April 2007

Back Testing Tip:

Ensign Stochastic System

by Howard Arrington

In this article I will design a trading system based on the

Stochastic study using the Design Your Own (DYO) feature in Ensign

Windows. Let's begin by understanding the fundamental

behavior of Stochastic so that we can pick some rules for when to

enter and exit a position. Click this link for

additional reading on the Stochastic

Fundamental Behavior.

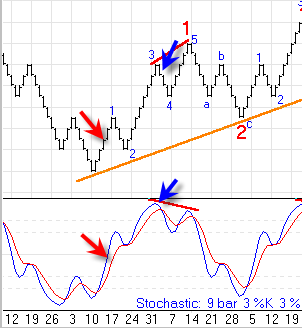

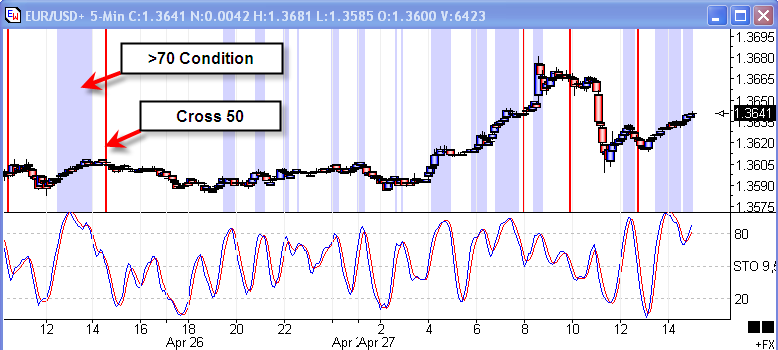

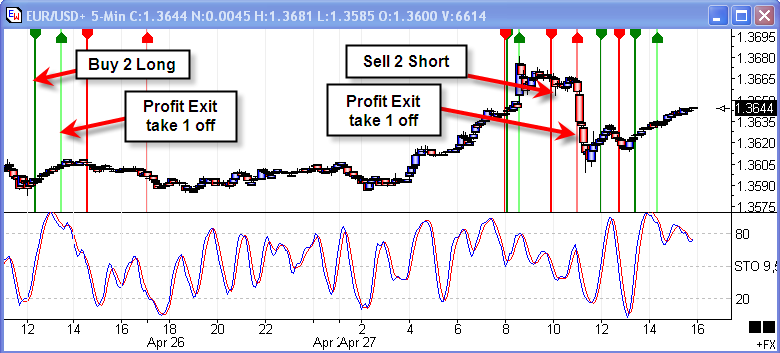

I want to catch a new trend when it starts, which has

been marked with the Red arrows on the chart. The Buy

Signal could be based on the Stochastic %K line crossing the 50%

level after having been below 30%. One of the exit

rules or objectives could be when the %K line turns down the 2nd

time, which is marked by the Blue arrows. This would typically

be at the end of a 3rd wave in the Elliott wave pattern.

So the portion of the chart I am trying to scalp is from the Red

arrow entry to the Blue arrow exit. The inverted pattern

would be the basis for the Sell Signal.

I would also like the system to try to scalp a trade

based on a profit objective. So I will design the system to do

a blend of both, and have rules for aborting the trade based on

either an adverse move or running out of time at the end of the day

session. Hopefully in a choppy market the 1st contract's

profit objective will put some money in the bank to offset small

losing trades, and in a trending market the 2nd contract held for

the 2nd Stochastic turn will make a nice profit for the system.

The following is an outline of the rules for the

Ensign Stochastic System. The design is based on trading

the EUR/USD forex symbol, but could be adapted to trading any

symbol, including the popular ES, ER2, NQ or YM futures symbols.

General Rules:

-

Trade signals between 7 a.m. and 3 p.m. Eastern Zone

time. That is when I am watching the markets.

-

Exit entire position (if any) at 4 p.m.

I do not want to carry positions over night.

-

Exit 1 contract on a profit objective of 10

pips. Test the system with larger and smaller

profit objectives.

Long Trade Rules:

-

The Buy Signal will be %K being below 30 and then

crossing above 50. Buy 2 contracts.

-

Exit entire position which may be 1 or 2 contracts

on the 2nd %K downturn. Location of the downturn does not

matter.

-

Exit entire Long position if %K crosses below

40. This is the bail out rule for being on the wrong

side of the move.

Short Trade Rules:

-

The Sell Signal will be %K being above 70 and then

crossing below 50. Sell 2 contracts.

-

Exit entire position which may be 1 or 2 contracts

on the 2nd %K upturn. Location of the upturn does not

matter.

-

Exit entire Short position if %K crosses above

60. This is the bail out rule for being on the wrong

side of the move.

Time Conditions:

Let's begin by taking each rule, one at a time, and

show its implementation using DYOs and Study Alerts in Ensign

Windows.

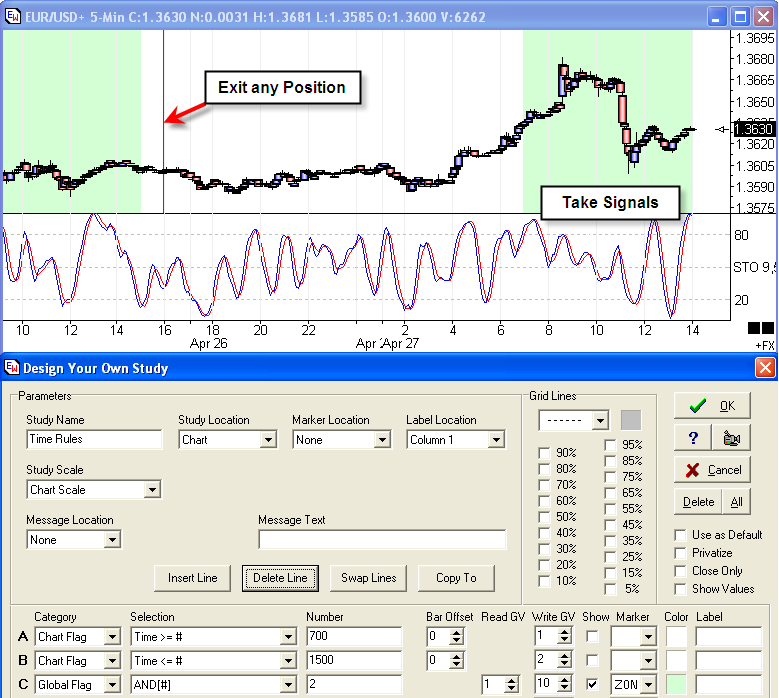

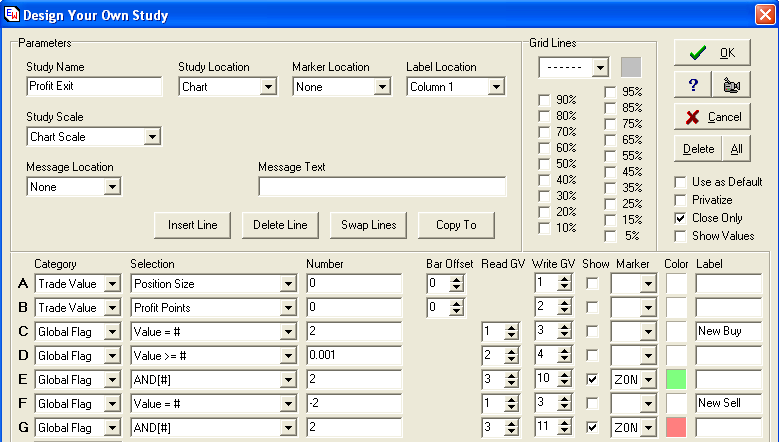

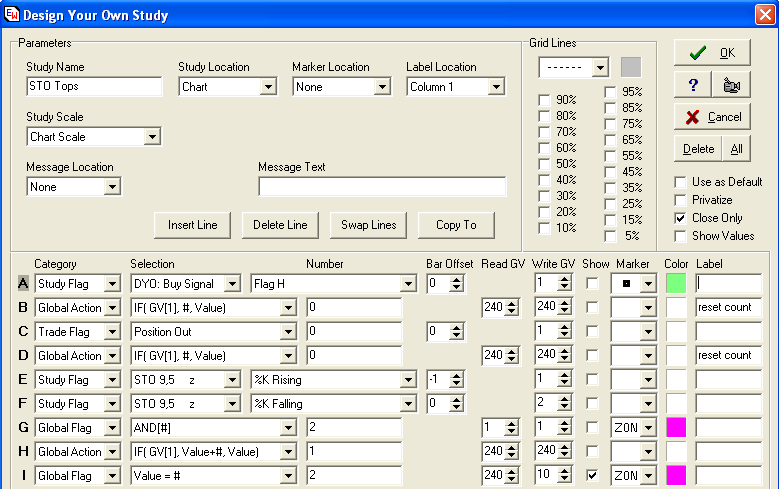

This DYO implements Boolean flags for the two rules

based on Time. Signals will only be taken between 7:00

and 15:00 EST which is marked on the chart with the green

background. This time condition will be stored as a flag

in Global Variable [10].

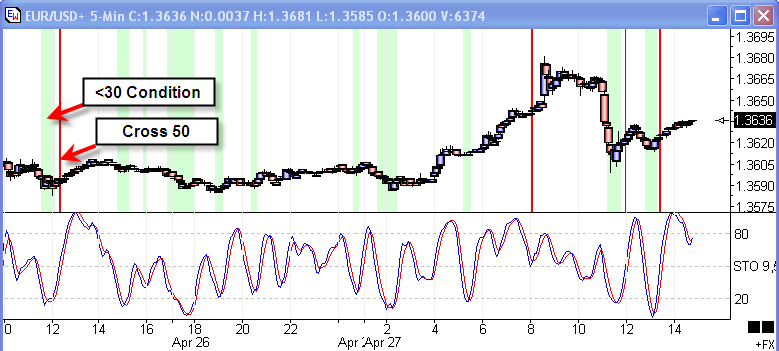

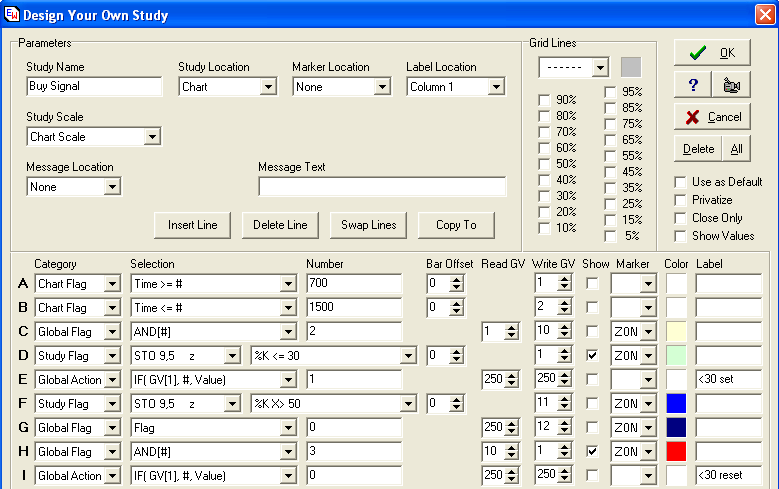

Long Signal:

Line D tests whether the %K is less than 30.

When this condition is true, Line E sets a Flag in GV[250] to

remember the event. The private Global Variable [250] is used

to remember this event between calculate calls since this trade

system might be running on multiple charts simultaneously.

Line F is True when the %K crosses above the 50

level. Line G copies the Flag for the <30 event in

GV[250] to GV[12], so it can be included in the 3 flag test

performed by Line H. Line H is the Buy Signal to put on

a long position of 2 contracts. When Line H is True,

Line I will reset the flag in [250] which clears the Below 30

condition. This condition will have to set itself again by

having %K go below 30 again. This way the system has only one

Buy Signal (Red stripe) following any Below 30 Condition (Green

stripe).

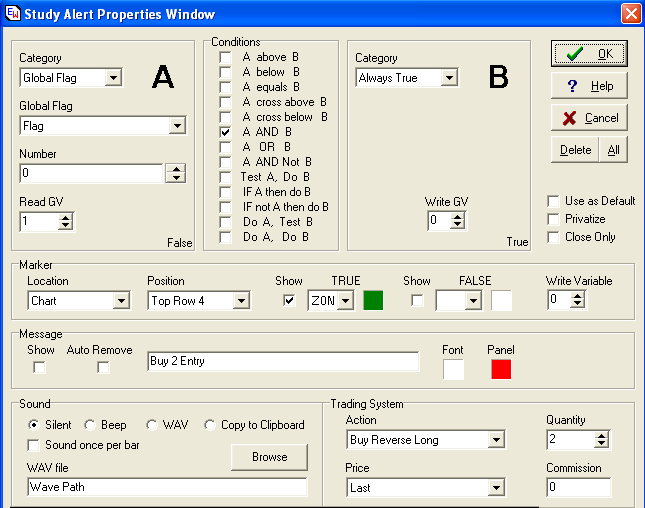

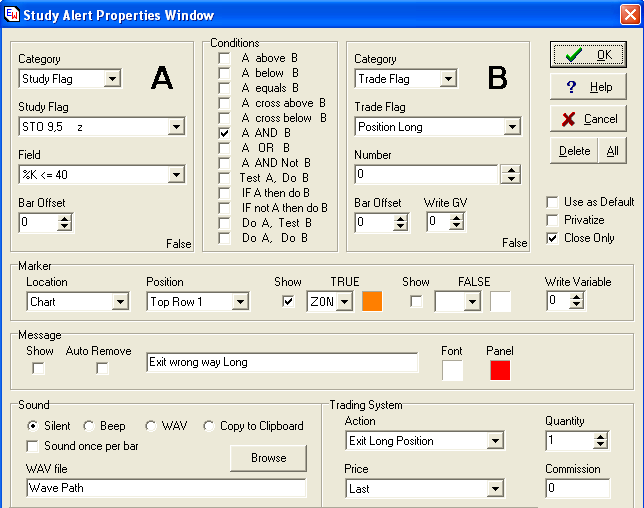

The following Study Alert will be used to execute the

trade system to Buy 2 contracts when the DYO Flag on Line H is

True. The Flag was saved in GV[1].

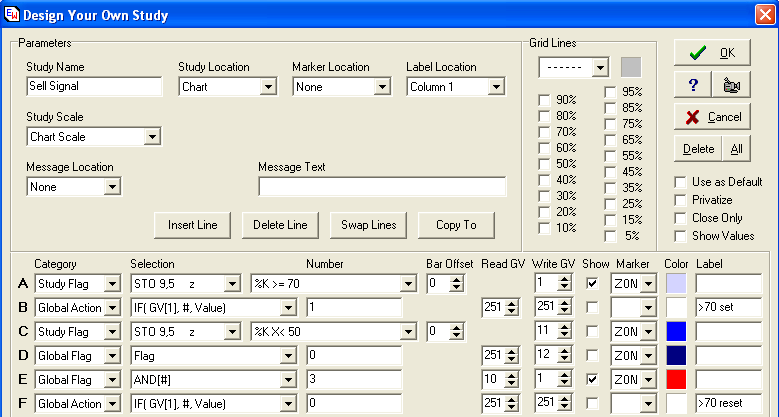

Sell Signal:

The logic for the Sell Signal is similar to the Buy

Signal logic. First the %K must be above 70 as indicated

by the blue stripes. Then it must cross below 50, and this

signal is marked by the Red stripe. The Above 70 condition

flag stores in GV[251] is reset by Line F so that a single

occurrence of the Sell Signal follows the Above 70 condition.

The Study Alert to sell 2 contracts when Line E is

true is similar to the one shown for the Buy Signals.

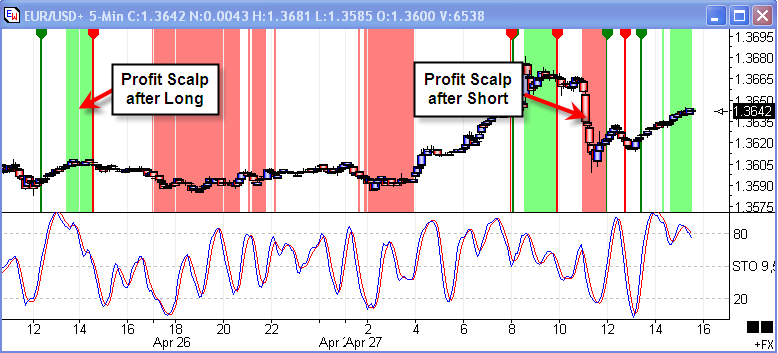

Profit Exit:

This DYO tests for a Profit scalp objective being

met. The DYO will only mark conditions where the

Position Size is either a 2 for a Long or -2 for a

Short. This means that the scalp to take off the 1st

contract has not happened yet. The scalp size in points

is the Number field on Line D. The DYO is putting green

stripes on the chart where the Position Size is 2 and the profit

exceeds 0.0010 points. The red stripes show where the position

is short 2 contracts (position size = -2) and the profit objective

of 0.0010 points has been met.

A True Flag on Lines E will be used to sell 1 of the

Long contracts. A True Flag on Line G will be used to

buy back one of the Short contracts.

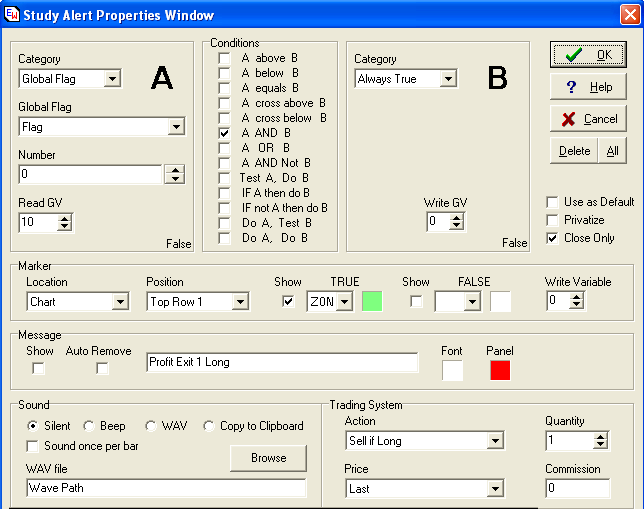

This is one of 2 Study Alerts that see the DYO flags

and take 1 contract off on a Profit Exit. The Flag was stored

in GV[10] on Line E of the Profit Exit DYO.

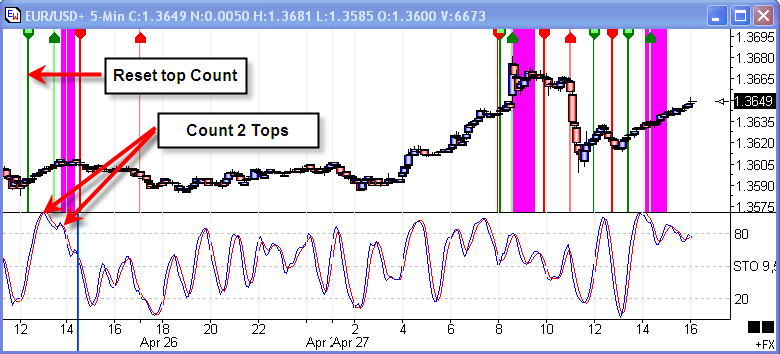

Stochastic Exit:

Line A and B will reset a private Global Variable in

[240] used to count the Stochastic %K tops when a Buy Signal is

seen. Line C and D will also reset this count when the

Trade Position is neutral.

Line E and F detect the top in the %K formation by

seeing a rising Stochastic on the prior bar and a falling Stochastic

on the current bar. When the top formation is detected, Line G

will increment the top counter in GV[240]. Line H will be True

when this count is a 2, and used to exit all positions.

Hopefully, the scalp objective was achieved ahead of this exit

signal, as was the case with the first Buy Signal on the left side

of the chart (dark green stripe) being followed by the light green

strip (profit exit).

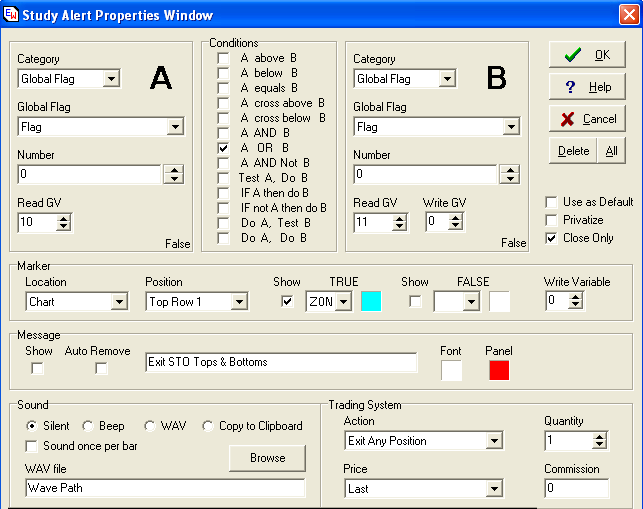

Here is an example of the Study Alert that watches the

DYO Flag for the 2nd Top/Bottom counter. The Flag for a

Stochastic Top Exit was stored in GV[10] and the Flag for a

Stochastic Bottom Exit was stored in GV[11]. Either

condition performs the action to Exit Any Position, so both Flags

can share this Study Alert.

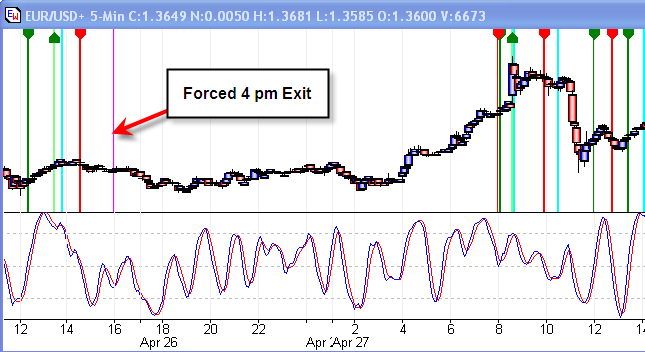

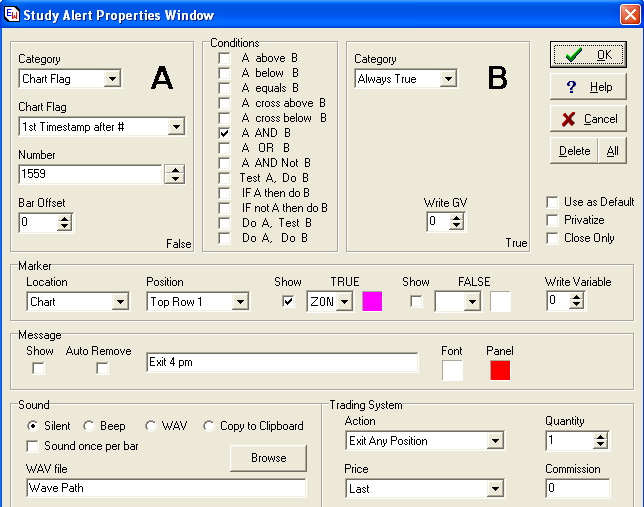

Time Exit:

Panel A is True for the 1st bar after 1559 which is

shown on the chart as the vertical pink stripe. This is the

condition to exit any open position for the night.

Wrong Trend Exit:

Exit Long positions if the Stochastic %K goes below

40. This is our wrong way protective stop. The

Study Alert to exit Short positions when %K is above 60 is similar

in design, but not shown here.

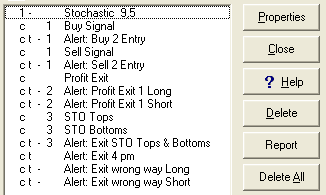

Design Summary:

This list of chart objects shows the final design.

The chart has a Stochastic study, 5 DYOs with names

like Buy Signal, Profit Exit, and STO Tops. The Study

Alerts on the list begin with the word Alert: and have a name

descriptive of their purpose.

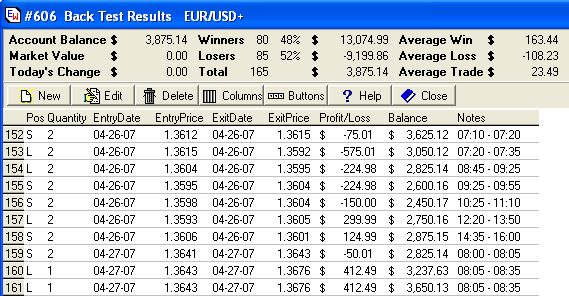

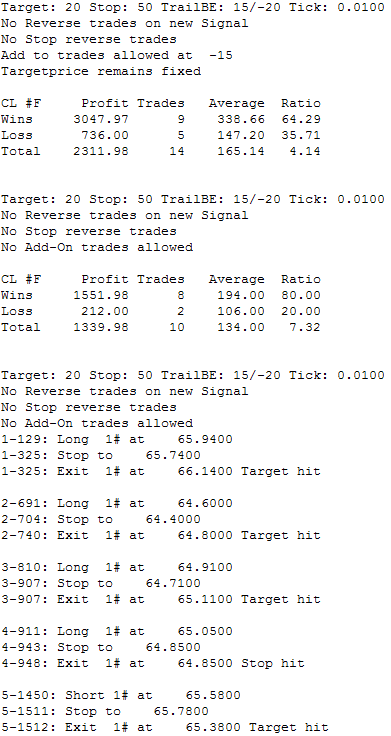

Trade Results:

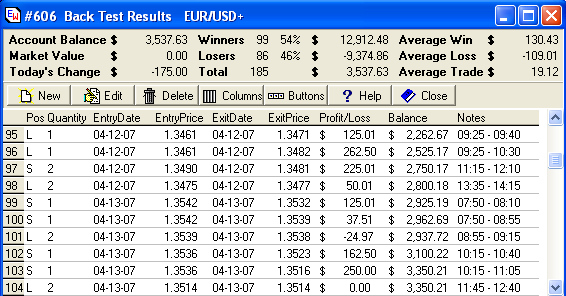

Click menu Charts | Trade Detail to see a ledger of

all of the trades.

The top portion of the form shows summary

information. Our system is mildly profitable with a gain of

$3,537 in 1 month of trading. The Winners and Losers

count needs to be taken with a 'grain of salt' because of the way

the ledger logs our method of putting on 2 contracts, and then

possibly taking off one contract on a profit exit. Lines

95 and 96 show this effect. Line 95 shows a Long

Position of Size 1 with an entry price of 1.3461. The

profit objective was met on a later bar that closed at 1.3471.

The Notes show this trade was on from 09:25 until 09:40. The

2nd contract traded is shown on line 96. It was put on at the

same price of 1.3461 at 09:25, and removed at 10:30 at a different

price of 1.3482.

Line 97 is a Short with 2 contracts, and apparently

both contracts existed on the STO Bottom Exit condition. Line

100 is a Short that was reversed by a Long position being put on

because they share the same 08:55 time stamp in the Notes.

So the system really had fewer than 185 trades,

because many entries are just the ledger's method of keeping track

of partial lifting of a position. The actual Average Trade

would be higher than the $19.12 shown. At $19.12 the

system is just break even because commissions and slippage have not

been deducted from the results.

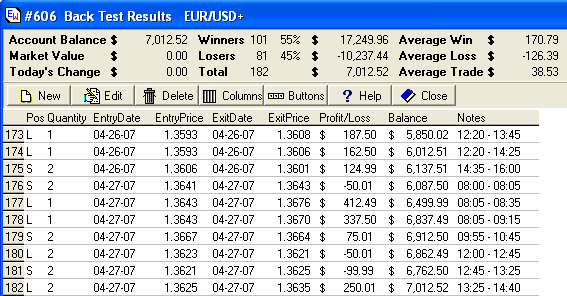

System Tweaking:

One of the unknowns was what scalp objective might be

the most profitable. The system was initially

designed with a 0.0010 pip profit object for the

EUR/USD. Lets modify the Profit Exit DYO, and the Line D

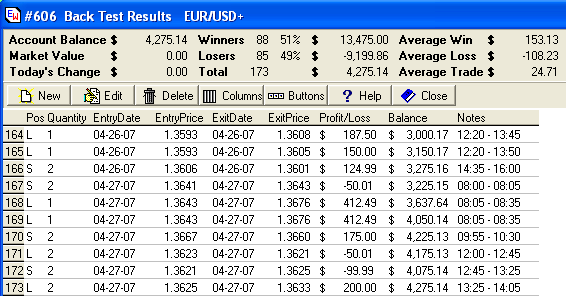

Number field. The following Trade Detail shows the result for

a profit exit of 0.0015 instead of 0.0010.

As hoped for (and expected) the trade results are

better. Fewer trades were made (which is good), and the profit

increased by $738. For the sake of an example, a profit

objective of 0.0020 will be tested and its results shown in the next

table.

I see the results are a few hundred dollars

lower. I do not know what the optimum profit exit for the

system would be, but that was not the objective in writing the

article. The article's purpose is to show how a trading system

of moderate complexity can be designed.

Another major exit condition was waiting for a 2nd top

or 2nd bottom in the Stochastic %K line. I am curious to

see if waiting until a 3rd top or 3rd bottom improves or worsens the

system. So changes will be made to the DYOs that test the top

and bottom counters. The profit objective will be returned to

0.0015 for this test, and the results are shown in the next

image.

Now this shows a very nice jump in the Account

Balance. The system improved from $4275 to $7012, and the

average trade is high enough to start paying for slippage and

commission. This is exciting and worthy of further

research.

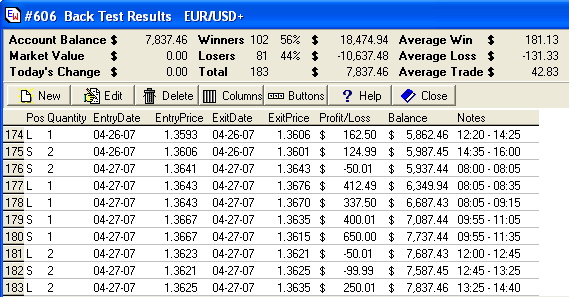

Another parameter to test is the Wrong Way Stochastic

trigger level of 40 when Long, and 60 when Short. I will

test the system with parameters of 30 and 70 used instead. The

results are shown in the next table, which are even higher, so this

change to the original design is yet another improvement.

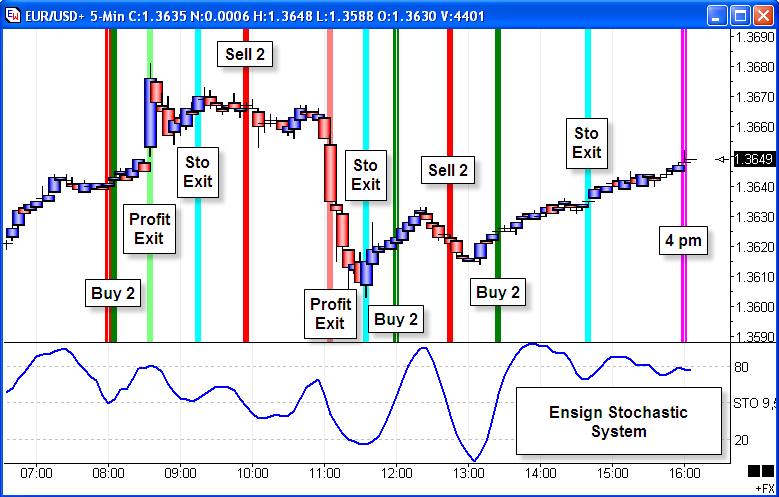

Here is an example chart showing the final

design with the colored stripes marking various trade actions.

The trades on the chart are those in the prior table, lines 176

through 183.

I know many of you will want to play with this Ensign

Stochastic System, so the studies, DYOs, and Alerts involved have

been saved as the EnsignStochastic template which can be downloaded

from the Ensign web site using the Internet Services form in Ensign

Windows. Enjoy and keep me informed if you discover

parameters or make changes that result in significant improvement in

the system's profit.

No warranty is made that future results will match the

results shown in this article. The trades shown in the article

are hypothetical, and no deduction has been made for commissions or

slippage.

Back Testing Tip:

Back Testing Signals![]()

by Christian Czirnich

Arrows on your chart. They look so good! And in

hindsight you see all these great trades that were marked on the

chart but somehow discount the losing trades.

But why do I have that warning voice in me asking me before I

take a trade: Is that really a valid signal? Yes, there

is that arrow, but .... You know not all of these signals

work. Do you really think you're smarter than all these other

geniuses out there designing trade systems for big firms for 6 to

7-figure salaries.

So another signal is not taken.

Enough!

Before I take one more trade I will have a very very long

look at my charts and confirm the validity of all these signals I

now place on my charts by cold hard facts. I need

numbers. I need statistics about the arrows on my

charts. And I can't do these by hand as I would never again

make a trade, if I need to rely on handwritten statistics

for say 10 symbols in 6 different timeframes for the last

3 months alone.

I need trade system analysis. Yes, I know the Tradestation guys

are laughing as that's one area that program is excelling in.

But,

- I don't have Tradestation

- I don't intend to switch and learn it only to come back to

Ensign after my statistic is finished

- I've used Ensign Software for 6 or more years and

- I'm convinced I can do everything TS can in Ensign as

well.

Fortunately Howard, the developer of the Ensign

Windows program is really a great guy and always willing to

help, if you have a question. He even makes adjustments and

additions to Ensign, when you have a reasonable suggestion,

which fits into his development plan.

First I wrote an e-Mail to Howard asking about trade system

analysis in Ensign and he answered me with 3 good resource links,

which got me started. Howard wrote back:

You would use ESPL logic to

implement your ideas and when you have a trade signal to either

enter or exit a trade you would use the ESPL commands for the

trade system. A ledger of your trades is made and some

statistics provided by that ledger. See these

examples.

http://www.ensignsoftware.com/tips/tradingtips42.htm

http://www.ensignsoftware.com/espl/espl119.htm

http://www.ensignsoftware.com/tips/tradingtips21.htm

Then I ran into some design problems and he added a new statement

to the ESPL programming language making the task I set for myself a

lot easier. Thank you Howard!

What did I do?

Designing Chart-Templates which paint an arrow once certain

conditions are met is simple in Ensign. The power of the

Design Your Own (DYO) study is really unmatched when it comes to

designing your own charts with bells and whistles. But the

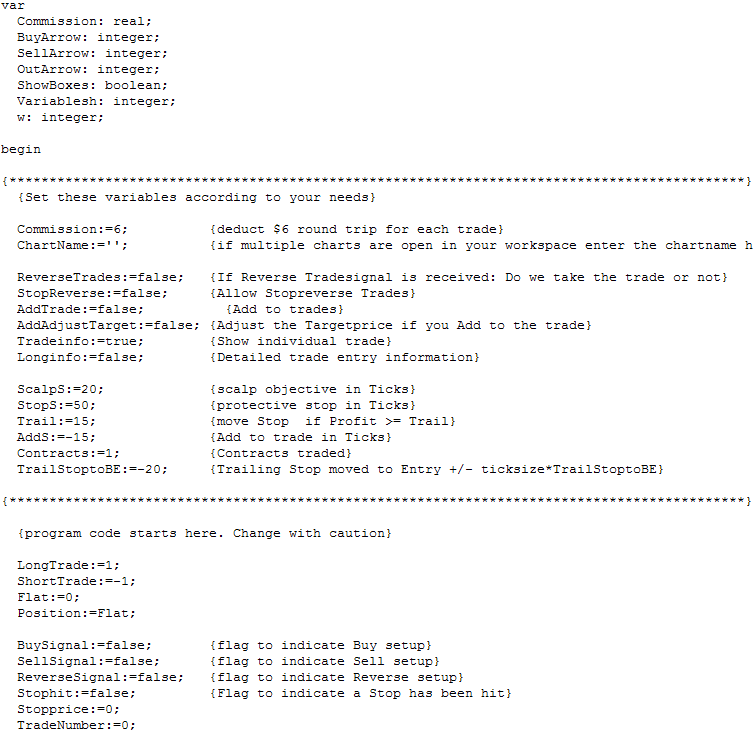

trade analysis needs to be done in ESPL. So I adjusted

Howard's ESPL code, found in the resources he sent me, to

link with my chart template, added some trade management I normally

do in my own trading and here is the result:

You have the option to add to trades, to reverse trades on a

signal received or if the trade is stopped out. For

information purposes I also added the option to show individual

trade details. These statistics were generated trading a CL M7

2minute chart.

My Tradesystem is a simple trend following system, which goes

long or short on a retracement with the trend. Nothing

sophisticated and actually an example how trade management can turn

a profitable trade system into a losing one and vice versa.

I have designed the ESPL code in a way, that you can enter the

Tradetarget, the Stop and a trailing Stop in ticks, which makes this

code applicable to a wide array of symbols.

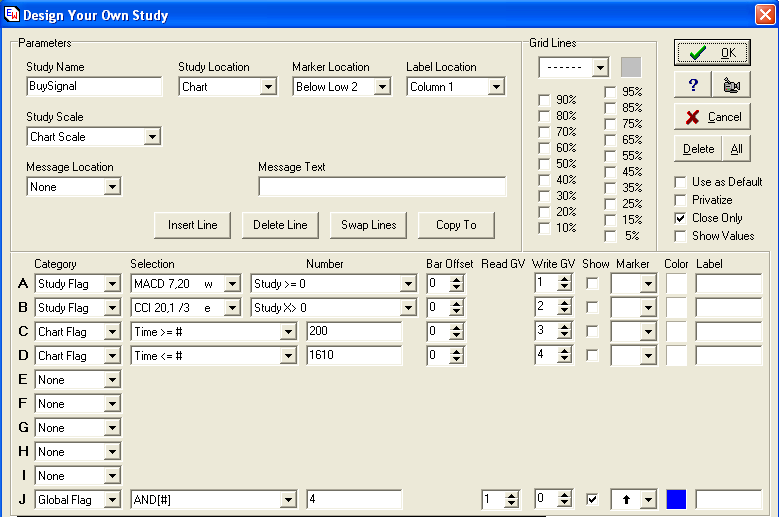

The Charttemplate itself needs to have 3 DYO Studies:

- One named "Buysignal" which goes True in Line J when a Buy is

triggered

- One named "Sellsignal" which goes True in Line J When a Sell

is triggered

- and one named Variables where you can transfer Numbers from

the chart to the ESPL program. Currently it needs to tell the ESPL

program only the minimumticksize of the symbol to be analyzed,

which is available in the [$Q] variable in Ensign.

Here is an example of the BuySignal DYO

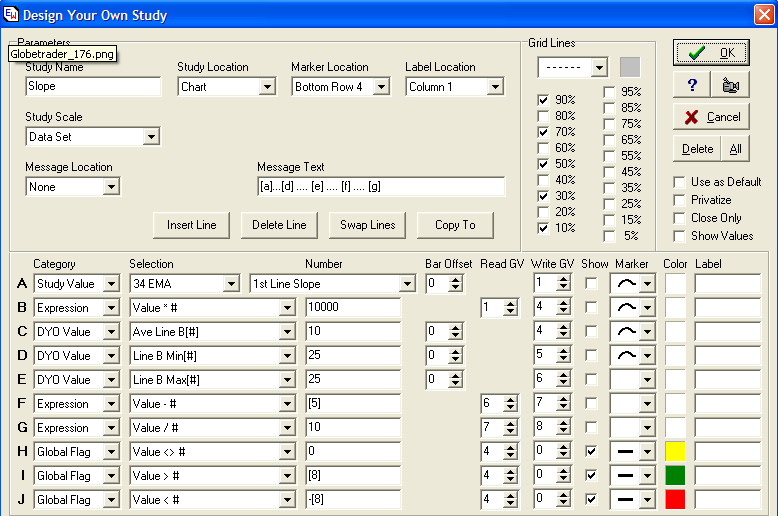

Adjust the Slope DYO Line G to adjust the Flat

period of the indicator where no trades are taken.

The Tradesystem analysis is done in ESPL. First you need to

place the code in your ESPL directory [\Ensign\ESPL], then you need

to load it in the ESPL script editor and adjust the variables

according to your needs:

(You need to enter the chartname, if you have more than one chart

open when testing. I have made myself a Tradesystem Workspace with

one chart only, so I don't need to change the code, when switching

symbols)

Click the [1] button on the ESPL editor form to clear the chart

and the Output window from any markers left from previous

tradesystem runs (if any). Click the [2] button on the editor

form to generate the Trade Statistics.

If you have Ensign and are interested in testing your own system,

here are the links to the Chart-Template

and the ESPL

code. Also see the http://www.globe-trader.de/TS-EMA-Trend.dat

template, as the chart picture shows the TrendCCI.dat Template while

the Slope DYO is part of the new template which trades bounces

of the 34ema and determines trend by looking at the slope of the

34ema. Both templates have a positive edge, so both might be

interesting for playing with. (Right click

the links and select Save Target.. to download directly in

the correct subfolders).

I wish you a profitable trade system analysis.

|