July 2006Trading Tip:

Instead of Smoothing,

Try Speeding Up Your

Indicator![]()

© MMVI al_gorithm

All

Rights Reserved

Contact Info:

catch_al@hotmail.com

Smoothed oscillators give the appearance of being easier to read

and can often help keep a trader from getting drawn into a trade by

noise or help keep you in a good trade. But their signals are

often obtuse, delivered cryptically and often after the best entries

or exits have passed. The closer you can tune your oscillator

to price action the more chances are that it will be helpful, rather

than hurtful.

This article is not about which oscillator or settings are

better. I’ve used both smoothed and raw indicators with great

success. But there are less common ways of tuning and reading

indicators that are equally valid and might even give you clearer or

earlier signals. As traders, we need to consider all options

with an eye to keeping things clean and simple.

Let’s first discuss oscillators in general, and then one in

particular. Next, we’ll compare signals generated from all the

oscillators on the same chart. I’ve chosen to use Alexander

Elder’s, minimally smoothed, Force Index as my robust oscillator

example. I could just as easily have chosen a very short-term

MACD or Stochastic oscillator. The same principles apply,

although you won’t always get the same signals.

Oscillator lines swing from above to below a centerline,

signaling overbought and oversold conditions. With most

oscillators, the degree of overbought or oversold can be measured

and there is a neutral territory (somewhere in the middle), but not

so with the Force Index. It’s simply a very robust, short-term

overbought oversold indicator. In other words, the Force Index

always considers the market it is measuring either short-term

overbought or short-term oversold. Therefore, it would be very

difficult to use the Force Index alone. It’s typically paired

with a moving average plotted on a chart to measure the trend, or

lack thereof.

Please remember as we go through this example that we are only

looking at the market in one dimension. For the purposes of

clarity, we’re only going to compare the price action to the

indicators in one timeframe.

If we were to employ multiple timeframe analysis, the turning

points would be much clearer, allowing us to take earlier signals.

We’d know in advance of taking any one trade whether it will be a

trend trade and need to give it a little more room to develop and

that we should hold it, or whether it will be a scalp trade where we

will have a tight opening position stop loss and a specific target

we would be looking to test.

For more information on implementing multiple timeframe analysis,

see my article in the October

2005 issue of Ensign’s Trading Tips Newsletter.

Money management is critically important to any trading strategy

but has not been taken into account in this article. In order

to stay focused on the issue being discussed, we’re simply going to

compare different oscillator buy/sell signals across various market

conditions, in one timeframe, without money management

considerations.

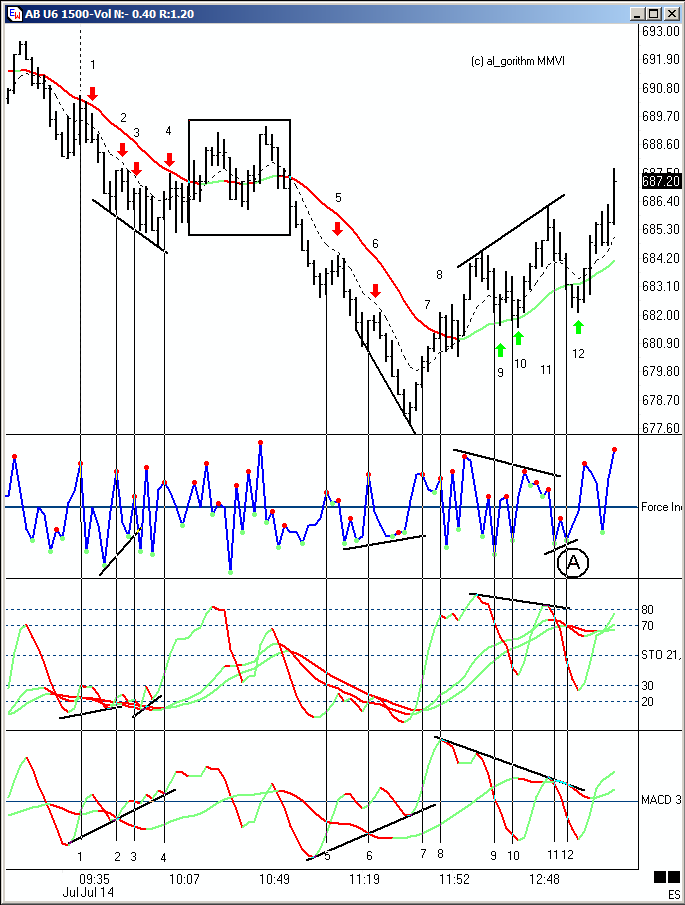

On the following chart I’ve plotted a very popular moving average

combination for reference, a 30 period weighted moving average (WMA)

and a 9 period exponential moving average (EMA). The 30 WMA

measures the trend and the 9 EMA helps measure the pullbacks within

the trend.

The Trading Plan

When there’s slope to the 30 WMA and the price bars pull back to

or past the 9 EMA, we’ll watch for the resumption of the trend,

presuming that it will continue until proven wrong. We will

time our entries with the Force Index signals and compare them to

the slower, smoothed oscillators. We are only concerned with

timing entries in this article. Everything else is being

disregarded. This is our trading plan for this example.

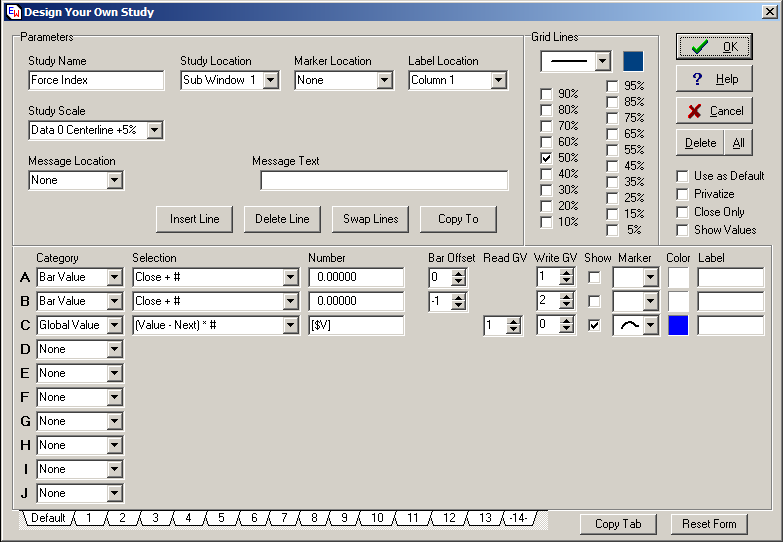

Here are the Ensign Window’s properties for the Force Index:

The formula is V(C-C1).

Where V = Current Bar

Volume

C = Current Bar

Close

C1 = Previous Bar Close

The Force Index measures the spread between the closes and

multiplies that value times the current volume. The premise

for the formula is based on the fact that typically, volume surges

in the direction of the trend and diminishes on pullbacks.

The following indicators and markers are plotted on this chart

and used as indicated:

30WMA – Signals Trend

9EMA –Gives A Reference Point For Pullbacks

Force Index – Signals Short-Term Overbought (OB)/Oversold

(OS) Conditions

The green and red dots on the Force Index are only there for

illustrative purposes to help you see which direction the trend must

be in to use that particular signal.

When the trend is down, the Force Index signals a sell when it

retraces "above" its centerline. A red ball appears at the top

of the swing signaling a short opportunity. Ignore all buy

signals when the trend is down with the one exception (divergence)

noted below. Typically, you’ll get at least one bar advance

notice of the turn, however, if the trend is about to wane, the

signal can be false. Money management and multiple timeframe

analysis keeps you out of trouble, but is not considered in this

article.

Stochastic Pair

(21,10,4 smoothed averages – Slow Lines) – Signals

Trend

(7,3,3 smoothed averages – Fast Line) – Measures Short-Term

OB/OS Conditions

MACD (3,10,17)

Slow Line – Signals Trend

Fast Line – Measures Short-Term

OB/OS Conditions

Vertical Lines – Drawn based on the each Force Index Buy or

Sell Signal.

Arrows – Indicate Buy and Sell Short Entries (trailing stops

would be placed when the Force Index signals (see vertical lines)

and the arrows indicate where your stops should have been

elected.

Numbers – Identify the lines intersecting all the

oscillators

It is not my intent to suggest, by marking out each trade signal,

that this is where a trader should have gotten in or that this is a

scalping system. The best trades are the earliest trades, in

my opinion, and then hold through the entire trend. But in

reality, we miss trades and so are frequently chasing.

Therefore, all trades have been mapped.

Now take a minute to study each signal on the chart and note the

differences between each of them. Each indicator signals the

turn but each in it’s own way. Compare and see if you can

identify them before proceeding.

There are many different ways to read or apply oscillator

signals. In general, I watch four things.

- The trend indicator (typically the slow line) for its slope,

level and spread.

- The momentum indicator, typically the fast line, for its

level.

- Where the fast line is in relation to the slow line.

- Both slow and fast line divergence (price action makes a lower

low while the oscillator makes a higher low, etc.).

Entry Opportunities 1-4: We’re only looking for shorts

since the trend indicator (30wma) is down.

Entry Opp 1: The Force Index gives a clear OB signal

and turns down one bar in advance. The Stochastic and the MACD

fast line have crossed above their slow lines indicating a

short-term OB condition, however they haven’t turned down yet, but

it doesn’t have to. Psychologically, aspiring traders seem to

need to see an indicator pointed in the same direction that they

want to trade, and that rarely happens with smoothed

indicators.

Entry Opp 2: Same conditions as 1, except that the MACD

and Stochastic are warning (diverging) which would cause many

traders to ignore the fact that the down trend is still in tact and

strong. Many would miss the 2nd entry opportunity

here.

One difficulty for aspiring screen traders using smoothed

oscillators is that when the oscillators become overbought or

oversold, they can stay that way for a long time. They’ll

threaten to roll over and signal an end to a move along with price

action, only to become more overbought or oversold with the next

push in the direction of the trend. We frequently hear

complaints from traders who get absolutely killed on directional

trend days. The oscillator signals an end to the trend and the

trader buys/sells into strength over and over again, all day long,

loosing every time.

Oscillators signal best during broad swinging markets.

During periods when the market isn’t trending or the market is in a

grinding trend (directional movement but the bars are heavily

overlapped), smoothed oscillators give lots of false signals.

Entry Opp 3: This time, the Force Index joins the party

and diverges from price action and this time it’s real. Price

action enters a real period of short-term consolidation before it

retraces deeper.

These first 3 entries were all winners. At a minimum, you

should have been able to move your stop loss to break-even.

Entry Opp 4: Again, the Force Index signals a short

opportunity. The Stochastic are warning and the MACD is

screaming divergence. Since we’re only looking at one

timeframe, it’s almost impossible for me to say what I really would

have done here, but based on only this one chart and the Force

Index, I would have taken this trade.

In my experience these are 50/50 setups, but because my money

management rules give me enough of an edge, I feel safe in taking

these lower probability trades. When they go, there can be

huge runs.

The Rectangle: We’re using the 30wma to indicate trend

in this example, so when it’s flat, we’re flat.

Entry Opportunities 5-8: We’re only looking for shorts

since the trend indicator (30wma) is down.

Entry Opp 5 & 6: Similar Stochastic and MACD read

as described in Entry Opp 1 with the exception that the fast lines

haven’t crossed above their slow lines, typical in a strongly

trending market on the first move after a consolidation

period.

Entry Opp 7: Ignored because of the Force Index

divergence. MACD shows the same but no sign of it on the Stochastic

yet.

Entry Opp 8: Ignored because the Force Index didn’t

even retrace below its centerline before it turned up again.

It’s a sign of strength that can’t be ignored.

Entry Opportunities 9-12: We’re only looking for longs

since the trend indicator (30wma) is up.

Entry Opp 9 & 10: Trend (30wma) is up, so go with

the flow. 9 gets you to near breakeven before retracing. 10 is

a clear winner. MACD was signaling divergence but my trades

for this article are based on the Force Index. The Force Index

divergence hadn’t formed as of the time of the #10 setup.

Entry Opp 11: Ignored because the Force Index didn’t

even retrace above its centerline before it turned down again.

It’s a sign of strength that can’t be ignored. See divergence

line marked "A".

Entry Opp 12: Even though we experienced a deeper

retrace this time, the 30wma stayed strongly up, so when the Force

Index signaled long with a higher low, it’s a safe entry and turned

out to be a very good trade, indeed.

Conclusion

As I said when I opened this article, I’ve used both raw and

smoothed indicators successfully. In my opinion, the simpler

and cleaner you can make your trading plan the better you’ll

do. Consider the following:

Using the MACD or Stochastic, you’re watching: The slope of

the slow lines, the spread between the slow lines, the level of the

slow lines, divergence of the slow lines, the direction of the fast

line, the level of the fast line, the relationship between the fast

and slow lines, divergence between the fast line, price action and

the slow lines…phew, and there’s more. No wonder so many

traders freeze, can’t trade more than one market at a time, are

indecisive, can’t follow a plan, can’t even make a plan…and on and

on it goes. Now add in several indicators, multiple

timeframes, multiple markets and it can become diabolically

complicated.

Using a robust indicator like the Force Index or a very

short-term setting of your favorite indicator, you can stay focused

on the price action (do you even remember what that is?) and when

you have a setup, any setup, a quick flick of the eye to the

indicator and you either place your opening position stop or you

don’t. Then scan the next market looking for the next

"quality" setup.

I suppose the debate over smoothed verses fast, and lots verses a

few indicators will go on forever. And that’s ok.

Whatever works for the individual is what’s most important.

Education is a never-ending process in this business. I hope

I've presented some ideas you feel worthy of investigating to

continue yours. |