June 2007

Study Tip:

MACD Fundamental Behavior![]()

by Howard Arrington

To understand a study more thoroughly, it needs to be observed on

a theoretical Elliott wave formation. To often a study is

slapped on a chart, adjustable parameters are tweaked, and with the

benefit of hindsight some trade signals are derived. The

advanced student might go the extra mile and delve into the

mathematics of the study's formula. But the fundamental

behavior of the study is not understood well. This article

will help you understand the Moving Average Convergence Divergence

(MACD) Oscillator better through an original approach.

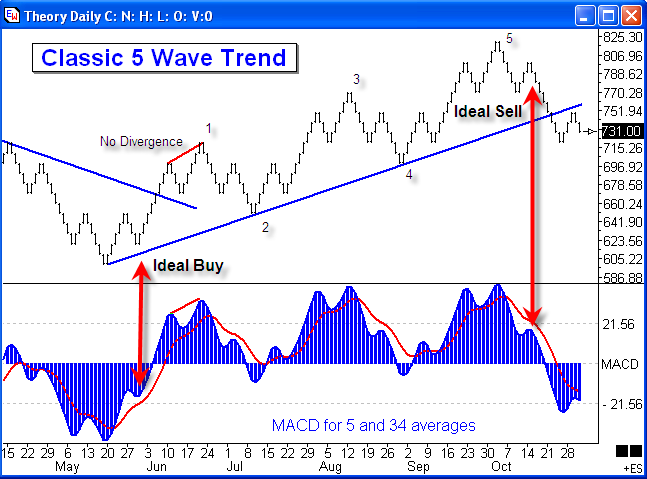

The basic concepts of the Elliott Wave Theory are that action is

followed by reaction, and there are 5 waves in the main trend,

followed by 3 waves in the correction. Since this

pattern is seen over and over in the markets, a theoretical

chart based on these principles will be used so MACD can be analyzed

without market 'noise' obscuring its fundamental behavior.

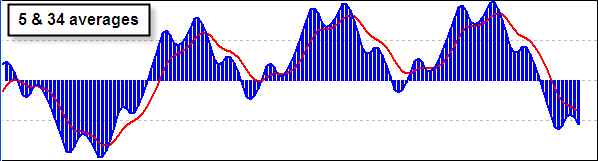

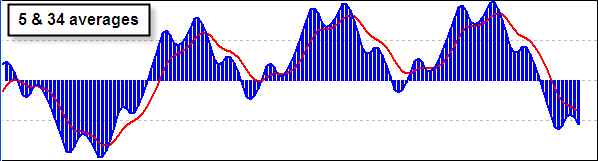

The MACD is the spread between a short period average and a long

period average. Typical parameters for the two averages are 5

and 34, which will be used in the examples for this article.

Various characteristics can be found in the 5/34 MACD

study applied to this theoretical chart.

1) Divergence is not present as the price action

puts in any of the swing tops or swing bottoms. Other

studies, however, such as Stochastic

and R.S.I.

often show divergence.

2) The patterns formed by waves 1, 3 and 5 are

very similar. So traders really need to count waves and wait

for the completion of the 5th wave to have the ideal entry signal.

3) The pattern at the Ideal Sell is a lower

right side shoulder on both the price action and on the MACD

study. The pattern at the Ideal Buy is a raised right

side shoulder on the chart and on the study.

4) If you want an earlier signal you might plot

a Moving Average of the MACD such as is illustrated by the Red study

line. The signal would be the MACD crossing its average.

In the example, a 9 period average is plotted as the Red

line. Again, wait for the crossing after the 5th wave is

in place.

5) The a-b-c correction in the retracement waves

2 and 4 will cause the MACD to cross its average and cross below the

zero line. Both of these would be false

signals. Wait for the completion of the 5th wave.

Average Formula:

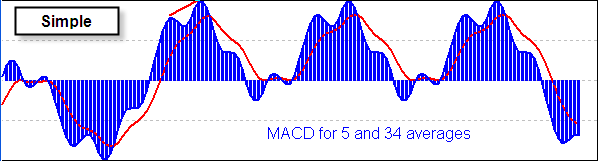

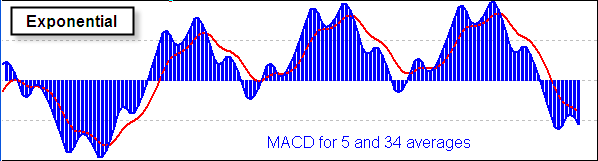

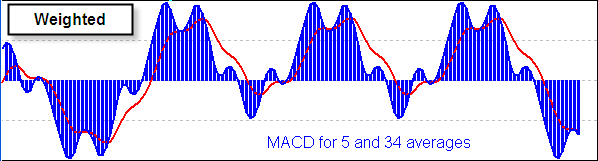

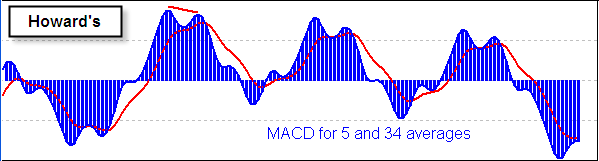

Now that the fundamental behavior of MACD is

understood as the Elliott waves develop in a market, the theoretical

chart will be used to observe the effect of different average

formulas. The first decision is whether to use Simple,

Exponential, Weighted or Howard's averages in the MACD

calculations. All examples shown in the next graph use

the same 5 and 34 parameters for the two averages.

The only significant difference observed here is that

Divergence is present when the Howard's moving average formula is

used. Note in the plot for the Howard's formula that the hills

for the 3rd wave and the 5th wave are decreasing in their

amplitude. Click here to learn more about Howard's

formula.

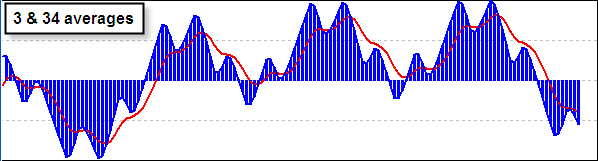

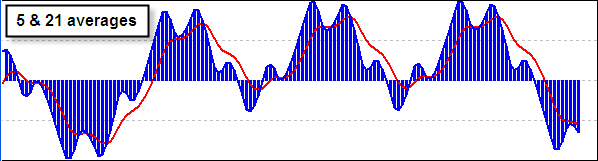

Average Parameters:

Now the parameter for the 1st average will be varied

to see the effect it makes in the MACD plot.

The observable difference is that a higher parameter

results in a shallower valley. The pattern remains basically

the same.

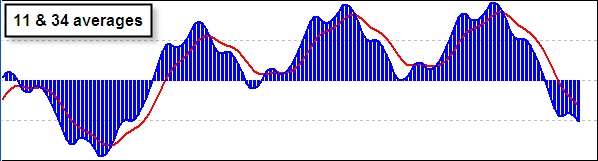

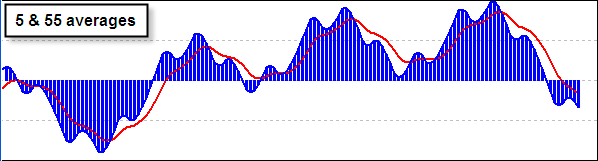

Now the 2nd average's parameter will be varied.

There is a bit of Divergence in the 3rd and 5th wave

patterns when a smaller parameter is used for the 2nd

average. The patterns and signal interpretations are

basically the same, regardless of the parameter used for the 2nd

average.

The theoretical chart has been very helpful in gaining

a better understanding the fundamental behavior of the MACD

study. Click the links below to read other articles

where the theoretical wave has been used to discover the fundamental

behavior of other studies.

|