved by trying to get a better

entry price by one or more ticks. The issues to be researched

are whether too many trades would be missed, or whether the more

favorable entry would result in a bigger profit. So lets

modify the system to test these possibilities.

The signals to Buy and Sell will come from Stochastic %K being

below 30 and crossing above 50, or being above 70 and crossing below

50. But instead of executing the trade on the Last price of

the signal bar, lets pick a more favorable price and then have the

system check subsequent bars to see if the range of a bar covers the

better price, and then execute the trade. Some trades will

naturally be missed by holding out for a better price. Back

testing will reveal whether the system is better or worse for the

attempt.

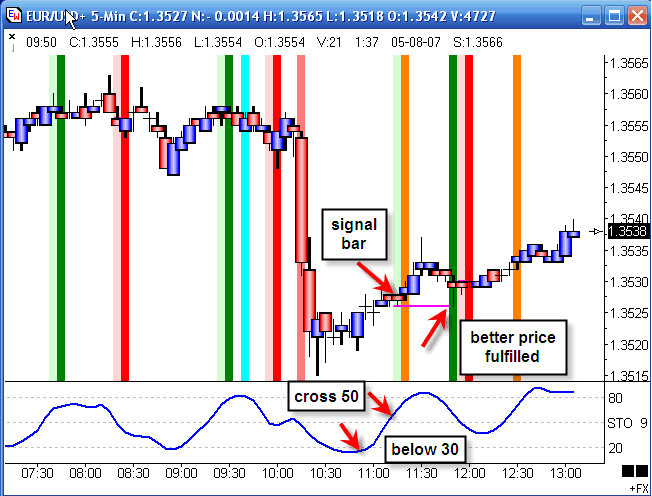

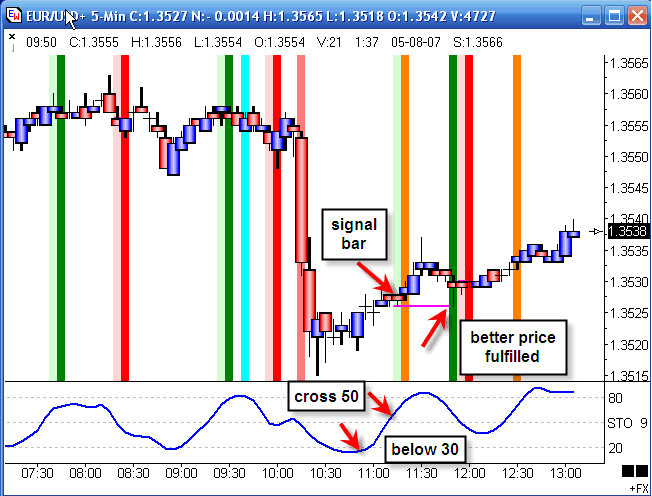

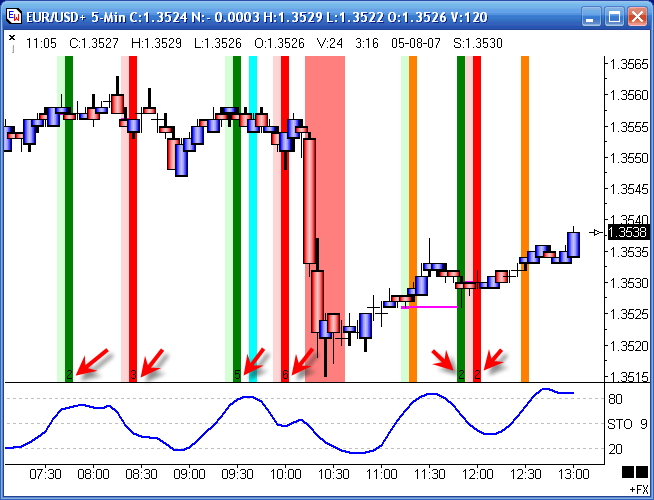

This chart shows an example of a Buy signal where the Stochastic

curve was below 30 and then crossed above 50. This signal is

marked by the pale green stripe on the chart, and the horizontal

pink line is the more favorable price I want to Buy at.

This price to enter Long is 1 tick below the Last of the signal

bar. This pink line will show on the chart sideways until it is

fulfilled, which in the example was about 7 bars later. The

actual trade to be Long was performed on the dark Green stripe at

the pink line price.

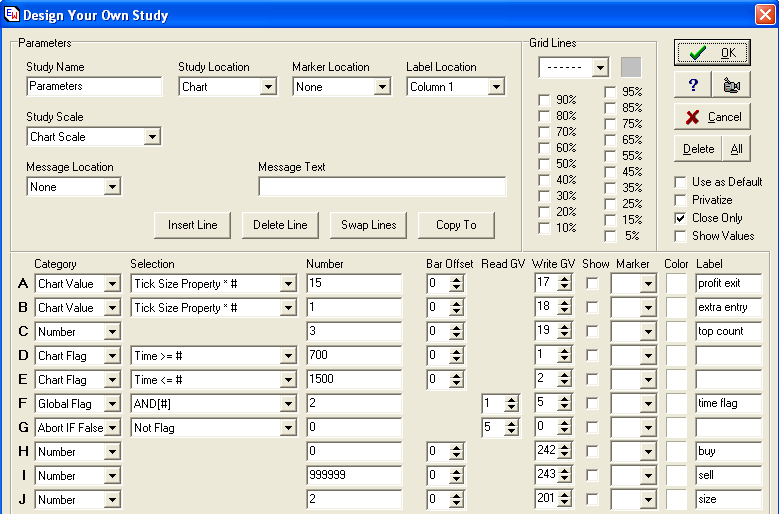

Parameters

Now let me show the DYOs that implement this kind of delayed

execution at a price under our control.

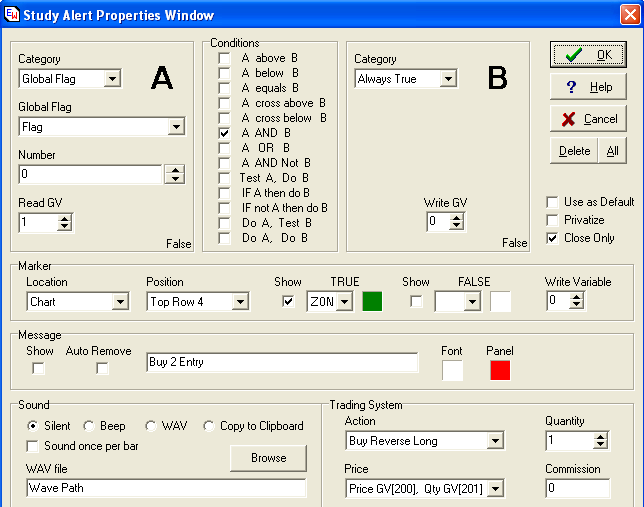

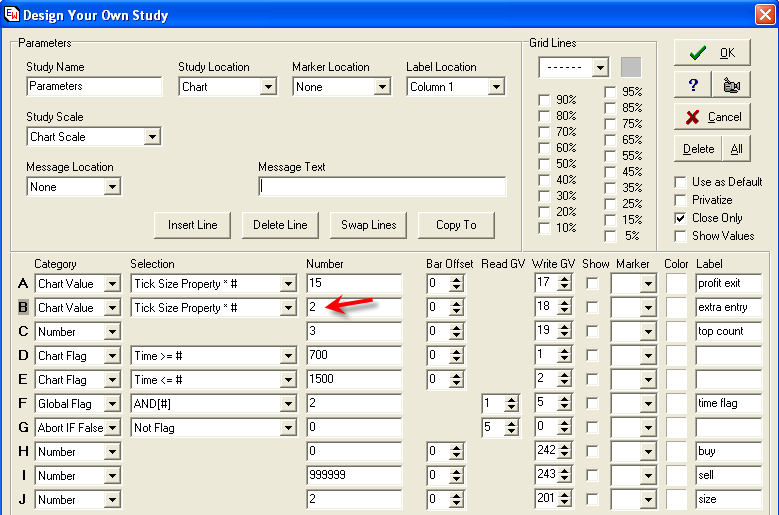

This is the first DYO in the modified trading system. It is

generalizing the design by using parameters which can be adjusted

for testing. In last month's design, one of the

parameters was a profit exit being 0.0015 points on the EUR/USD

forex chart. This was 15 ticks, and it was also 15 ticks in

the e-mini ES system design.

Line A is a way to generalize this parameter by first reading the

Tick Size property and multiplying it by the 15 and saving this

point objective in a Global Variable (GV). Later on when

a profit objective is tested, the contents of GV[17] can be used

instead of having a hard coded profit objective in points that is

unique for a symbol. This Line A profit objective is 15 ticks

regardless of the symbol. For example, 15 ticks for e-mini ES

is 15 * 0.25 = 3.75 points.

Line B will be a general parameter of how many ticks the system

is trying to hold out for as an improved price over the Last of the

signal bar. In the example the system is holding out for 1

additional tick on the entry. For a Long the entry price will

be the signal bar's Last minus 1 tick, and for a Short the entry

price will be the Last plus 1 tick. The entry price objective

is 1 tick more favorable than just trading the Last price from the

signal bar. Edit the Line B number field to be a 2 if you want

to try to hold out for an entry price that is 2 ticks more

favorable, etc.

Line C is the Top and Bottom wave count objective to control an

exit of the position. The parameter 3 was discussed in the training

class, but is put on this DYO and saved in GV [19] so we don't

have to find the wave count in a later DYO and edit it there to do

testing of a different parameter for the wave count

Lines D, E and F set the window of time when trading is permitted

and were discussed in the training class and in the April

newsletter.

Lines G, H, I and J control private Global Variables. The

price to Buy at will be in GV[242]. The price to Sell at will

be in GV[243]. The number of contracts to trade is initialized

to 2 and stored in GV[201]. These GVs will be erased or

initialized during the night session when the chart is outside of

the hours when signals can be taken. The hours when trading is

permitted are those on Lines D and E on this form.

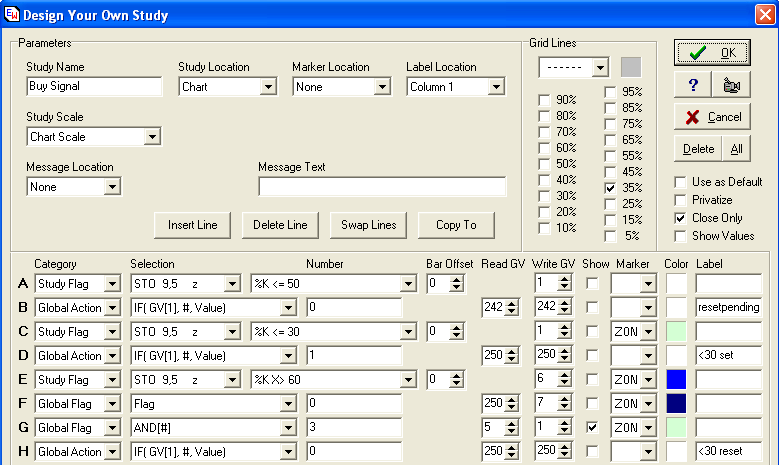

Buy Signal

This is the DYO for the Buy Signal, which is very much like last

month's DYO and discussed in the training class.

Line A tests when the Stochastic is Below 50, and when this

condition is True, Line B will reset the pending Buy price in

GV[242] back to zero. This test aborts a pending buy

when Stochastic is Below 50.

This DYO keeps track of the condition for the Stochastic being

below 30. Line C will be a Boolean True when the Stochastic %K

is below 30. This condition is then remembered in GV[250] by

Line D putting the number 1 (a Boolean True flag) in GV[250].

The signal bar is when the Stochastic then crosses above 60 (in

my example.) For the EUR/USD chart a crossing above 60

produces better results than a crossing above 50. The results

are similar. The idea is the same. Line E will be a

Boolean True when the Stochastic %K crosses above 60. This

condition is stored in GV[6]. Line F moves the flag in

GV[250] to GV[7] for testing.

Line G is the AND operation of GV[5] AND GV[6] AND

GV[7]. GV[5] has the flag for the Time test from the previous

DYO. When all three conditions are a Boolean True, we

have a Buy Signal. This signal bar is marked by a vertical

pale green stripe on Line G. And Line H resets the Below

30 condition flag remembered in GV[250] to a Boolean False.

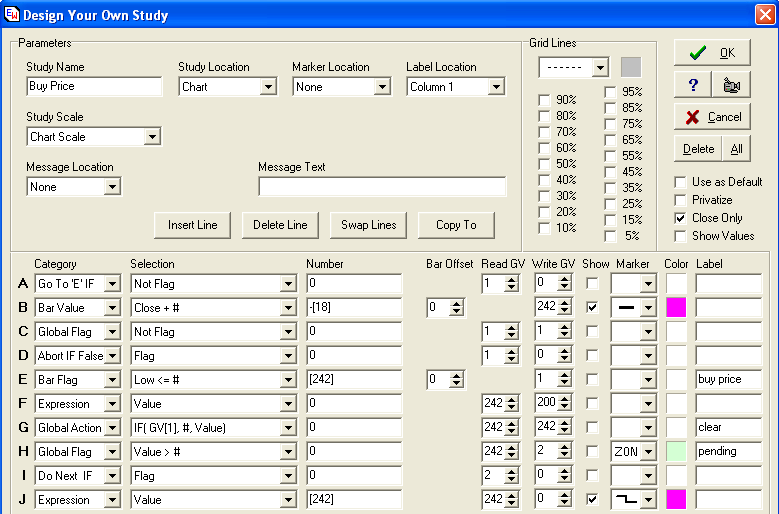

Buy Price

This DYO implements keeping track of the price to Buy at, and

when that price is fulfilled, executing a Long trade.

The Buy Signal from the prior DYO was stored in GV[1] so it can be

tested in this DYO on Line A. When the bar is not a

signal bar, execution jumps down to Line E and checks to see if this

bar's Low fulfills a pending Buy Price.

Lets assume we have a signal bar (pale green stripe) and thus

execution continues on Line B. Line B will read this signal

bar's Last and subtract the extra hold out point objective stored in

GV[18], which was set by Line B in the Parameter DYO.

This new better price to buy at is then saved in GB[242] and marked

on the chart with a pink line.

At first glance it looks like Line C and D could be combined

because their end result is to abort this DYO. Line C

first clears the signal flag in GV[1] by doing a Not operation on

the flag. This is done because GV[1] will be used by the next

DYO. Line C is clearing this flag so we do not buy on the

signal bar. The signal bar just sets up a pending buy and that

still requires a subsequent bar's Low to cover for a Buy

fulfillment. Line D then aborts execution in this DYO because

this is the signal bar.

Line E tests a non-signal bar to see if its Low is at or below

the Buy Price in [242]. This Buy price is moved by Line F to

GV[200] for use in the next Study Alert as a special GV that can

hold the price for a Study Alert to buy at.

Line G tests the Buy flag in GV[1] which was the Low being at or

below the entry price. This is the signal to execute the Buy

at our price in [242] and in [200].

Line H tests whether we have a Buy price in place. It will

be zero if we do not have a pending Buy, as is the case from the

initialization done before the market opens. You can check the Show

box on Line H to add more light green stripes if you want a

continued reminder a Buy is pending. I found that it was

sufficient just to have the Buy price continue to be shown as a

horizontal pink line and that is what Lines I and J

accomplish. If the Buy Price is non-zero, then the Buy order

is pending and the Buy price shows as a pink line on the chart, as

in the example chart shown earlier.

Buy Execution

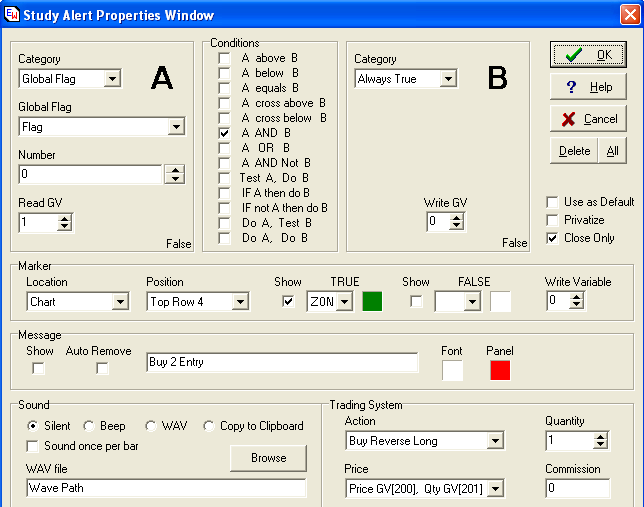

This is the Study Alert that performs the Buy action. It

looks at the flag in GV[1] which was the test for Low <= Buy

Price. Note the Price selection box in the Trading System.

This selection says to use as the trade Price the value in Global

Variable [200]. This is why the prior DYO moved the Trade price from

the private GV[242] into GV[200]. The Trade Size or

Quantity will be the value in GV[201], which overrides the setting

in the Quantity spinner box.

Look at the example again now that we have run through the logic

for the Buys. Each Buy is the dark green stripe and it

is preceded by a pale green stripe which is the pending Buy

signal. On the first 2 Buys the trade bar immediately followed

the signal bar. With the pale green stripe, the intent is to

buy when the market covers the Buy price which is one tick lower

than the signal bar's close. And in the first two Buys, the

following bar gave the better fill price. In the case of the

3rd dark green stripe, we had to wait 7 bars to get the pending Buy

order filled.

Do you see where I am headed with this example? Do you like

the possibilities that are being demonstrated? In my opinion,

this system has a greater resemblance to reality. You see a

signal, place a Limited Buy order, and wait for the order to be

fulfilled.

Sell Signals

Now, I do the same thing for the Sell signal being pending with

the pale red stripe and the actual Sell being accomplished with the

dark red stripe. The Sell price is 1 tick above the signal

bar's Last price. Fulfillment does not happen on the signal

bar, but rather may happen on a subsequent bar. The 3 dark red

stripes in the example all fulfilled on the bar following the signal

bar for going Short.

Between 10:00 and 10:30 we have a red stripe that is medium dark,

and this is a marker for one of the exit signals at a profit

objective. The dark red stripe at 10:00 sold 2 short, and the

medium red stripe 3 bars later lifted one contract at a profit

objective. The profit objective exit still uses the Last of

the bar it exits on. This exit on the profit objective is

based on the bar's close, which can be greater than the 15 points

set as the minimum for a profit objective. The exit on the

medium red stripe was the close of that big down bar. The exit

on a profit objective is the same as discussed in the April

newsletter.

The example also shows an orange stripe at 11:20 which is the

exit of the 2nd contract from the Short at 10:00. This exit is

based on the Stochastic climbing above 70 while the position is

short.

The bar ahead of the orange stripe is a signal for a pending

Buy. In the April newsletter design, that signal would have

exited the Short and put on 2 Long contracts. With the change

to hold out for a better entry price, the exit was triggered by one

of the conditions to abort a trade which seems to be going the wrong

way. So the 2nd contract of the Short was exited at the

orange stripe. The abort for a wrong way Stochastic still use

the signal bar's Last price. I did not want to monkey around

with the safety net. If you get a signal to abort, just do

it. Trying to hold out for a better price when exiting might

be hazardous. I am only holding out for a better price on

Entries. If I miss the entry price all that happens is I am

left on the sidelines waiting for the next train to leave the

station. I can live with missing a trade because I still have

my capital in hand to trade with. For an exit signal based on

Stochastic being the wrong way, and for a Time of day exit, etc,

just exit on the signal bar and use the Last as the exit price.

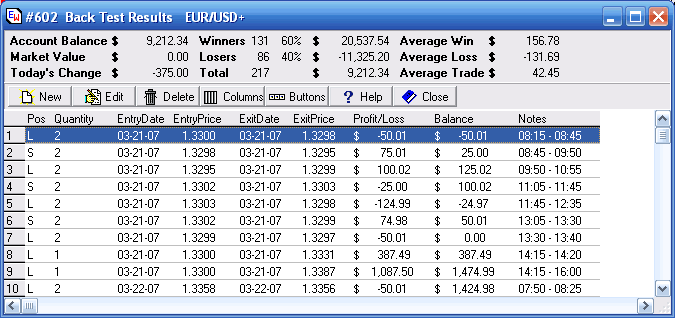

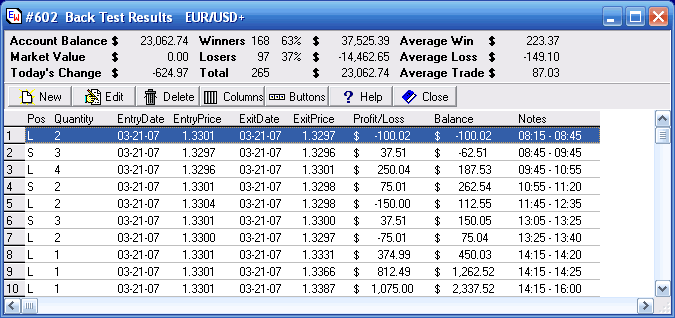

Trade Detail

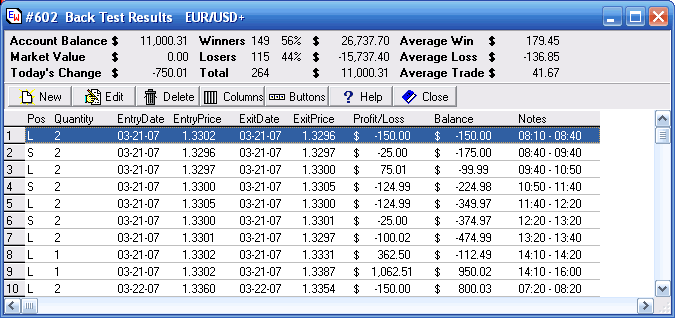

Click menu Charts | Trade Detail. This shows a summary of

the trades made by the Ensign Stochastic System. Let me show

you a summary from the April newsletter's system so I can compare it

with the modification that attempts to get a better

price.

The form above shows the results of using the system designed in

the April Trading Tips newsletter, which executes all trades at the

signal bar's Last price. The key numbers of interest are the

Account Balance of $11,000 and Total Trades of 264.

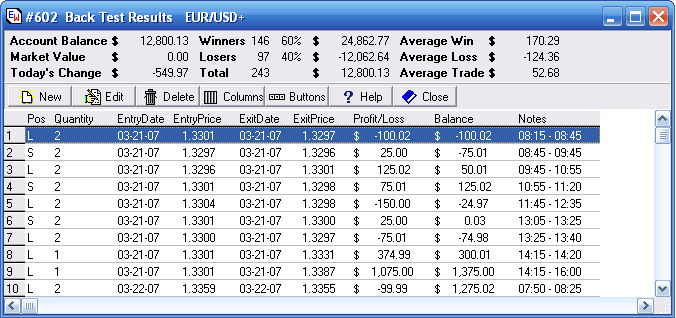

This 2nd summary is for the new system that tries for a 1 tick

better fill price for Entry on trades. Note the improvement in

the profit is $1800. Profit is $12,800 versus

$11,000. The Total trades is 243 instead of 264, so it

must have missed taking some trades. That was to be

expected. Looks like it missed 20 out of 264 trade, or about

8% of the time. However, since the profit improved, I consider

this a good thing. It missed mostly losing trades by dropping

Losers from 115 to 97.

The Average Trade in the prior form was $41, and now it is

$52. That is about the size of 1 tick of added profit on each

trade. So the average profit increased, as would be expected

since the system holds out for a better fill price.

Since the system has a Parameter DYO where the number of ticks to

hold out for can easily be change, my next test waits for a fill

price that is 2 ticks better than the signal bar's Last price.

The Line B Number field has been changed to be a 2, instead of a

1. Now the system will try for a two tick better price (lower

price) on a Buy and (higher Price) on a Sell.

The number of trades dropped to 217 from 243, so many more trades

were missed. These missed trades affected the profit

more than was made up by the added tick in the profit of profitable

trades. It is wonderful for the system to find these answers.

Possibly more trades were exited at our abort conditions as was

illustrated in the chart earlier at the orange line. That one

example showed the exit of the short trade was at a worse price, and

offset the benefit of trying to get a Buy at a better price. I

will return the parameter back to a 1.

This research tool is giving you the fishing pole so you can do

more research in this area of adjusting the entry

price.

Pyramiding a Position

Now lets move on to the 2nd improvement in the trading system

design by managing the size of a position through pyramiding.

I will leverage on the system design shown so far, and keep

the improvement of holding out for a 1 tick better price to Enter

positions.

Twenty five years ago when I was first searching for the Holy

Grail, I observed that a good winning trade often was preceded by a

losing trade. And this is a big CLUE that I have not seen in

publications anywhere, so let me emphasize it by discussing it.

We often look for good markers, clues or signals for when to make

a trade. Yet, we emotionally do exactly the opposite of what we

should be doing. When we experience a losing trade, the

natural reaction is to be hurt, recoil, and say I am not going to do

that again. Then when we have a winning trade, we get

too confident and trade a bigger position and then get really hurt,

and start all over again.

As a kid I would play a game called 'double or nothing'. If

I was trying to take my brother's money, and I had lost to him, I

would say double or nothing, and we would flip the coin again.

Eventually I won and would erase my debt. Now think about that

simple example of double or nothing. If you have been a

winner, you will eventually lose and return to zero. If you

have been a loser, eventually you will win and return to zero.

'Double or nothing' is a form of Pyramiding, but as a child I did

not know that big word existed.

Pyramiding Theory

Let's apply the principle, however, to the trading system

design. I can show you it works in a moment. First I

need to set out a ground rule and discuss the theory of why it

works. Lets go back to a classic wave model where a

trend unfolds in waves that we can generalize as Trend - Reaction -

Trend - Reaction - Trend. This is the Elliott 5-wave pattern,

which I will shorten to the notation T-R-T-R-T.

The Ensign Stochastic system, and most systems, are able to

extract a profitable trade during a trend or the T wave. But, what

follows a T wave most of the time??? It is a reaction

wave or a correction wave which I show as an R wave. Most of

the losing trades happen in the R wave. And then being bruised

we emotionally are on the sidelines just when the next T wave is

starting. Instead, we should recognize that T follows an R,

and statistically, the best time to pocket a winning trade is

following an R wave.

DO YOU SEE THAT? If I can share any key concept in this

article, it is this concept about T_R_T_R_T patterns.

The probability of a winning trade is greater following an R wave,

or following a losing trade. So, lets put that characteristic

into our system

If we have a winning trade, assume it was in a T wave, and we

should reduce our exposure for the anticipated R wave due next. Now

it might be T-T pattern at a nice V top or V bottom turn. The

market might be starting a whole new trend and that would be the

case after a 5th wave starting a new 1st wave, for a T-T pair.

So we do not want to be out of the market. We just want to

manage the risk better by having a reduced exposure since an R wave

follows a T wave more often than T follows T.

The first rule will be: If the last trade was a winner then

reset our trade size to the default of 2 contracts. This

is the size used in the system shown above. A new trade was

initiated with 2 contracts, and then had options to lift one

contract at a profit objective and let the 2nd contract run its

course to be exited by Time or by a Stochastic pattern.

In the pyramid model, I will begin with 2 contracts, and return

to trading 2 contracts after a winning trade. But after a

losing trade, my hypothesis is that I will have a higher likelihood

of having a winning trade because T follows R more often than R

follows R. After a losing Trade, assume it was because

of an R wave, and a trend wave will follow. Therefore, we

should trade a bigger position. The 2nd rule will be:

After a losing trade, increase the position size by 1 and trade 3

contracts. If we lose again, increase position size by 1 again

and trade 4 contracts.

Some of the abort signals such as the wrong way Stochastic are

good indicators too, like a strength of signal or quality of signal

indicator. After these abort signals, lets increase the size

by 2 instead of by 1.

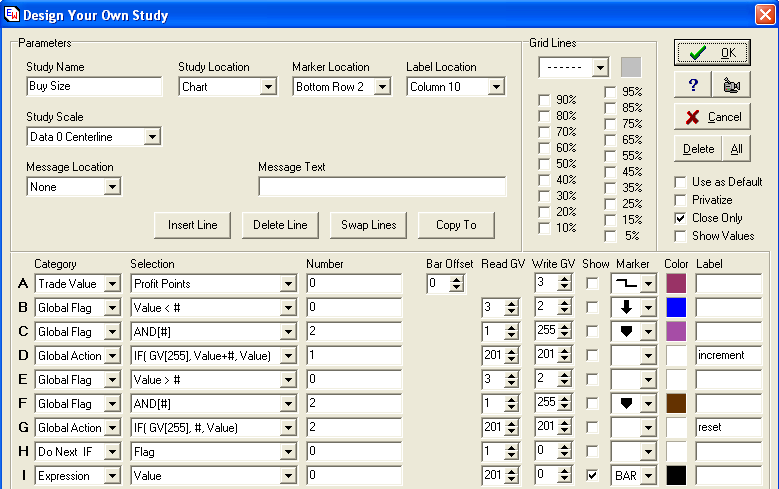

Buy Size

Let me show the DYO that implements the pyramiding rules.

Line A will see what the current trade's profit is in

points. All I really care about is whether it is a winner or a

loser, so the points are compared to zero by Line B. This

profit or loss flag is saved in GV[2] by Line B.

Remember, GV[1] has our flag to execute a trade, such as the

pending Buy signal was Low <= Buy Price. When the

current trade is showing a loss, and we are ready to do a Buy

Signal, Line D will increment the trade size amount stored in a

private GV [201].

This trade size was initialized to be a 2 before the trading day

began, and it is also reset to a value 2 after any winning

trade.

Lines E, F, and G perform the reset when the current trade is

profitable, and there is a signal to Buy in GV[1]. Line G,

when the flag is True will read the number 2 from the number field,

and write it to GV[201], otherwise leave GV[201] alone.

So in summary, Lines A, B and C will increment the size to trade

when the current trade is a loser, and Lines E, F and G will reset

it back to a value of 2 when it is a winner.

Lines H and I do a little visual of showing this trade size or

quantity on the chart on the stripe for the trade execution.

This chart is an example of the Pyramid system in

operation. The first trade was a Buy and the buy size was 2 at

7:40. Then at 8:20 there is a Sell signal and execution.

The Long trade was unprofitable so the Short used a position size of

3 instead of 2.

There is a Buy signal at 9:30, and underneath that pale green

stripe is an orange stripe for the bail out of a short with

Stochastic above 70. The bail out found the position was a

loser, and incremented the size by 2, so a Long trade of 5 was put

on.

The 10:00 signal was to go short, and the last trade was again a

loser, so it traded 6 short. Wow, what discomfort in having 3

losing trades in a row, though they were all small losses.

However, there is joy in being loaded up for the only good trend in

the day.

At each of the medium red stripes, a profit objective is met, so

that signal removes one trade at the bar's close. The system removed

one trade at 5 different bars at 5 different bar closes. These

happen to be some pretty nice exits into the bottom of the

plunge.

After 10:35 the system still has 1 Short on, and this was exited

at the orange stripe, (the Stochastic above 70 abort rule), but

still at a very nice profit. Then the green Long trade is

following a profit and the trade size is set back to 2. The

red Short at 12:00 is after the green profit (small one) so trade

size stayed at 2., and then was closed out at the abort rule for a

small loss.

Now that you understand the theory behind the idea, and see its

implementation, I need to show you the Study Alert for the Buy.

Note the Signal to buy is still the GV[1] as discussed in the

first part of this article. The Price selection shows the

Price is to be found in GV[200] and the Quantity is to be found in

GV[201]. This selection will be an override of the Quantity

spinner box. I use this selection so I can have the DYO manage

the trade quantity, and disregard the Quantity spinner setting on

the Study Alert form. Now it makes more sense why in the last

DYO shown I did the increment or reset for the trade size in

GV[201].

Pyramid Trade Details

Now lets look at the trade detail summary for the Pyramiding

system.

The Profit has jumped from $12800 in the system from the first

part of the article to $23,062. This is an excellent

improvement. The system did not really increase the trades

from 243 to 265. All it did was change the sizes in the

trades. The count increase is due to more trades being lifted

one at a time, like the example just discussed, and each lifted

trade occupies a separate line in the ledger.

For example, ledger Line 7 was a loss of $75. Lines

8, 9, and 10 are the 3 contracts traded in the next trade started at

14:15 but lifted at different times. One was lifted at 14:20

on a profit exit. One was lifted one bar later at 14:25 on a

profit exit. The 3rd contract was removed at 16:00 on an end

of day time exit rule. See the Entry and Exit times for the

trade in the Notes field.

The Pyramiding model that can trade a bigger position, such as 3

contracts, may use more lines in the trade details ledger to show

how these contracts were resolved.

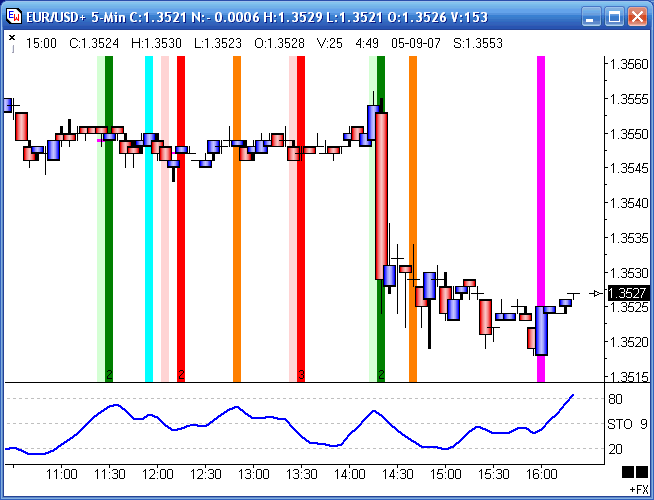

Today's Change

The value on the Today's Change shows the change in the Account

balance for the trades made just today. The account was at

$23,686 yesterday. The system was doing fine today (May 9th,

2007), until it got caught on a whip lash into the plunge. Let me

show the trades for Today's Change of -$625.

The system was short 3 contracts at 13:30, and the Stochastic

poked its head up over 50 on that nasty little poke bar at 14:20.

That primed the system for a pending Buy, which was filled by the

plunge bar at 14:25.....ouch..... bad stuff happens...... and no

trading system is immune to it.

The prior example showed being loaded up and on the right side of

the plunge, and how the system lifted trades on profit exits. This

example shows being on the wrong side of the plunge. But it

came so close to being on the right side.... if only that Stochastic

value had stayed below 50 it would have been short. Or if the

Stochastic had not gone below 30 ahead of that it would not have had

the Buy setup signal.

However, if I try to tweak the system in hindsight to make a

better trade for today's plunge, I do so at the risk of worsening

the system for other days. The beauty of back testing is

you can adjust parameters and see the effect on everything, and not

just the effect on the one case you are staring at. I have to

show the system as designed, and today was a punch in the eye.

Still the system shows a handsome profit for 6 weeks of back

testing. I am not worried..... just bruised a bit from

today. I have confidence the system will recover today's

losses.

Wrong Way Exit

You may want to add rules to manage a protective stop for a

runaway market. The abort rule for being the wrong way was

watching Stochastic being above 70 when Short or being below 30 when

Long. In the example, this rule aborted the Long position on

the orange stripe 4 bars after the plunge.

You would add a DYO that implements more rules for an exit on a

loss, similar to the logic for an exit on a profit objective.

However, it would not have helped this particular example much

because the bar to Buy just happened to be the plunge bar and the

system might not have tested your protective stop until the next bar

since it is a Close Only option on all the DYOs.

Back Testing

Back testing is across all data in the chart file, and my chart

file example had data from March 21st. That was sufficient for

me to get some results. If the file were twice that size, I

could expect to have twice as many entries in the Trade Detail

ledger. Also a bigger file takes longer to calculate, and

these DYOs and Alerts can be CPU intensive. Therefore,

when designing I make frequent changes to the property forms and do

not want to wait a long time for each change to

recalculate. I clipped the file by deleting bars ahead

of March 21st. I try to be practical about the file size as I

research ideas and implement them.

The reason for having the Close Only option checked is that in

hindsight I cannot execute signals intra-bar. In hindsight I can

only see where Stochastic ended on the bar, for example. So to

match the same model for real-time you should have Close Only

checked so the signals like Stochastic are checked only on the close

of the bar. Stochastic might have gone above 70 intra-bar and

then been below 70 at the end of the bar. You would not want that

momentary move above 70 to affect your trade results.

Also, I would not use (H+L)/2 as an entry or exit price

because the results will typically be biased and you cannot get the

fill price. For example, in a down move, the signal might be

to go short when Stochastic is lower. Stochastic will be lower when

a close is on the bottom of the bar, and the average of the range

would statistically to be a more favorable price to sell Short at

than the bar's Last price. So use the price nearest the

calculation, which is Last for a Close Only evaluation, or use the

ideas shown in this article where you pick your price and then watch

to see if you are fulfilled on a subsequent bar.

The Pyramid trading system can be downloaded as a template from

the Ensign web site using the Internet Services form. The

template has been saved as EnsignPyramid.

No warranty is made that future results will match the results

shown in this article. The trades shown in the article are

hypothetical, and no deduction has been made for commissions or

slippage. |