November 2006

Trading Tip:

Larry at the Expo![]()

by Howard Arrington

The material for this article is from the seminar presentation by

Larry Pesavento, given Nov. 18th in Las Vegas at the Traders Expo on

the methodology he uses in his trading. I have extracted

the text from a video tape I made of his presentation. The

text has been edited to summarize the principles being taught in the

seminar. I also created my own examples for this article that

mimic the charts shown in Larry's Power Point presentation.

|

Bias:

Take money out of the equation and you will trade a lot

better. I have always said I would be almost infallible

as a trader if you would take off the price, the time, and the

name of any chart I was looking at, so I would not know if I

was trading wheat, the Euro, the S&P, or IBM or

Google. Because then I would have no bias at

all. Because I have been doing this for 43 years, I have

biases, and I have to fight those all the time. Usually

that is when I get into trouble, when I fight them, and so I

do a lot of psychological work to try to get around them.

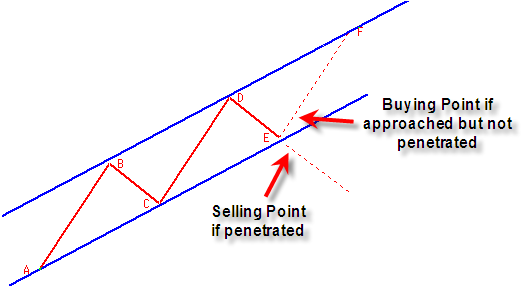

AB=CD:

This is an uptrend. You have higher tops and higher

bottoms. What we are trying to do with a forecast tool

is to find these spots (there a trend line meets a channel

line.) |

Point C might be a 61.8% retracement of the AB move, and CD might

be a 1.618 expansion of the BC move. We are trying to take

these ratios of 0.618, 0.786, 1.272 and 1.618 and find

the point in time where we are expecting a turn, match the price to

it, put the trade on and see how it works. A tool I use

often is the AB = CD tool. I am looking for the CD leg

of the move to be equal to the AB leg of the move. The

BC wave will be a retracement that is around 61.8 percent of the AB

leg. Here is an example.

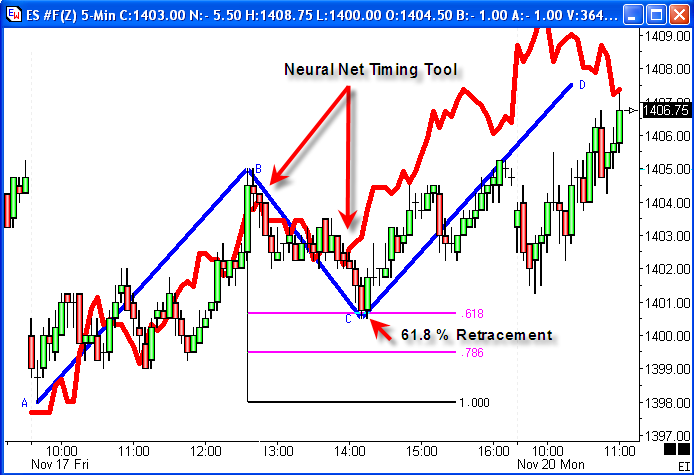

Neural Net Timing:

I use the Neural Net timing tool to tell me when to

expect a change in trend, as in this example at Point C.

I look for a retracement to the 61.8% price level and put on the

long trade at Point C. The Neural Net is showing a high

probability that the market will continue to rise the rest of the

afternoon, which it does in this example.

Even if you did not keep this trade overnight to get

to Point D, you still had a small profit buying at Point C and then

closing out near the end of the day. We are trying to find

those points where the market is getting ready to trend and you have

a nice Fibonacci number to buy off of. It is that

simple. You do not have to have any oscillators, MACDs, moving

averages, or any of those things to make it complicated.

Oscillators are lagging indicators based on things in the

past. With pattern recognition, we are talking about things

that occur in the future. We are looking to Point D for our

trade. Now we are going to be wrong some of the time.

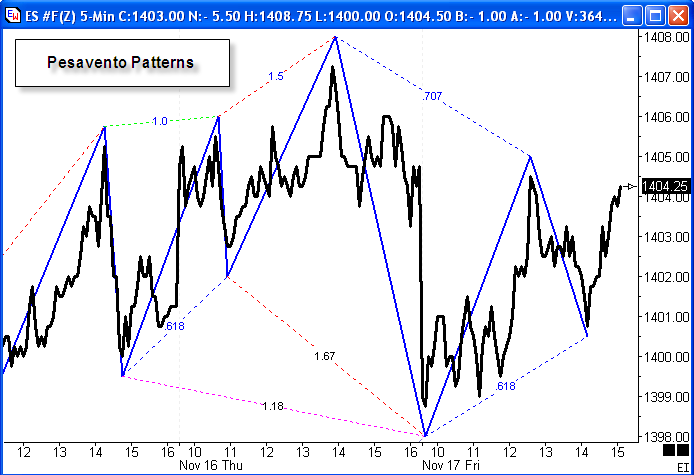

Pesavento Patterns:

(Larry then showed a chart with just a zig-zag

line). You should learn to do a chart like this. I

am going to overlay the Fibonacci numbers on the swings of the

chart. I use the Pesavento Patterns tool to label the swings,

like this example.

Look for the Fibonacci numbers given

earlier. You will learn to spot the AB=CD

relationships. In a downtrend, we want to sell into

rallies. In an uptrend, we want to buy on

retracements. Use the Neural Net timing tool to find

places where it is showing the time for a bottom or the time for a

top, and trade at the Fibonacci price levels.

We are trying to match the price with the time, which

is an unusual concept because most people do not have TIME in the

future. The Neural Net curve is going out one day into

the future and showing with a high probability when the market is

going to turn. I wish we had a chance to show live

trading in today's seminar because you probably would not believe it

when you see it for the first time.

Do I make money every day? No, I do not make

money every day. But I make more money than I lose. I

have more profitable days than losing days. When I do lose, it

is because I misinterpreted what I am looking at, or the Neural Net

is totally wrong.

When you are ready to do a chart for the next day,

this is the type of analysis that you want to do. You want to

mark all the relationships on the chart that you can see. Put

on the Pesavento Patterns so you see all of the Fibonacci

percentages. You will start to see the bigger patterns of the

AB=CD. The numbers you are watching are the 0.618, 0.786,

1.272, and 1.618. Any time you are getting ready for an

expansion swing that is occurring into a forecast High, and the

current contraction swing is arriving at a 0.618 or 0.786, that is

when you are looking to be a buyer.

Now I can't show you everything in just one

hour. If you have interest in these types of patterns, begin

by learning to mark up a chart with the swing relationships like the

Pesavento Patterns. That you can get right out of my book

(Fibonacci Ratios with Pattern Recognition). That is real easy

to do. But it is going to take you awhile to do it. I

have spent 15 years trying to find this, because I did not know

what 1.272 was until 1986 and I had already been trading for 25

years. So it was a real revelation when I found 1.272.

Then when I found 0.786 a little later. That was when I wrote

the book, and it was named 'Book of the Year' in 1997. And, it

has been pretty popular ever since.

What you are trying to do is find the particular times

for the turns, and the prices for those turns will be at a Fibonacci

relationship. Every day when I walk in, I have a place where I

want to be a buyer and a place where I want to be a seller in the 10

major things I want to trade. I wait for the Neural Net tool

to tell me when the time is right. Then I look to see if the

price is right where I want to buy it. Of those 10

market, I will probably have 4 or 5 orders to execute, and I might

only get filled on 3. I might miss the other 2 orders by

just a little bit.

Human Nature:

(Audience question: What is the time frame of

the charts? Are these daily charts?) This

particular chart happens to be a 5-minute chart. The

principles work on basically any chart. If you took off the

time scale and the price scale, no one could tell which chart it

was. The charts basically look all alike. They have to

because we are all human beings, right? Do you know why you

lose trading? Because you are a human being and you want

to avoid pain. So when you are watching the monitor, you are

focusing on the up ticks when you are long and the down ticks when

you are short. If you would stop looking at the monitor and

just follow your trading plan you would be better off. If you

put a limit order in and put an alert on so it will either stop you

out or alert you at your first price objective, then go back and

look at it. I look at the markets early in the morning for

about a half hour just to see how close I am to what I

expected. Then I don't watch it. I do other

things. If it gets to my price it will beep, and then I will

look at it. Isn't that an easier way to trade than to sit

there all day long and agonize over everything that you are

doing? Agonizing is not trading.

When you see these young kids in a trading room, with

400 to 500 in the room, go back 6 months later and there will be a

whole new group of young traders. Because very few people get

this right when they do it. The statistics of people making

money in this business, 90% of first time traders are going to

lose. Why? They don't know what they are doing.

Now the person that stays with it over 3 or 4 years, is going to

learn the rules and develop a trading methodology. You are

looking at someone who is very biased about what I do because I have

been doing this pattern recognition stuff for a very long

time. I have not found anything that works any better. I

have a pretty good idea there will be a top right there.

(Larry points to a point in the future on the chart which completes

an AB=CD pattern at a 1.272 ratio at a Neural Net timing

point.) I am not waiting for an oscillator or anything

to go. Now I have a Neural Net tool that gives me the timing

of when to enter the market.

Complexity:

(Audience question: How you keep yourself from

adding more to your methodology? Are you continually

learning and trying new things?) I learn something all the

time. All I have to do to learn anything is just call

Howard. He will teach me something because he knows a lot more

about this stuff than I do. My stuff that I do is really

simple. And I don't understand computers very well. I am

totally computer paranoid. I literally panic, so I keep it

really simple. I haven't done anything different than what I

have been doing for so many years. I have looked at other

things, but I just don't do anything different. I see these

same retracement patterns every day, and then I use the Neural Net

tool to try to give me my timing. I try to be right 3 days a

week, break even 1 day a week, and I'll lose 1 day a

week.

My biggest problem that I have is because I am a

strategist for a hedge fund, and I have to give predictions of where

I think things are going to go in seven or eight weeks, like when

crude oil was topping out. I got that one right. And I

have to make an opinion, and I have to realize that my opinions are

wrong a lot. So I have to protect myself against myself.

Usually if you are in something 3 or 4 periods (bars) and it is not

working out you will be wrong. Usually this stuff works out

right away, I mean almost instantaneously, within 20 to 30

minutes. If you are not profitable after 20 or 30 minutes then

there is probably something wrong, and you should get out of it and

look at something else.

Christmas Present:

I'll give you a Christmas present. If you are

really interested in trading, buy Mark Douglas's book 'Trading in

the Zone'. Its a $25 book. If you will read that

book and then reread 3 pages a day for the rest of your trading

life, you will do great. What the book will do is teach you

that you know nothing about the markets and that it is not necessary

to know everything about the markets. You will learn that it

is about probabilities. Even though this is a trade, it is

just 1 trade out of a hundred trades. As soon as you lose you

have to go right into your next trade and follow your trading

plan. The only thing that prevents me from making money would

be if I were sick or they close the markets. That's the only

way I am not going to make money. I will sit there all day

long and trade live in front of audiences. That's the fun part

when you are at a show and can show people in real-time what this is

doing.

The Ensign Windows program has a playback system where

you can actually go back in time and pull up some charts and update

them as if they were live, and that's fun to do too. But in

one hour today I can't do this. What I am trying to do in this

hour is show you what the AB=CD formation is, hopefully you will

look at the four Fibonacci levels we talked about, and maybe even

take a look at the Neural Net timing tool. If you are trading

currencies and take a look at this, you will not trade without

it. It will get you hooked because it is a real edge in the

markets that you have never seen before. But it is not

infallible. It is only a probability and it is only a

tool. There is nothing incredibly mysterious about it.

It is just mathematics and looking at patterns. These numbers

are in the market everyday and that is why they repeat so much and

gives you an edge. But most people do not do this type of

work.

Repetition:

I walked through the Expo hall yesterday watching all

the exhibitors showing their charts with oscillators.

There was nobody doing this kind of thing. They use some

Support and Resistance, but no one was looking at all the patterns

and how they relate. Once you see how this swing repeats again

here, here and here, you see this basic vibration in the market

repeats over and over again. That is all the markets are

ever doing, repeating over and over again. It only goes up,

down or sideways. It is not the hardest thing in the

world.

My little daughter when she was about six, we would

get Commodity Perspective every Saturday morning by special delivery

because we did not have computers back then. I would get my

charts on Saturday morning and she would help me draw the

lines. I would let her mark up charts like cocoa and coffee

which I did not trade. I would ask her which direction the

market was going. She would look at the chart and say, this

one is going up, or this one is going down. If the market was

going sideways she would put her thumb in her mouth and shake her

head. That is what most of us do anyway when we don't

know what the market is doing.

(Audience question: What is your daughter doing

now?) She is a doctor in Denver, Colorado.

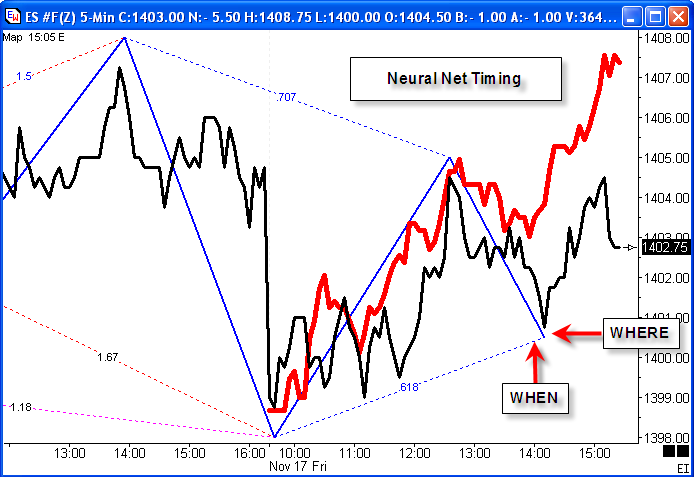

(Larry then showed several examples of the Neural Net

curve for the next day, and then added the bars to the chart so the

Neural Net curve and the bars could be compared.

Correlation was high, but not perfect. Some examples were

shown where the Neural Net curve had a better fit when plotted

inverted on the chart. Please read my 2002 Trading Tips

article about Neural

Networks.)

Always Use Stops:

The Neural Nets do not work this well all the

time. That is why you have to use stops. Let me tell you

about my personal trading. Whenever I put a trade on, 2 things

happen. I don't use electronic trading and I know you are not

going to believe it, but I still pick up the phone and call an order

desk. I tried a couple of electronic trades and I screwed them

both up. So I am still picking up the phone can calling my

broker. I am probably one of twelve people who still do

that. My broker will not take the order if I do not give the

corresponding stop loss order. The two reasons why you lose in

this business is that you put your stop too close because you don't

know what is going on, and the second thing is you don't put a stop

in immediately. If you don't put a stop in when you place the

trade or shortly thereafter, just send the check directly to

me. Then you won't have to worry about commissions you pay to

your broker. You have no chance if you don't protect

yourself. You don't know what is going to happen next.

Even with the Neural Nets you do not know what is going to happen

next with 100% certainty. No one knows that.

(Larry then showed a Swiss currency chart where the

Neural Net correlation was high for the first few hours of the day,

and then the currency broke down when the Neural Net curve was

turning higher. This was a good example where having a stop

was necessary. The Neural Net curve ascended the balance of

the day and the actual market went sideways.)

Face Value:

Currencies are the best thing to trade because you are

trading the most pure thing in the world. There is no supply

and demand to worry about. It is just people moving

money. That is all it is. You do have to worry about

when people talk about the money, though. People like George

Saros use the markets to manipulate their position. You might

find that hard to believe, but it is true.

Do you folks know what my educational background

is? I have a Masters degree from Harvard, a Doctors of

Jurisprudence from Yale, and I worked for Chief Justice Burger for 2

years before I became a Navy Seal, and I won the Congressional Medal

of Honor twice. (Audience chuckles) Now what I just did

to you is what CNBC does to you each day. They sit there and

lie to you. (Audience laughs) Well, they do. No,

its true. They are passing on to you all this information they

are getting from these self-serving sources. After a while you

would think they would get the picture they are feeding them this

stuff.

When I worked at Drexel, which is no longer in

existence because of Mike Milken, they used to have stock broker

meetings on Monday mornings and they would have portfolios of stocks

that Rothschild who owned Drexel was trying to get rid of, and the

joke was put lipstick on this thing and get rid of it. And

that is what the brokers tried to do. That was back in the

70s. Now you buy something and it goes up forever. Back

in those days it was difficult to be a stock broker. You have

to be real careful when anybody tries to tell you something.

Exceptional Timing Tool:

(Larry then went through several additional chart

examples that illustrated the Neural Net timing. Most of

his examples were using 2-minute bars. The Neural Net curves

are available Monday through Friday for the hours of 8:30 a.m. to

3:00 p.m. Eastern time. Creation of a Neural Net curve

for a 24-hour day is a project that has not yet been accomplished,

but might come to pass.)

In my Friday seminar, the Neural Net curves were so

exceptional, I had to separate the bars from the curve so you see

what the market was actually doing. One lady said I know you

are pulling my leg so she got up and left. The Euro on Friday

actually was so perfect that it tracked all of this. There

were little swings and the correlation was nearly perfect.

When you get days like that you walk out wishing it could be like

that every day. But, unfortunately, it is not.

(Audience question: In nearly every chart you

have shown, why does the correlation at the beginning of the day

look better than the last couple hours of the day?) Yes,

the last hour of the day you will have less correlation. The

reason why is because you have gone through several hundred 2-minute

bars towards the end of the day, and so the correlation is

less. But we have tested it early in the day, tested in

the middle and tested it towards the end of the day. It

doesn't make any difference. Once the probability curve is

made for the whole day it is not going to change very much.

(Audience question: What do you base the day

upon for a currency pair?) We use the opening time for the

Chicago Merc opening time because that is how my research got it

started. Back in 1990, there wasn't any Forex currencies to

trade. Initial tests were done on the Merc products for the

pit traded currencies. Beginning of the day refers to 8:30

a.m. Eastern zone time for all currency pairs for the Neural Net

curves. The curves go through 3:00 p.m. Eastern

time.

(Audience question: Does the Neural Net work

better with one currency than another?) No, any 2-minute chart

you want to look at, whether it Gold, S&P, soybeans, or Google,

doesn't make any difference. It is a probability based

thing. It is going to work some of the time and lose some of

the time. It gives you a probability of being right more than

it is wrong. In my personal trading, I am close to being right

70% of the time. I want to be in markets where they are

playing big with lots of volume and volatility. It is not

going to work on thinly traded stocks, IPOs, or stuff like

that. You want volatility. You want liquidity. And that

is what Forex offers you.

You have really great risk control. You can view

things overnight. When you wake up you can put a trade on and

be out of it by the end of the day. That is an ideal situation

without risking very much. My problems as a trader when I have

to make an investment decision for the hedge fund, when crude oil

was making highs up there during the fighting between Israel and

Lebanon, all the things I was looking at, how was I saying oil is

not going to make $80? $78 was it. I agonized for

months. Every day they would call me and say why is it not

breaking? I said, 'When it gets above $80, call me. I

don't know when it is going to break.' Now it is $56 and they

want to know where it is going next. I don't know. All I

can tell you is that was the top. $55 may be the bottom but I

am not sure.

Trade of the Year:

I do a trade of the year every year. I have been

doing it for many years and some of my trades in the past have been

buying crude oil at $11, buying gold at $2.50, selling Treasury

bonds when they were selling at $127, buying the Nikkei Dow when it

was at 7000. Out of the last nine years I have had 7 winners

and 2 break evens. And this year, I hate to say this, I have a

very, very strong negative bias towards the stock market. If I

could stand up on a chair, I would yell and scream at you, but it

probably would not make any difference. But I see very bearish

connotations.

If the INDU goes below 11,500, which is about 700

points from where it is right now, you have a chance to lose a lot

of money if you are in the stock market. The reason behind

this would take me 2 hours to go through. The patterns are

there just like we were in the year 1999 and 2000. Very, very

negative. Whether it works or not, I don't know. Believe

me, I know nothing about fundamentals. I never read a

newspaper. I don't listen to television. This is all

about what is on that bar chart. That is all I know.

(Audience question: How strong was your opinion

back in 2000?) If you want to know, it was in this meeting in

San Francisco, March 24th a Saturday, and I had 400 people in the

room and the markets had been going straight up. People were

walking into the room with their equity runs of how much every one

was making. I was standing on a small podium, and I was

showing them all these patterns, the Butterflys and Gartleys.

Everything was so bearish, much like it is now. But it seems

worse now because we have divergences. The NASDAQ is not even

38% retracement from the high in 2000, and most of the stocks that

were popular then like JNPR and CMGI, these stocks used to be $200

and $300 stocks and now they are nothing.

And I got up on my small podium, and I yelled and

screamed at them. I had 400 people in the room and I said if

the NASDAQ goes below the low of last week, get out of all your

stocks. All you are risking is if it goes back above the high

you can buy them back. At least protect yourself. That

week, Business Week, U.S. News and World Report and TIME magazine

had the same cover of a bull, one with NASDAQ 5000, Dow Jones

15000, and the other with something about the NASDAQ going to

the moon.

On November 6th, 2006, on Barron's front page was the

DOW 13000. The Dow has a very poor track record. You

don't ever want to get your picture on the front of TIME

magazine. That is not good. That is usually when it is

over. It is really not a very good thing. One

person out of 400 people called me to thank me for getting him out

of the market. And as you know, the NASDAQ has dropped

85%.

(Audience question: Do you feel that same way

now?) I feel more so now because we have so much

divergence. The Transports, and the NASDAQ have

divergence. We do not have the euphoria like back then, but we

have euphoria in other markets like the bonds and in real-estate

market. People do not realize how badly they can get hurt in

real-estate. But they will learn.

If you bought a house in Beverly Hills in 1929, you

had to hold that house 36 years before it got back to

even. I am not saying things will be as bad as

1929. When you see a piece of real-estate in New York that is

1200 square feet going for 2.3 million dollars, you know something

is not right here.

(Audience question: What is your prediction for

the Dollar?) I do not like to make predictions like

that. I give a 'Trade of the Year' based on patterns. If

the Dollar goes below 83, and it is at 85 now, there is a chance the

Dollar could melt down. That won't be good for anything.

It hasn't rallied very much, and if it breaks really hard, and the

Euro gets above 130, the Euro could go to 150., the Pound could go

to 2.50. Remember, the Pound used to be $7, so a lot of these

things could still move.

(Audience question: If the markets break down,

will Gold go to $1000?) They are totally different

markets. I know you believe that the man who makes the rules,

rules the Gold. Each market is different. I do not look

at inter-market relationships. I do watch for relationships

among the currencies. But gold investors are different than

stock investors. A gold investor is always a gloom and

doomer. He is always looking for the end of the world, and

always has a little bit of paranoia. But remember a paranoid

person only has to be right once. (Audience

laughs)

Bar Chart Tells It All

All I do is just look at the patterns. I don't

do anything else, don't look at fundamentals, or watch the Federal

Reserve. None of that stuff. My Masters degree is in

Business and my BS degree is in Pharmacy. I don't know

anything other than what is on those bar charts. I believe the

sum total of all buyers and sellers is in the bar chart. They

can lie to you, right?, like Enron. They can cheat you

like K-Mart, Wal-Mart and some of the others, but they can't hide

from you. If prices are going up there are more buyers, and if

prices are coming down there are more sellers. That's all you

really have to know. Sometime between when Enron went from $95

to zero, it had to cross the 200 day moving average, didn't

it? And if anyone ever talks to you about trading a 200 day

moving average, don't walk away from them, run away from them.

That thing doesn't work. That is the biggest crock of

baloney. They have been using that for 60 years, and it still

doesn't work. That's just my opinion, however wrong it may

be.

(Audience question: How do you decide what price

to trade at?) When I look at a particular time, I want to also

look at the previous day and know support and resistance

points. If the market is moving down, I might wait for a rally

to then sell short. If it is not making a point I want to hit,

I might pass on the trade, or wait for a retracement move to get

in. More often then not, because it is based on patterns, you

are going to get a lot of places where the highs and lows are going

to come in at your numbers. It repeats over and over.

Just go back and look at old charts. Patterns repeat over and

over. Do you know what it is like to wake up in the morning

knowing you can beat the markets? It is a great feeling.

(Expo staff opens the door and announces 5 minutes

remaining.) Oh, thought that was a margin call.

(Audience laughs loudly) |